The Dow Jones Index consists of 30 of the most powerful companies in the US. Research has shown that historically, buying the Dow’s worst performing stocks has generated huge returns the following year. In 2021, that company was Disney, and its share price corrected by 40.5% last year.

So, will Disney be a star performer in 2022? Let’s evaluate Disney.

We will analyse Disney’s business, industry, competitive dynamics, risk, and valuation. I will also conclude by sharing if I will buy Disney’s stock myself (Yes, No, or Yeto).

An Overview of Disney’s Business

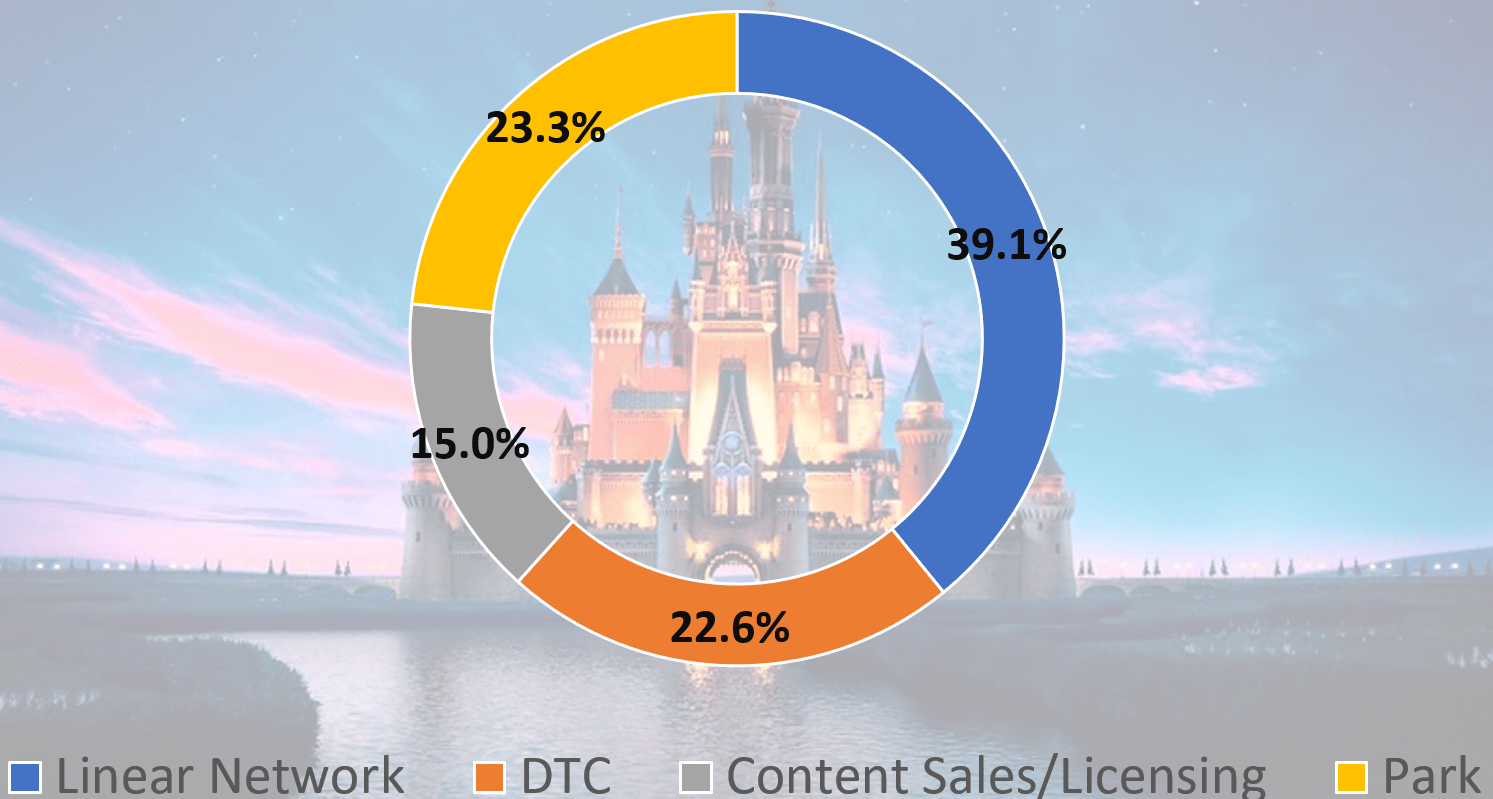

Analysing 2021’s revenue, you can see that Linear Network makes up a large part of its revenue. Linear Network consists of Broadcasting (ABC network station) and Cable TV. The second largest segment is Disney’s wildly popular parks; Disneyland. The third largest segment is its new business segment; Direct-To-Consumer (DTC) video streaming. The smallest segment is Content Sales/Licensing which sees Disney licensing its intellectual property to 3rd parties.

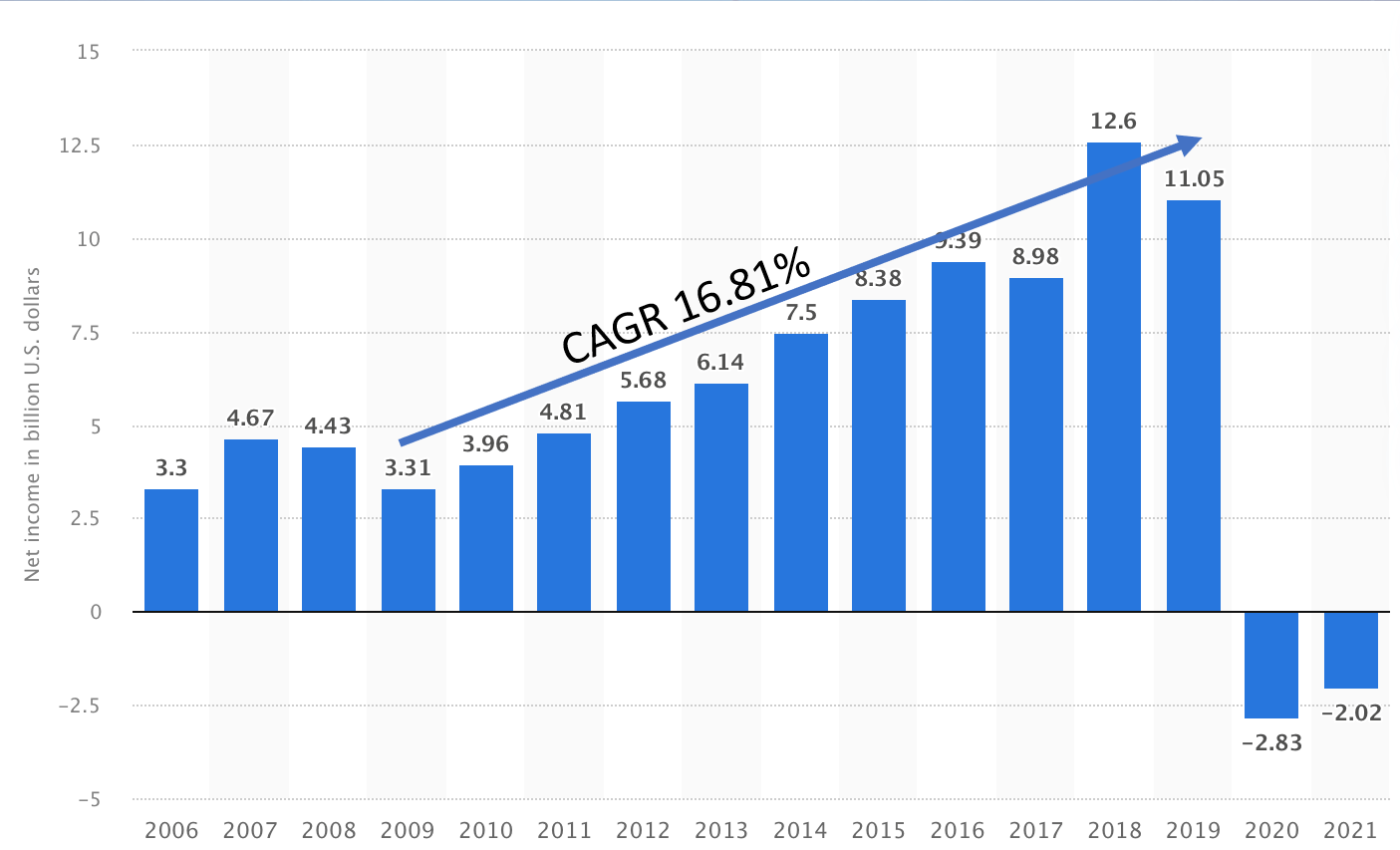

From 2009 to 2020, Disney’s net profit has grown at about 17% yearly. This is a reasonably fast growth rate.

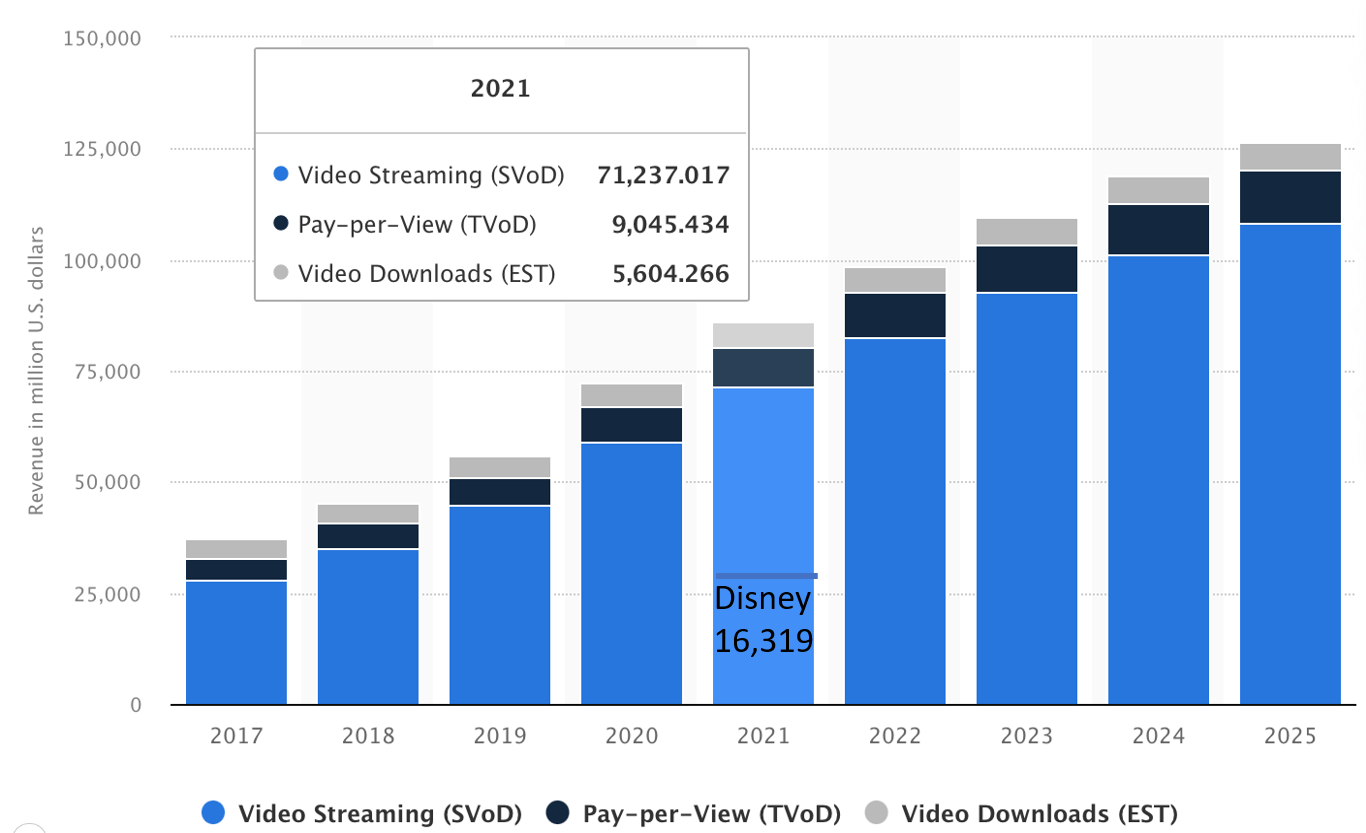

An Overview of Disney’s Industry

1. Linear Network

Linear Network is a declining business worldwide. Most people previously watched a lot of Cable TV. However, most of us have migrated to streaming and we watch Cable TV a lot less, choosing to surf the internet instead.

Pay TV reached its peak at 120 million subscribers in the US in 2012. However, today there are less than 70 million subscribers. Research indicates that it will stabilise at around 50 million subscribers in the future.

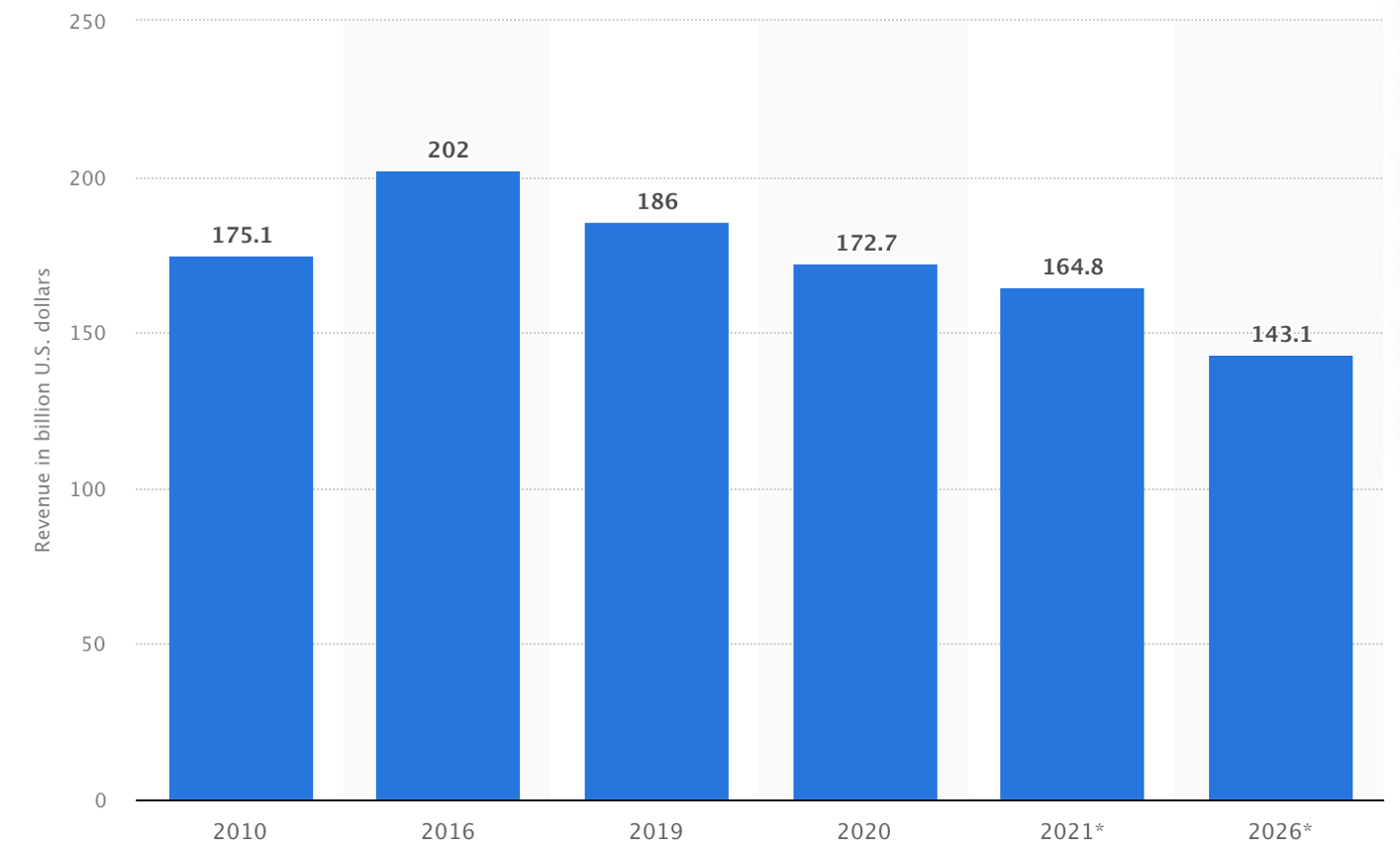

Additionally, this chart shows how Pay TV’s revenue has declined from 2016 to 2020.

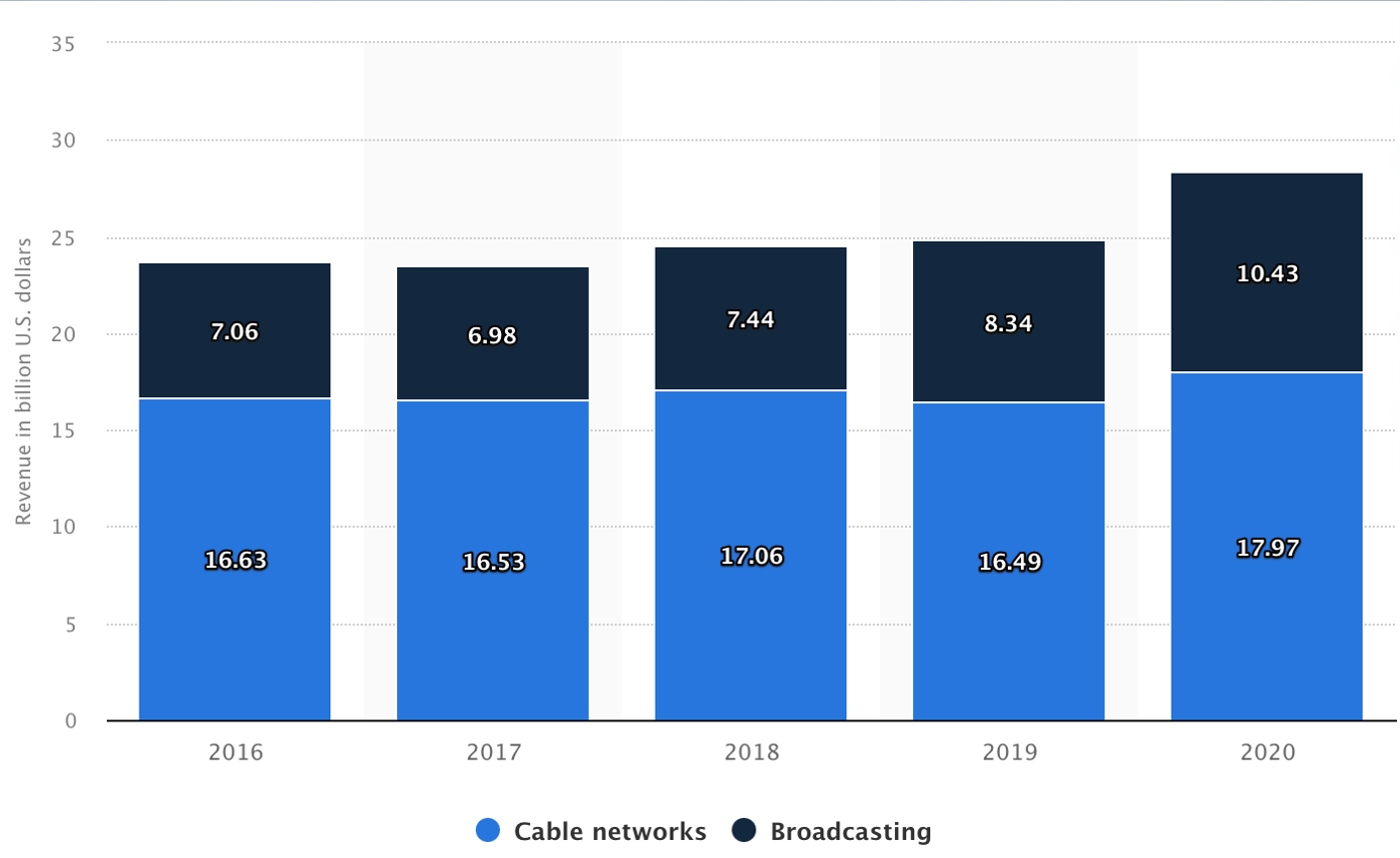

However, Disney has been holding its ground very well. Its revenue has been very consistent and even saw growth. This is because Disney raised its price despite the falling number of subscribers. Hence, it managed to maintain its revenue.

2. DTC

Disney’s crown jewel of the future, DTC, is growing. As of 2021, Disney accounted for 25% of the market share. This is incredible given that Disney is a relative late comer in this industry.

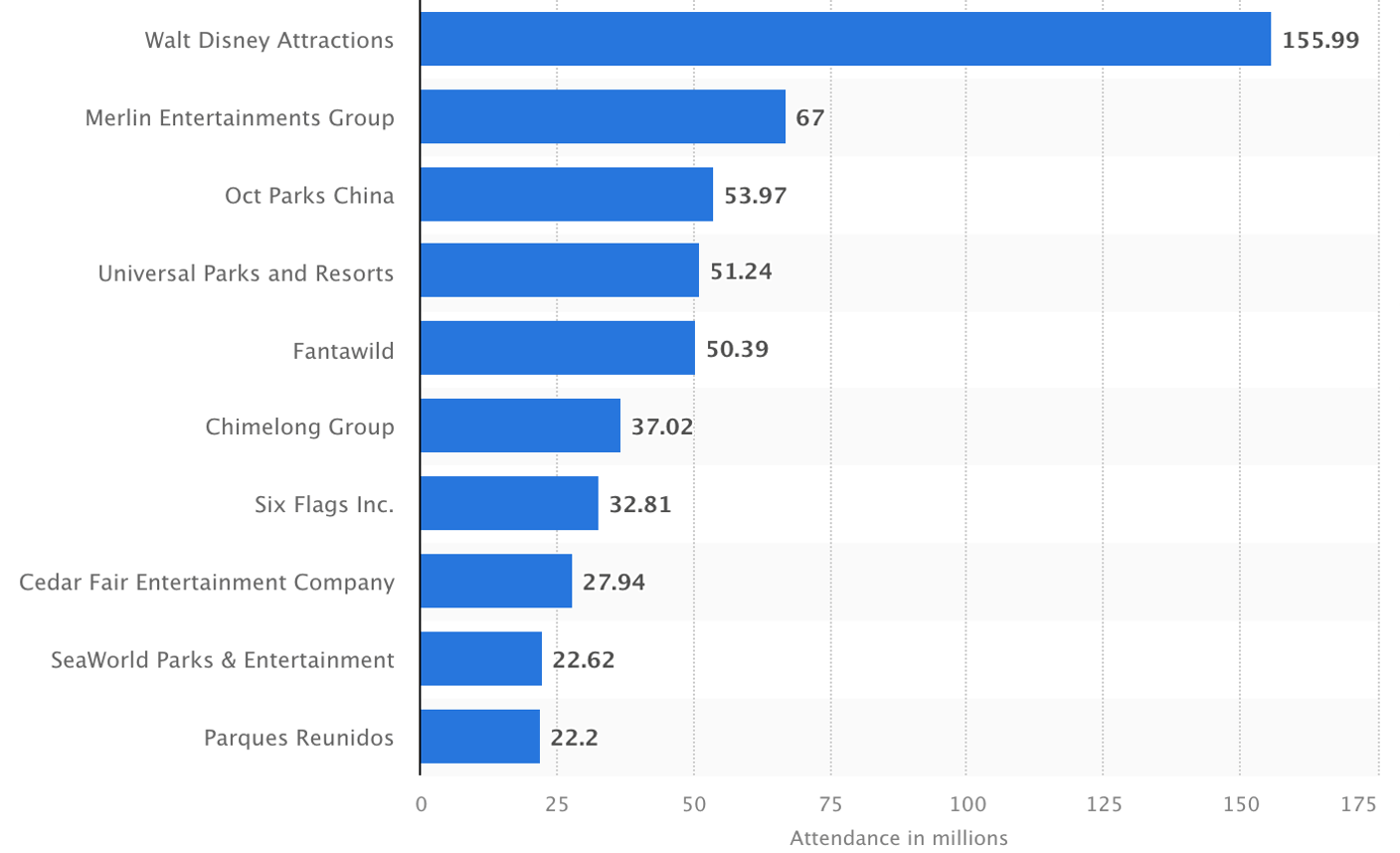

3. Disneyland

Disney is dominant as the leader in the Theme Park industry. Disneyland’s revenue is also largely derived from the admission fees, sponsorships, parking, food and drinks, etc.

Disney’s Investment Analysis

1. Disney’s competitive advantage

Disney’s competitive advantage is its powerful and popular intellectual property. Most of us recognise characters like Mickey Mouse and Donald Duck because we grew up with them. Many of us also recognise characters from movies like Star Wars, X-Men, and The Avengers. Younger children will recognise characters from movies like Frozen. I think it is very hard to substitute them as these characters are etched in our memory since childhood and we want more and more content that revolve around these characters. In contrast, competitors will find it very difficult to gain significant ground for this.

Moreover, Disney can monetise and harness its intellectual property within a powerful eco-system. For example, when Disney acquired Star Wars from Lucasfilm, created more Star Wars movies and series and built Star Wars attractions within Disneyland to attract more park goers. It also created Star Wars merchandise and uploaded the Star Wars movies onto Disney+ to attract more subscribers. This exemplifies how a single intellectual property can be monetised over many segments and create a lot of profit for Disney.

2. Disney’s market

Disney’s DTC growth potential versus Netflix’s

Its competitor, Netflix, took a decade to attain 100 million subscribers, and subsequently achieved 200 million subscribers in the following 3 years. In contrast, Disney, a relative late comer in the DTC market, started its business in 2020 but managed to achieve 100 million subscribers within a year. In fact, Digital TV Research forecasts that Disney could attain 200 million subscribers in 2025, becoming competitive with Netflix then.

DTC is also a very attractive, fast growing, and recurrent subscription type of business. The companies who participate in DTC are going to have a very high valuation. However, when compared to other DTC’s, I think Disney has a better advantage. Other DTCs like Netflix build a lot of new and exciting content that could be a hit or a miss. However, once Disney creates a successful intellectual property, it can easily create more content as explained prior. Hence Disney has a lower risk way of creating successful content.

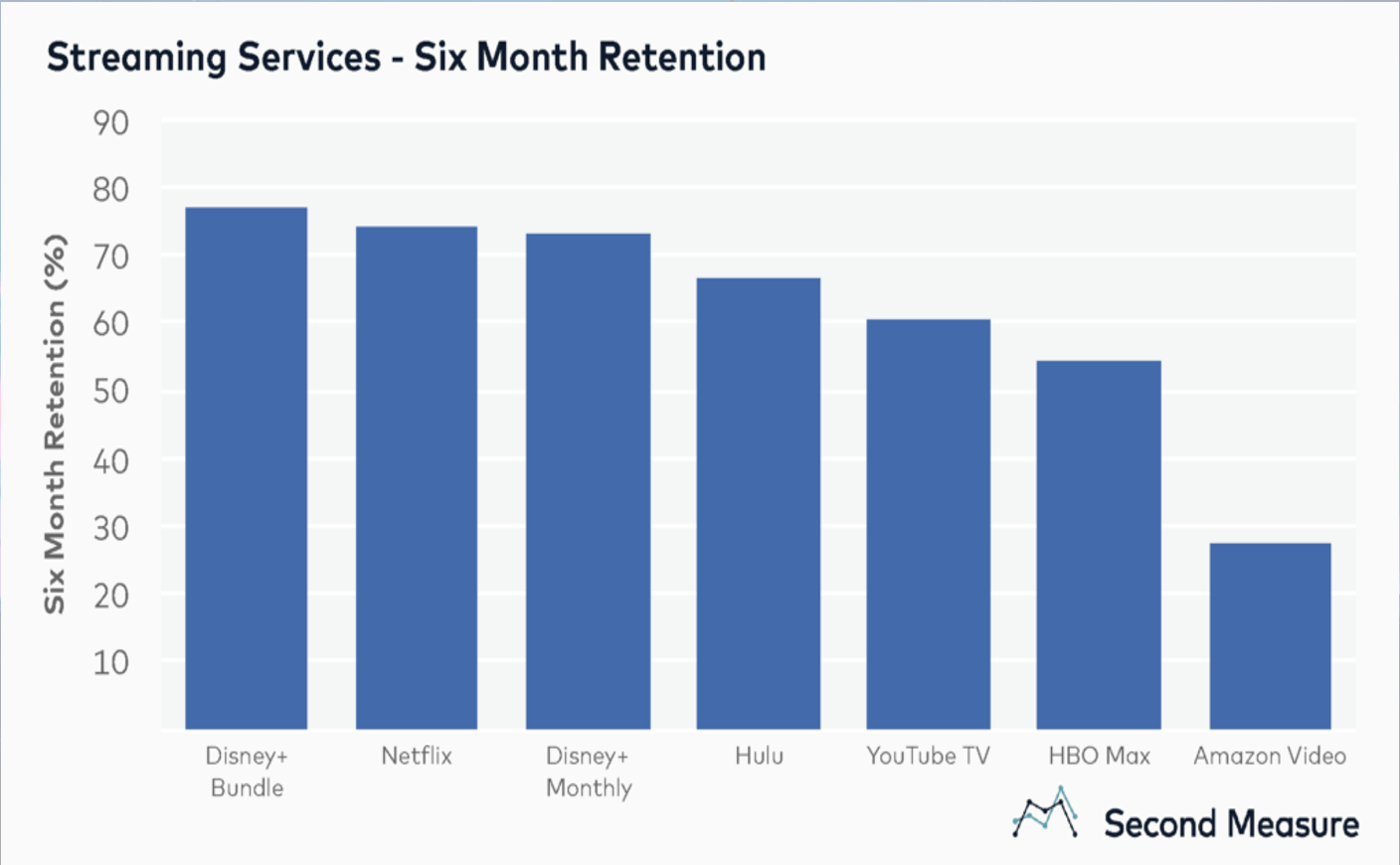

Disney’s retention rate in the DTC market

Additionally, Disney is powerful as it has the highest retention rate at around 80%.

Disney’s potential subscriber growth

The total addressable market for this streaming business is about 1.1 billion subscribers, so Disney’s current subscriber count of 100 million is just scratching the surface. With less than 10% of the total addressable market captured, there is still a lot of room for growth.

Disney’s growth for other business segments

Disney’s Parks business and Linear Network business will experience a high single digit or a lower double digit’s kind of growth in my opinion. This is because Disney will be able to raise its price for Disney land every few years, allowing it to offset inflation and earn even more profit.

Overall Disney is going to be a reasonably fast-growing company.

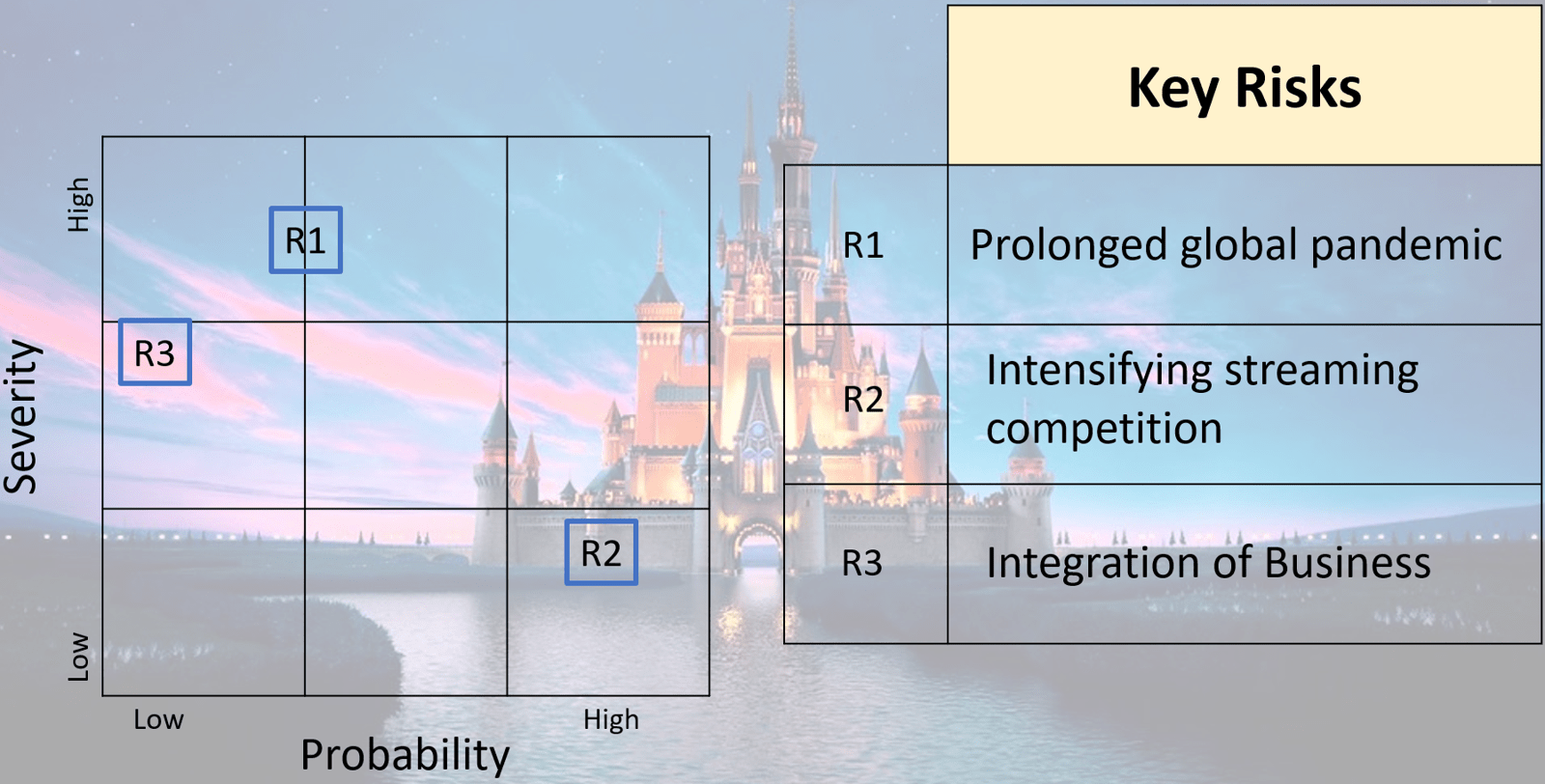

Risks of Investing into Disney

There are 3 possible risks of investing into Disney.

1. Prolonged global pandemic

Its Disneyland business profits dropped into the negatives during the peak of Covid-19. Although it is recovering now, a prolonged pandemic would mean restricted admission into Disneyland and hence it will take a much longer time to bounce back to pre-Covid profits.

2. Intensifying streaming competition

Other competitors like Amazon and Apple have also started to enter the market. However, this risk is relatively low as Disney has a very rich content library while newcomers need to build their content library up, giving Disney the edge.

3. Integration of Business

Disney has been acquiring new intellectual property and integrating them well into its business. Since it is quite successful, it is a relatively low risk.

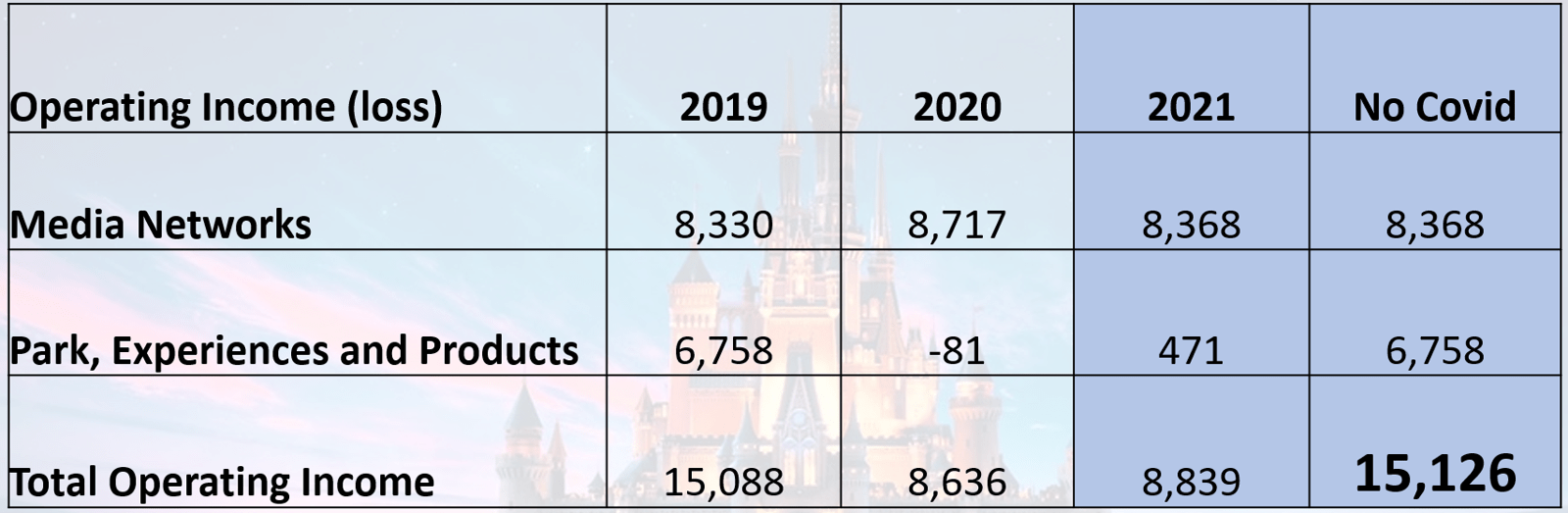

Disney’s Valuation

It fell by 15% in 2021, but does this mean it is attractive? I calculate the valuation by looking at all its businesses as they were in 2021. I do not assume the same for its Parks business as it currently is only receiving a fraction of its pre-Covid business. And once Covid-19 is over, it will likely experience a return to its pre-Covid levels of business.

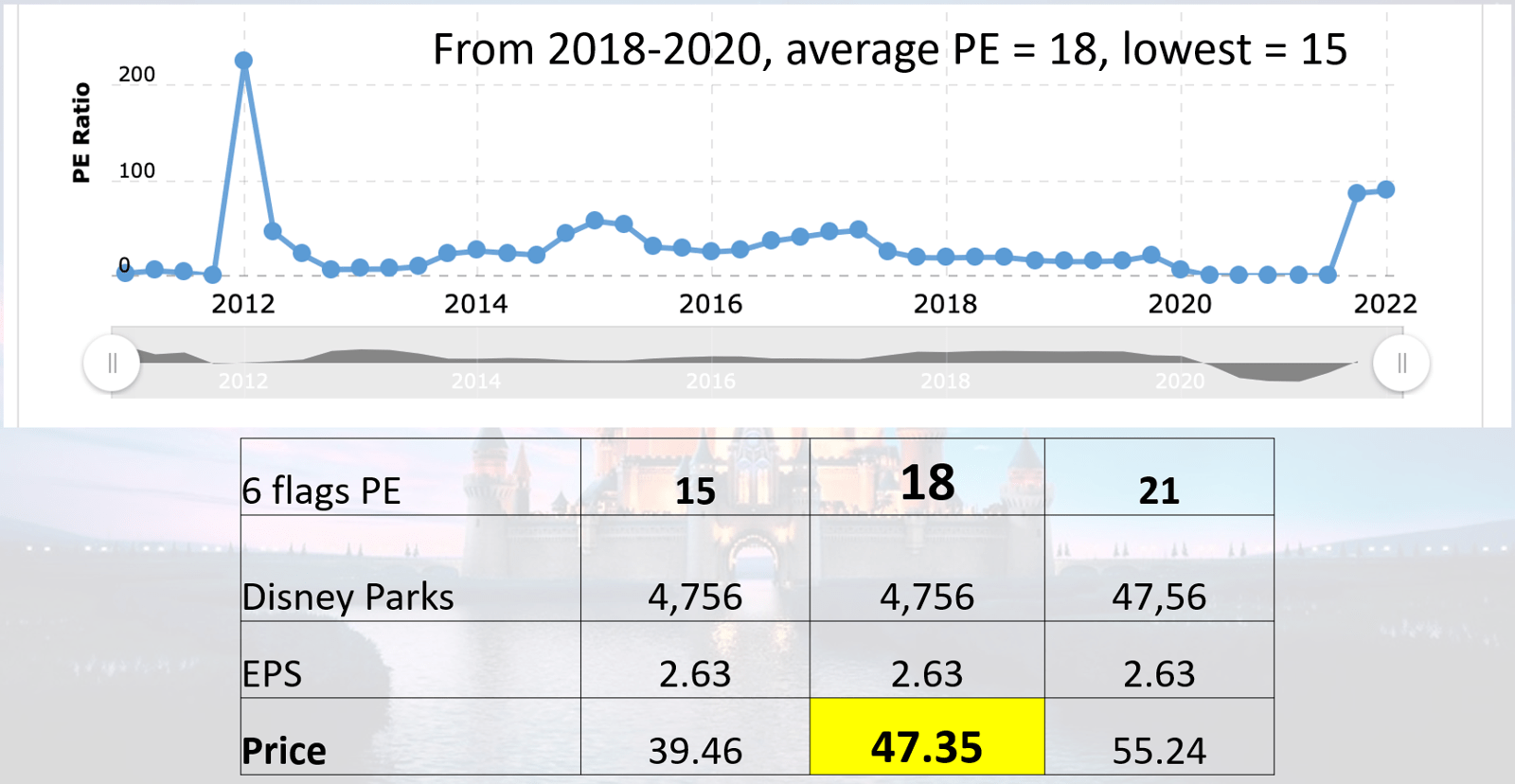

With that, the valuation I derive is about a 28x Price-Earnings ratio (P/E ratio). This is not cheap as it is more expensive than Disney’s P/E ratio before Covid-19 which was just below 20. However, we must note that during Covid-19, Disney entered the highly valuable, sticky, and recurring video streaming business.

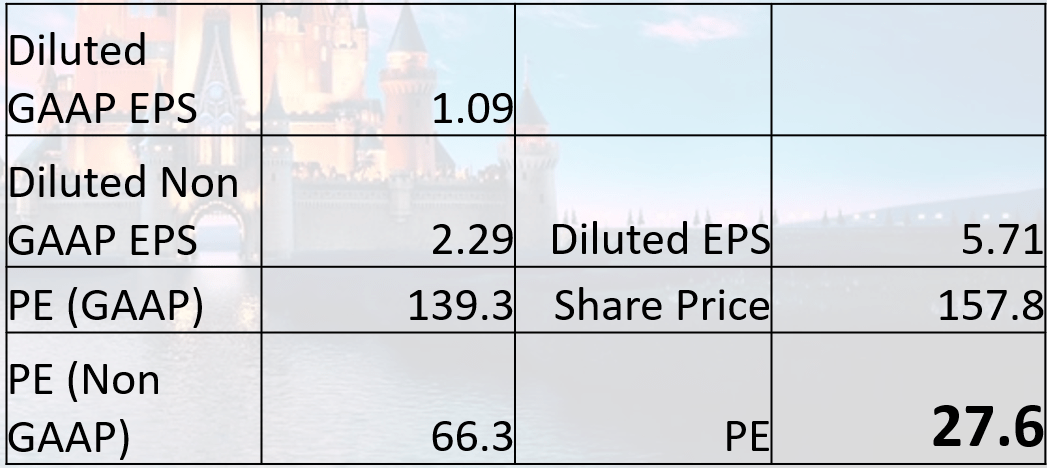

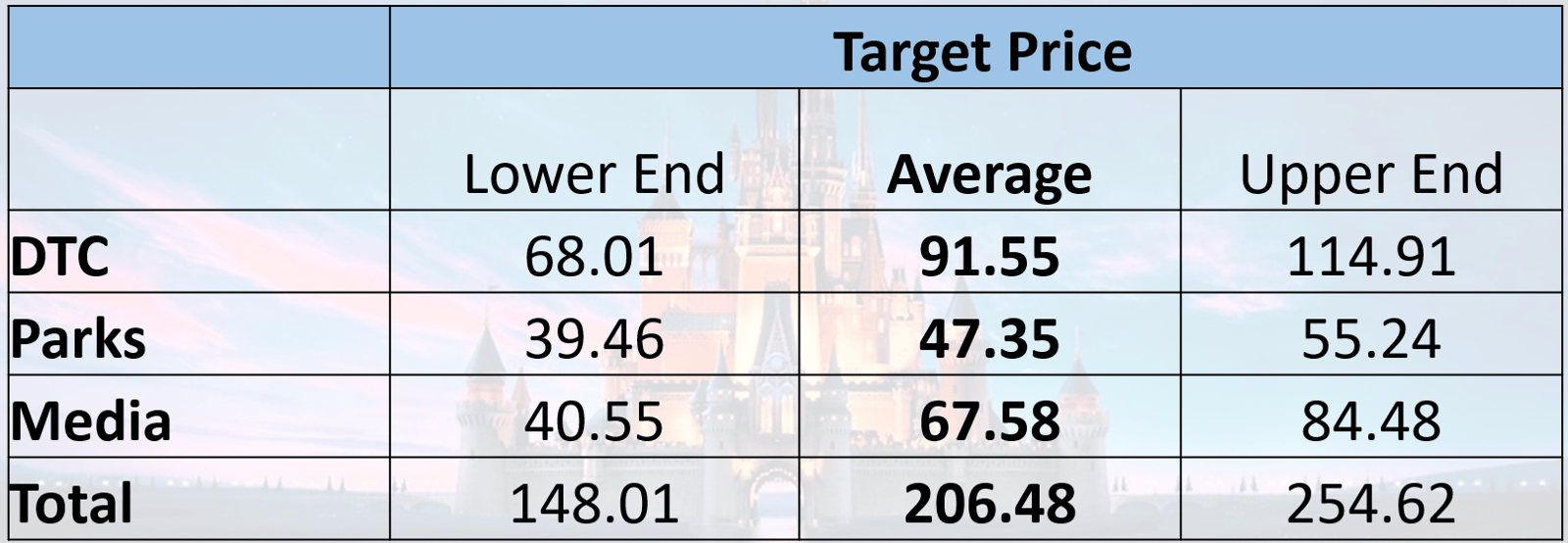

We can also find Disney’s valuation by looking at the valuation of its nearest competitors. Today, Netflix sells at 9.8x Price-To-Sales. If Disney achieves this valuation, it will have $92 per share.

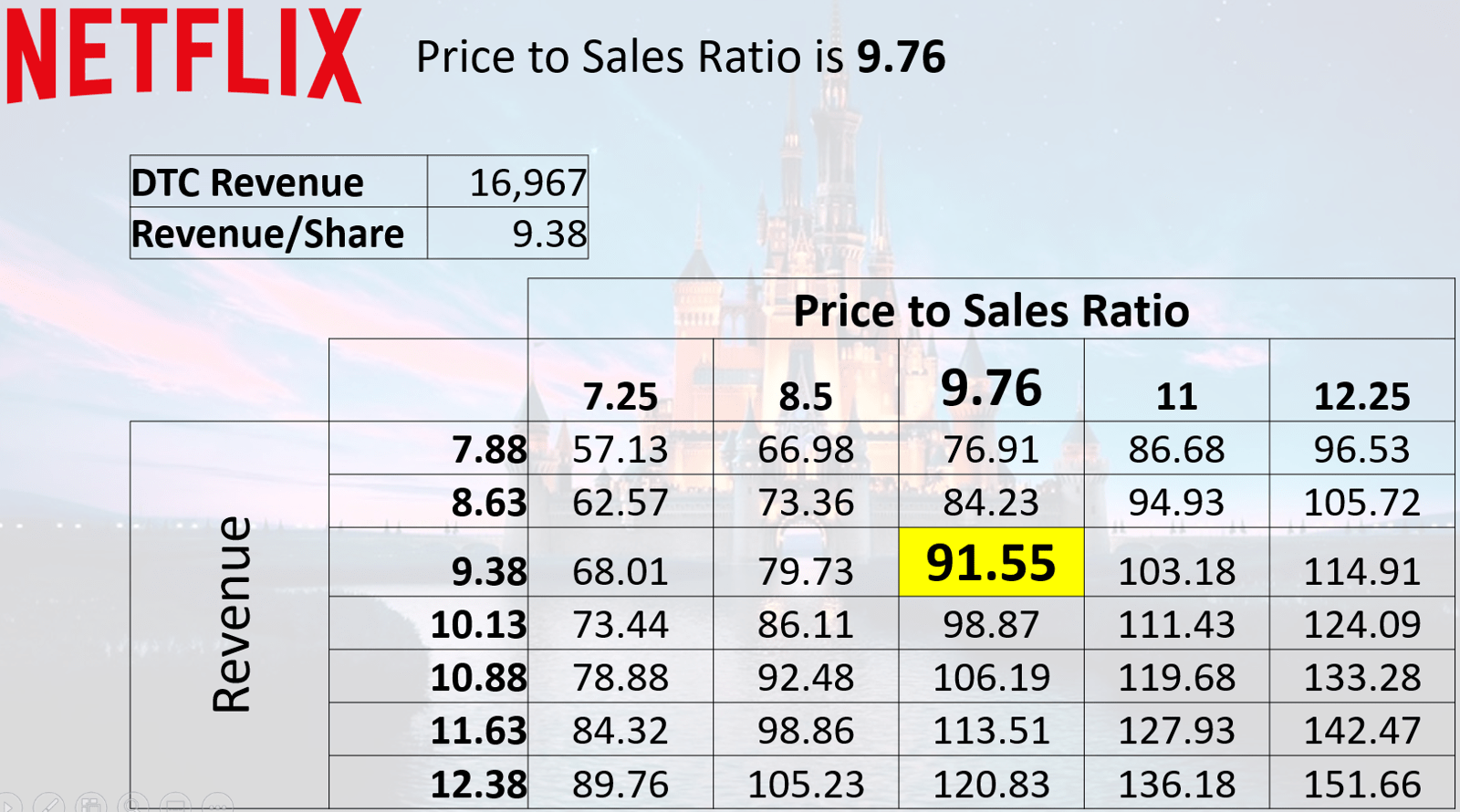

For its Parks business, assuming it is pre-Covid, we can compare it to 6 Flags, its nearest competitor. 6 Flags’ P/E ratio averages at approximately 18x. This will translate to $47 per share for Disney.

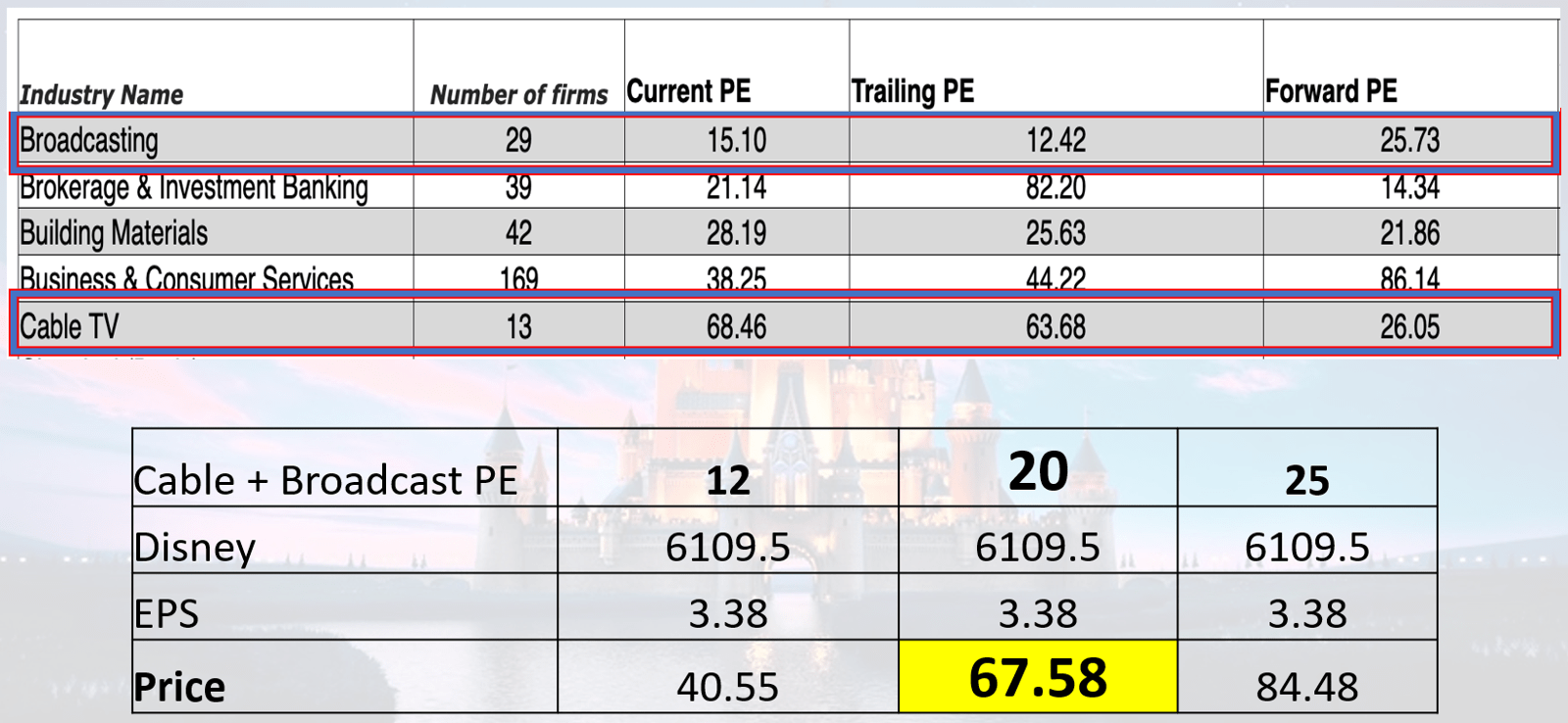

For its Linear Network business, Broadcasting and Cable TV both have a forward P/E ratio of 25x to 26x. This will translate to $68 per share for Disney.

Adding these together will result in $206 for Disney’s valuation. Since Disney is selling at $157 today, I think it is quite attractive. I also provided a lower and upper end comparison below for your estimation.

Forecast of Disney’s Valuation

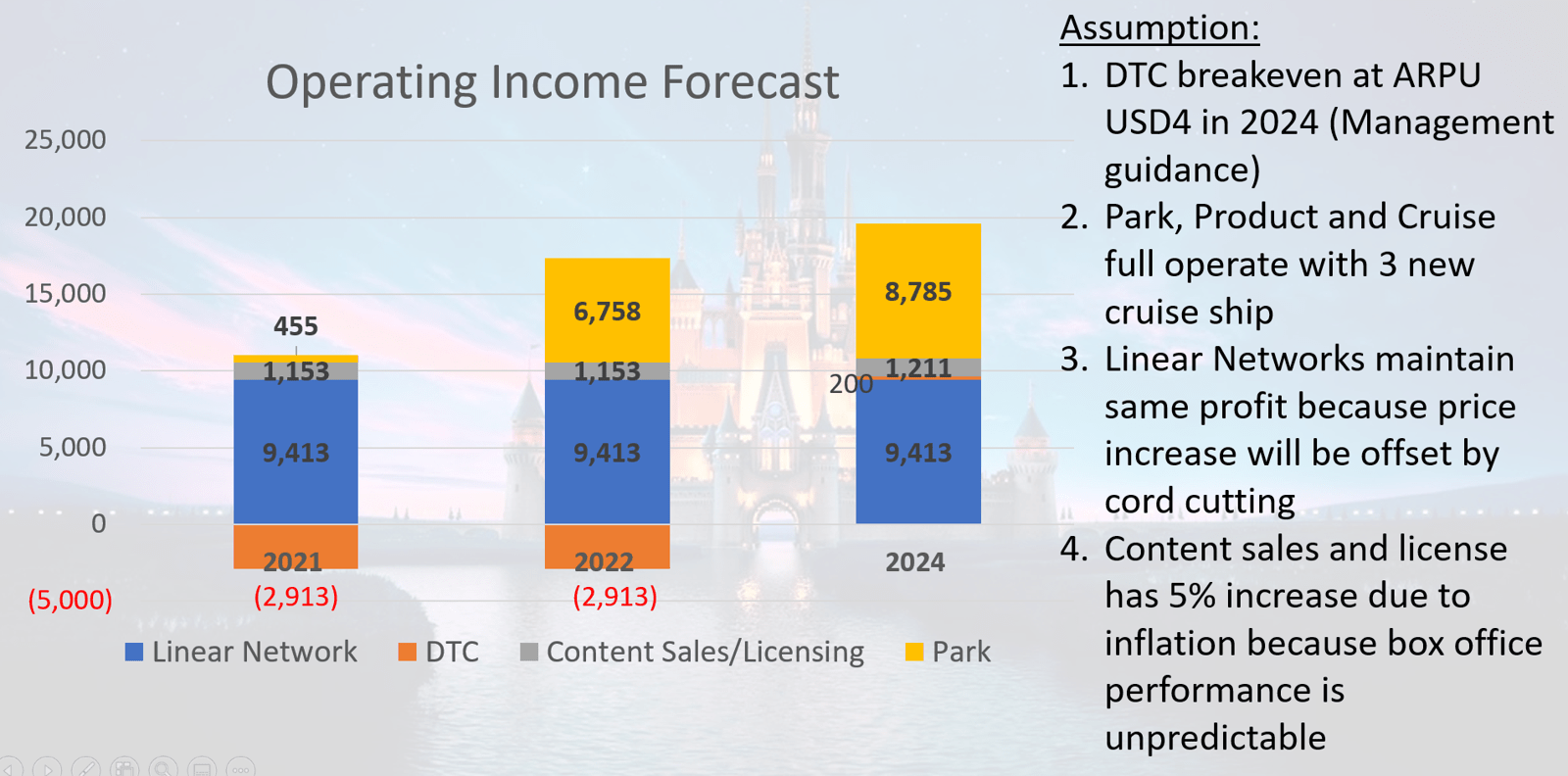

Its DTC video streaming service is still in its infancy. Hence, it is still making losses. However, let us forecast to 2024. We will assume that its Parks business will grow about 5%, combating inflation. We will also assume that it will fully operate its 3 new cruise ships and that its DTC will grow from the Management’s guidance. These and the additional assumptions stated in the image above will give us a valuation of about $250 per share in 2024. This is a 60% upside.

Disney: Yes, No, or Yeto?

My answer is: YES!

I like Disney especially given the price fall last year. The price fell because the new subscription rate has fallen behind expectations. However, I think this is only temporary and in fact gives us an opportunity to buy into Disney!

However, this is only my view! Before you decide to invest into Disney or any other company, do seek your financial advisor’s input first.

Important notice

If you would like to seek advice on your personal investment portfolio, get in touch with me at heb@thegreyrhino.sg or 8221 1200, I would love to connect with you.

Stay updated with the latest news and insights, subscribe to my newsletter, and spread the word.