We have heard about the seven wonders of the world, but did you know that there is an eighth wonder? Albert Einstein was thought to coin compound interest as the eighth wonder of the world. One of his famous quotes, “he who understands it, earns it; he who doesn’t, pays for it.” In other words, once you understand how compound interest works, you will open a wellspring of successful investing.

What is Compound Interest

Before we dive into how compound interest works, we must understand the role of “interest.” We can view interest as the cost of borrowing. Consider that you are the borrower; you must pay an additional cost on top of the amount you loan from the lender.

There are 2 types of interest, it can be expressed as simple or compounded. Simple interest is drawn every period (or year) on the principal amount. Compound interest is the total sum of the principal amount and the accumulated interest from previous periods (or years).

So, as an investor, you will undertake the role of a lender. What compound interest means is that you will not only earn the interest on your original invested amount, but also on the interest you have accumulated over the years. Let us look at the Cupcakes Analogy for a clearer explanation.

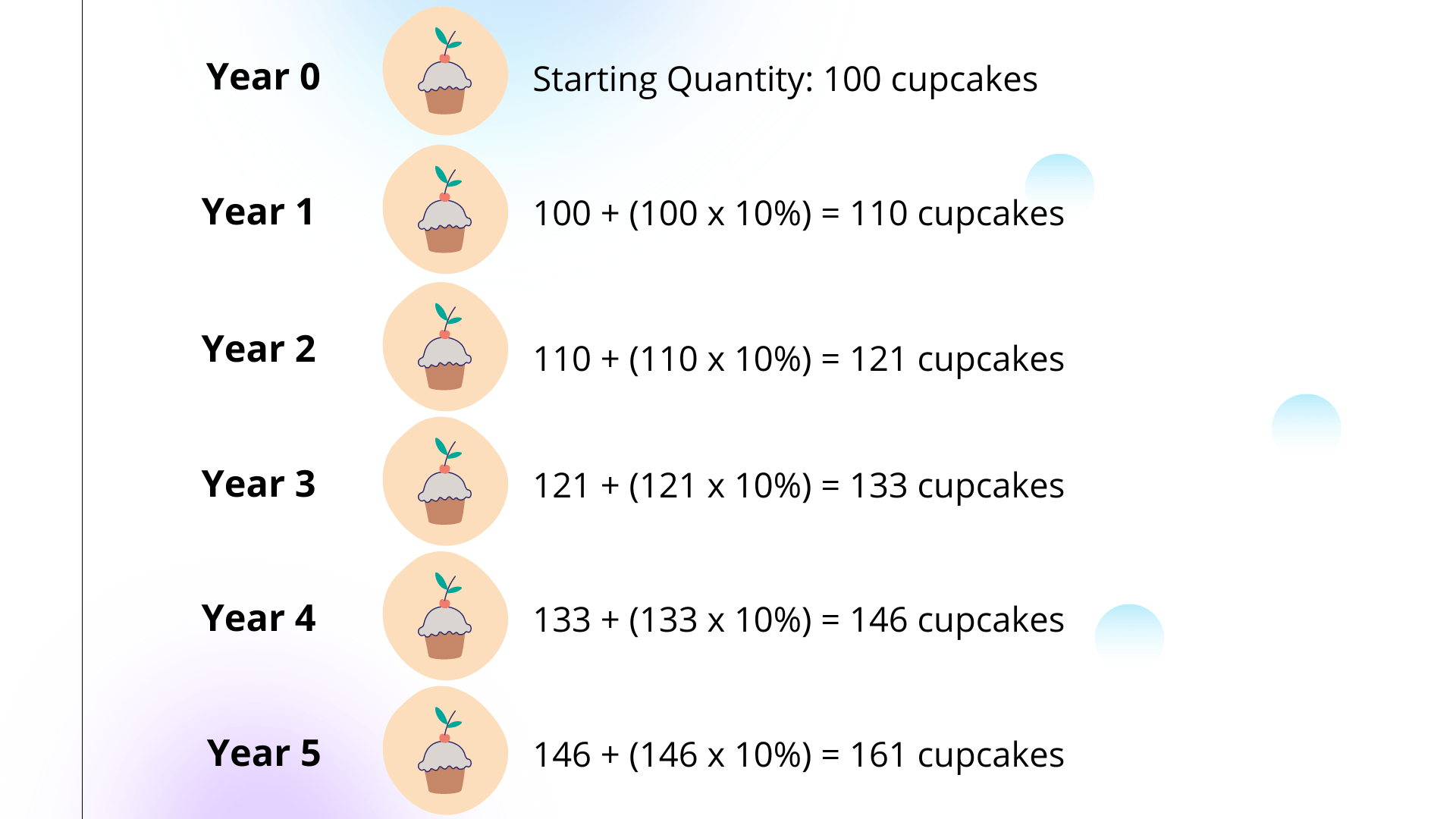

The Cupcakes Analogy

Let us assume that you consume 100 cupcakes in the 1st year. To thank you, the bakery owner honours you with additional 10 cupcakes each year for the next 5 years on top of your base quantity. Applying compound interest to this analogy, at the end of the 5th year, you would have received a total of 161 cupcakes; more than what you originally bought.

The Magic of Compound Interest

In monetary terms, if you invest $1 at a 10% rate of return, the value of this dollar will be worth $1.10 by the end of the 1st year. If you continue to invest the $1.10, by the end of the 2nd year, the value will increase to $1.21. Here, your interest earns interest —

this is the magic of compound interest.

You can calculate the future value of the original amount using this compound interest formula:

Future Value = P (1+r/n) ^(n*t)

P denotes present (principal) value

r denotes interest rate or the rate of return

n refers to the frequency of the compounding periods in a year (if the interest compounds once on a yearly basis, “n” = 1)

t refers to the length of time you invest

From this formula, you can see that time is also an important factor in allowing money to work more effectively for you.

Value of Time in the “Magic” of Compound Interest

As mentioned, the key essence of the investing formula is time. The earlier you start investing the dollars in your pocket, the earlier you can attain your financial goal.

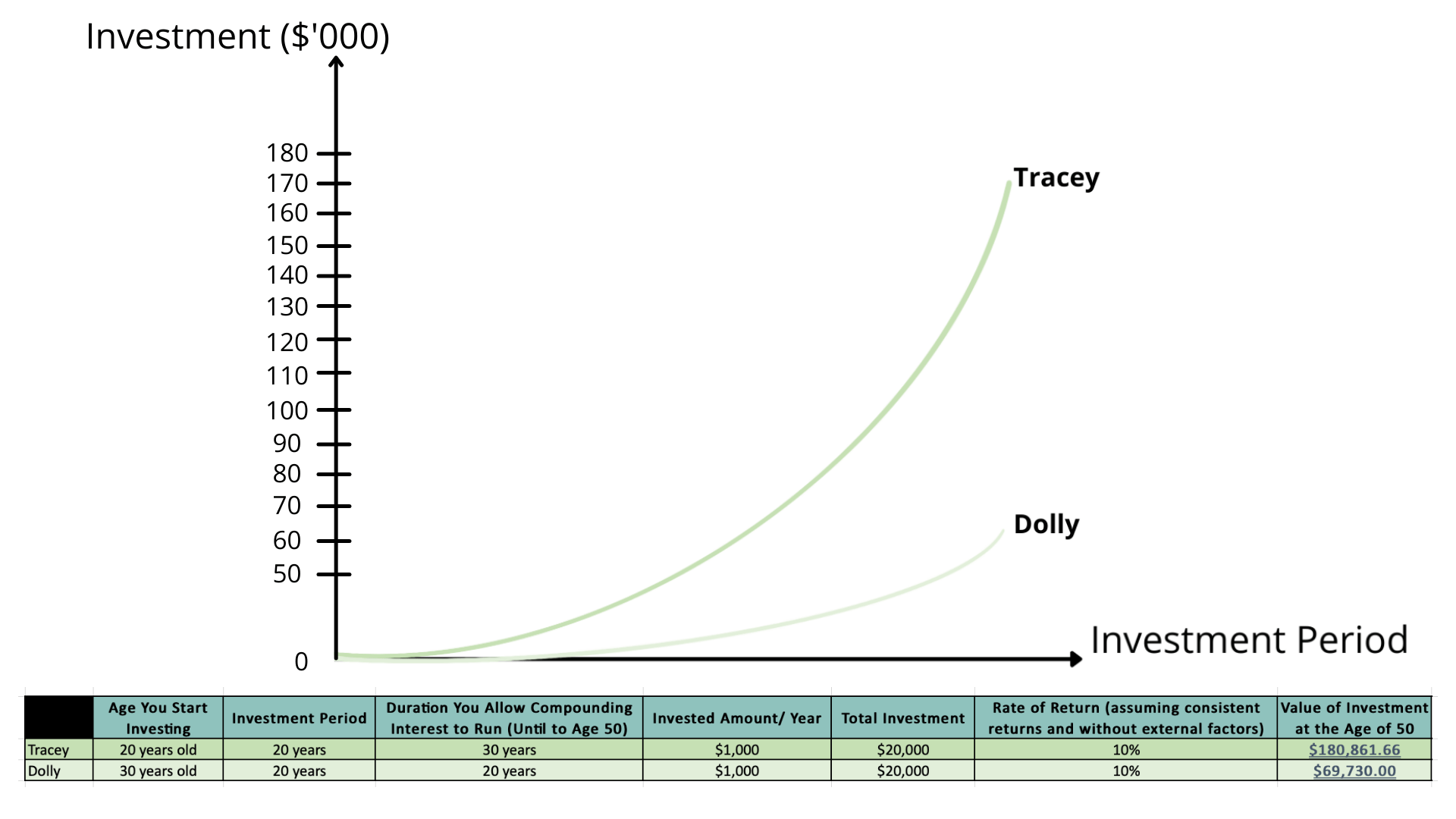

(This is only for illustration purposes only; it does not reflect the actual rate of returns and the external factors influencing market performance.)

The illustrated comparison table shows that Tracey started investing at an earlier age of 20 years old. However, the total value of her investment is more than Dolly’s despite them investing the same amount of $20,000.

The increase in the value of the invested amount over the 20-year period does not grow along a straight line. Instead, it grows exponentially along a curved slope. The slope indicates the size of growth that is greater than the previous year. If the investment period is extended beyond 20 years, the slope will keep moving in an upward direction. This shows how compounding magically affects investment and how time triggers this impact.

One of the pitfalls of investment is timing the market. Why waste your time and effort making groundless market performance predictions when you can maximise the power of compound interest over a long-term? As you make regular deposits, for example on a monthly (quarterly, semi-yearly, or even yearly) basis, it will give you wider exposure to the rate of returns from varying market performances.

This consistent investment strategy propels the impact of compound interest in the long-term. This generates higher and reliable returns for you.

Is Compound Interest the Golden Ticket to Financial Freedom?

Compound interest can benefit you if you utilise correctly by starting early and making consistent deposits. You can then leverage its power to grow your wealth exponentially by allowing investments to grow and compound over a longer period.

On paper, we can set up an ideal environment for investments to grow without holding back. However, in reality, there are several external factors that affect its growth. Factors such as inflation, payment lapses, and even debt loans can hinder your financial progress. Nonetheless, it is still proven that the magic of compound interest allows your money to grow exponentially and ultimately outpace inflation. To reduce any downsides, ensure that you have enough cashflow to stay the course.

While we are unable to control market performance, we can analyse data trends and execute strategies to combat unforeseen circumstances. These are some of my articles where I surveyed interest rates and the economic environments. I then suggested strategies to stay afloat regardless of the economic situation.

I hope that this article provides you with insights into compound interest and how it helps in your wealth accumulation. If you would like me to review your investment strategy and financial portfolio, feel free to reach out to me at heb@thegreyrhino.sg or 8221 1200, I would love to connect with you.

Subscribe to my newsletter to stay updated with the latest news and insights and share valuable knowledge with your loved ones.