The US Federal Reserve’s (FED) chairman has retired the word “transitory” when describing inflation as he thinks it is no longer appropriate. Simultaneously, there is contemplation on the possibility of increasing the rate of tapering – the process of reducing Quantitative Easing. This will pave the way for an earlier increase of interest rates next year.

What I have previously shared about inflation is increasingly becoming a reality. Now we are currently experiencing the first wave of inflation.

Inflationary pressure and its build up in 2021

March 2021 saw a year-end inflation forecast, by the FED, of 2.4%. Then, they increased it to 3.4% in June and 4.2% in September. Finally, in October, US consumer prices ultimately surged by 6.2% year-on-year. This largest surge in the last 30 years shows that inflationary pressure is building up.

We are currently experiencing this first wave of inflation due to 2 reasons. Firstly, supply chain disruption has led to inflation. Supply cannot keep pace with the spike in demand after the initial fear of Covid-19 subsided. The shortage then inflates prices. Secondly, under-investment in areas, like energy, has also led to inflation. This has caused a spike in energy prices, and subsequently a rapid increase in prices for goods. Thankfully, these factors should dissipate in six months to a year.

However, we cannot play it safe. A second wave of inflation is coming.

Labour shortages will cause the second wave

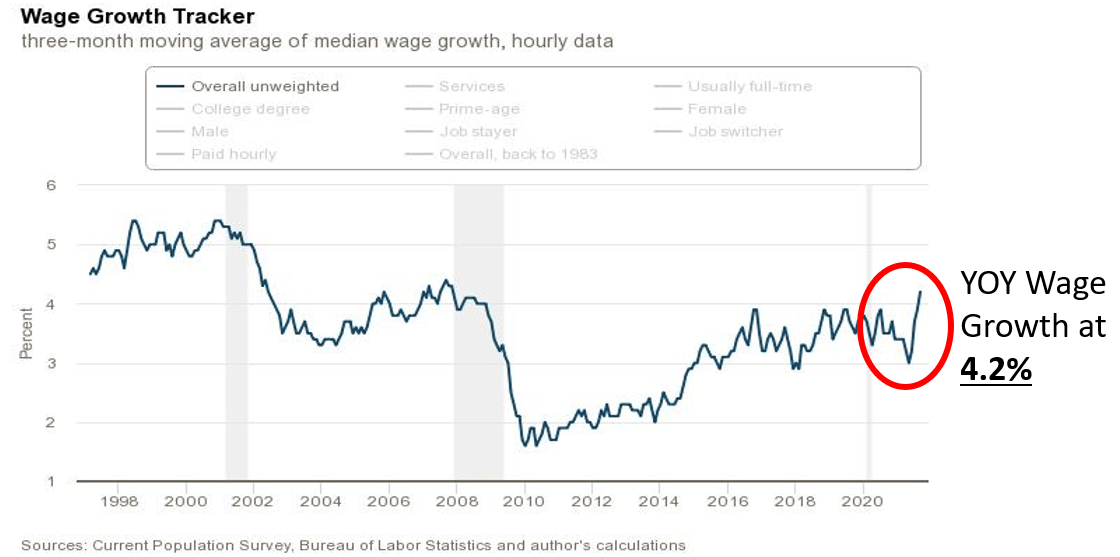

Wage growth has been rapid with a recent 4.2% spike year-on-year. However, this seemingly positive growth is caused by labour shortage. To share some examples, Amazon experiences employee turnover so often that executives are worried they will run out of people to employ. Similarly, FedEx must divert packages after experiencing the effects of labour shortage.

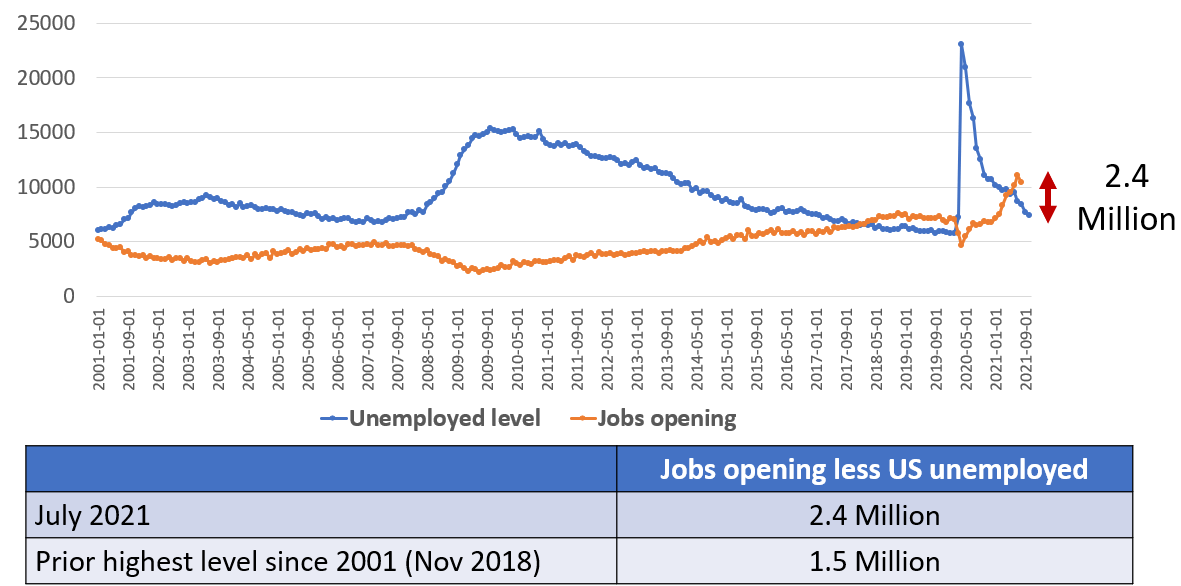

CNBC says there are millions of job vacancies, but a worrying shortage of workers still prevails. When we compare the number of unemployed people and job openings, the latter far surpasses the former. This is the second time it has happened in the last 20 years.

For every unemployed person, there are about 1.3 to 1.4 job openings. So even if everyone was employed today, there will still be a shortage of employees. Before Covid-19, the peak of the gap between the number of unemployed and job vacancies was 1.5 million in November 2018. Now we are facing the biggest gap ever at 2.4 million.

Low labour participation rate affecting labour shortage

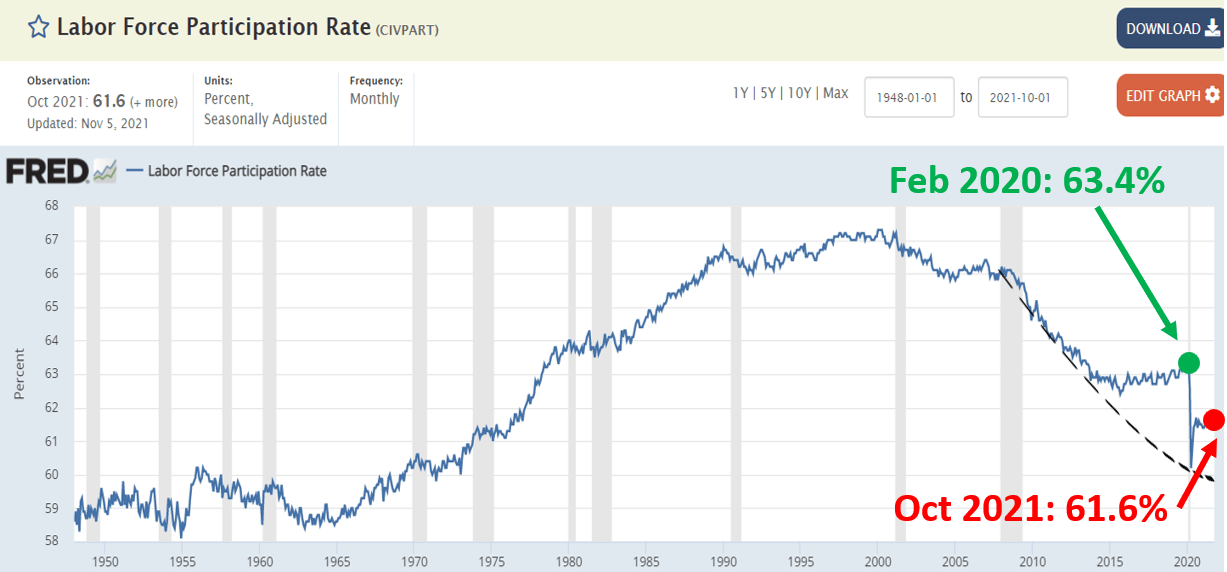

Before Covid-19, the labour participation rate was 63.4%. This meant that 63.4% of the US population was actively working or seeking jobs. However, this fell after Covid-19 where only 61.6% are currently actively participating. This drop means 6 million people have stopped working or actively searching for jobs. Looking at the decline since 2018, this fall seems much more natural and permanent.

In fact, looking further back, we can see that job participation rate started slowly falling in 2000. However, the big fall came in 2008, when the generation of baby boomers started retiring at 62. With the continuation of baby boomers retiring in the long term, we will still have many years of such a decline. Hence, labour shortage issues will continue to be persistent.

Rising housing costs will cause the second wave

Housing and rental prices have gone up 10% to 20% year-on-year. However, the inflation measurement of Shelter has only gone up by 2.8%. This because the inflation measurement is a lagging indicator, wherein the large shifts in the prices will soon show as it climbs in the next few months.

What will happen during the second wave?

The second wave of inflation will probably be more persistent. As inflation picks up, central banks will increase interest rates to curb it. This will pull down asset prices. Unicorn Financial Solutions, the company that I am the Head of Investment Research of, has been preparing by staying 2 to 3 steps ahead.

How we segment our portfolio! And how you can segment it too

Firstly, by default, we have 50% in capital preservation. This includes investing in things like gold, cash, and bonds. We have the other 50% in equities. However, in July, we reduced our equities exposure by 10%, opting to keep more cash instead. This gave us the advantage to buy into more good assets if prices were to fall due to heightened inflation and interest rates.

Secondly, we maintained 10% to 20% of gold in our portfolio as gold tends to be a very good hedge against inflation.

Thirdly, we are buying companies that are very suitable for inflation. Following Warren Buffett’s investment wisdom, these companies must be able to increase their prices without significant losses in sales or market share. They should also have low capital requirements. This allows them to produce a lot more without buying additional machines and equipment. Subsequently they will also be able to continue raising prices without any big increases in costs. We include them in our portfolio as inflation can be a friend to these companies.

Lastly, if you are new to investing, make sure that you have a great financial plan and a fantastic financial consultant. This will ensure that you have a customised financial plan to ride through any volatility.

I hope that I have given you peace of mind even as inflation risk continues to headline the news. If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you have now, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Please share this site with your friends! Do subscribe to my newsletter for updates and remember to leave comments. I would love to connect with you.

As the Christmas rolls in, I wish you all a very happy festive season ahead.