I will be sharing my view of the year ahead in this article.

2022 is a year that will be split into 2 halves; and I will categorise these halves as “1 Step Back, 3 Steps Forward”. The first half will see us experiencing “1 Step Back”. The market will be volatile and growth companies will experience a sell down; the widespread selling of their shares resulting in falling prices. The second half will see us experience “3 Steps Forward”. It will be marked by a strong come back of these growth companies. (Do note that the halves are just distinct parts of the year. The first half does not directly correspond to the first and second quarters of the year and vice versa.)

2022 will be a very interesting year of opportunity!

The first half of 2022

The first half will be akin to a rainy storm just before the rainbows and sunshine. We must prepare for a lot of volatility.

Historical indication of possible volatility

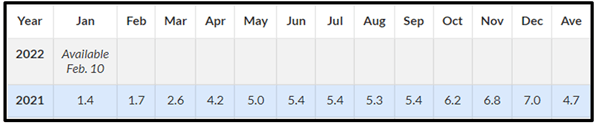

I have talked a lot about inflation in 2021.

At the start of 2021, the inflation was quite mild. However, the inflation kept going up over the course of the year. This matches what I have been saying throughout 2021: inflation will be an issue and a game changer. This rising Inflation would also lead to rising of interest rates that will negatively affect stock prices.

The change that came on 22 November 2021

Jerome Powell, the chairman of US Federal Reserve (US FED) was renominated on 22 November. Before this, he shared that inflation was transitory and that investors would not need to worry. In fact, the projection in early 2021 was for interest rates to only increase at the start of 2024. Hence, the market took the inflation in stride, there was no significant increase in interest rates, and the assets market held up.

But after 22 Nov 2021, Jerome Powell took the stance to retire the word “transitory” as it was no longer appropriate. This meant that the FED recognised the impact of inflation and wanted to combat it. Subsequently on 16 Dec 2021, they corrected their previous projection and stated that there would instead be 3 rate hikes in 2022. There would also be a faster wind down of their bond purchasing (money printing).

There were also discussions for Quantitative Tightening (QT) on 5th of January 2022. Hence, in 2022, the FED is saying that they are going to have a very tight monetary policy.

This sent shock waves through the stock market causing growth companies, represented by the Nasdaq index, to decline by more than 9%. So, if you grab this opportunity when companies are selling down, you will welcome the second half of 2022, where these stocks will see an increase.

The second half of 2022

The second half of 2022 will see the stabilisation of the FED’s monetary policy. This will happen as the FED generally has more bark than bite. They are using strong words to bring down inflation and will taper Quantitative Easing (QE) to raise interest rates. However, in the latter half, I think they will not follow through with the interest hike.

The FED and their previous actions

During the Covid-19 crisis, Jerome Powell said that the FED would print an infinite amount of money to stabilise the market. This was because the stock market dropped by 35% within a month during Covid-19. He also said that the FED would buy corporate bonds, junk bonds, and that the FED would do everything to stabilise the market.

These were the strong words he used to stabilise the market. However, because of these words, the market stabilised, and the FED did not have to continue with their intervention for a long time. Hence, I think the FED is going to do the same this time round.

Jerome Powell’s Pivot

At end 2018, shortly after Jerome Powell was elected, he said that the FED would raise interest rates and engage in QT. That spooked the market, resulting in a 20% drop in a month in Dec 2018. Jerome Powell then swiftly pivoted and said that the FED was going to stabilise the interest rates and that QT was not going to continuously occur.

7 months after, the FED dropped interest rates instead, doing a 180-degree pivot away from the initial direction. This shows that Jerome Powell is very flexible. If the inflation calms down, I think he will rapidly stop increasing interest rates.

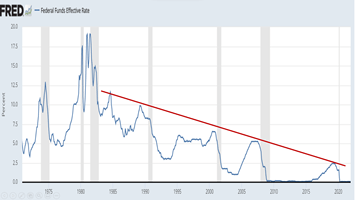

Why is that so? The terminal interest rate, or federal funds rate, is the target interest rate set by the Federal Open Market Committee (FOMC). It is also the highest interest rate of each economic cycle. The successive interest rate over the last 30 years has gotten lower and lower, peaking at 2.5% the last time round. If this trend continues, the terminal interest rate will likely stop below 2%, which aligns with what the FED want. So, when interest rates ease in the second half of this year, the equities from growth companies will stage a strong comeback.

China equities and their growth in 2022

Last year, China equities tumbled by approximately 30% to a near rock bottom. However, the Chinese Government just cut the interest rates and injected liquidity into the market at the start of the year to stabilise the equities market.

Since this is Xi Jinping’s 3rd term of presidency, I am sure that he wants it to be marked with a stable economy and bull stock market to ensure that everyone remains happy. Hence, the China equities market is slowly finding its foot and making gradually recovery. Hence, it might be good to invest in China equities now.

How to position your portfolio to capture opportunities?

You should position yourself, in the first half, to buy up great stocks at an attractive price as the market drops and the price of these quality companies gets cheaper. For the second half, we can then enjoy a ride up in the stock market and increase our wealth.

Personally, if you do not want to time the market, you could stagger your investments. Using Dollar Cost Averaging (DCA) on monthly basis, you can ride out this volatility in the first half. Alternatively, you can invest a few lumpsums as the market gets lower in the first half.

All the best in your investment journey this year. What I said is not advice but instead is what I am doing for myself. You can use this to increase your knowledge or for entertainment. Please seek advice from your own financial advisor to position your own portfolio! With this, I want to wish everyone a very good year of the Tiger.

Important notice

If you would like to seek advice on your personal investment portfolio, get in touch with me at heb@thegreyrhino.sg or 8221 1200, I would love to connect with you.

Stay updated with the latest news and insights, subscribe to my newsletter, and spread the word.