To analyse the changes in the equities market since the start of the year, we will be using the MSCI All Country World Index ETF[1] as an indicator of the overall health of the financial markets. The ETF went down by 33% from 19 February to 23 March but recovered by 41% as of 11 July.

As mentioned before[2], both have continued to follow the same trend. The stock market has largely climbed back up, but the economy is still floundering as of now.

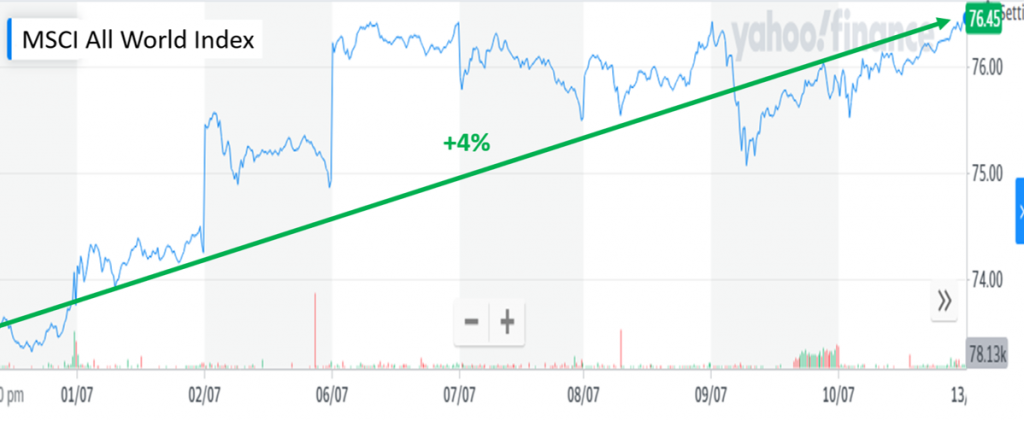

However, if we were to zero in on the last 2 weeks, we will be able to see that the stock market has climbed about 4%. There are several reasons that led to this climb.

The negatives these past 2 weeks

The first negative cause that impeded the growth of the stock market would be the rising number of Covid-19 cases in the US over the past 2 weeks. As I mentioned before, the resurgence of Covid-19 cases in the US was extremely likely due to their eagerness to reopen. Sure enough, the number of cases has gone up in both the US and some other countries.

The second negative cause would be the US and China trade war causing the current relationship between the 2 countries to be the most strained now. The relationship between these 2 superpowers have not been pleasant and has been getting worse. More tariffs are to be expected due to their opposing interests of China wanting to rise to rival US and US not being able to afford that happening. This points to a near impossible reconciliation between these 2 countries.

The positives these past 2 weeks

The first positive cause would be that we are closer to finding a vaccine. 3 companies, Sinovac, AstraZeneca and Moderna, have their respective vaccines in phase 3 of their trials. However, even if the vaccines are approved, the economy will not rebound straight away.

Unlike the stock market, the economy often takes more time to grow. This is due to either the vaccine needing time to be produced and distributed or there being inertia in terms of people spending to fuel the economy.

The second positive cause would be the impact caused by the Federal Reserve (FED). It has experienced a northward bounce of up to 40% for the last 3-4 months due to the Quantitative Easing (QE)[3] conducted by the FED. However, this does not ensure that the companies will grow well. In fact, there are many other factors that control a company’s growth that I will touch on in the next segment.

Growth in a post Covid-19 world

The last decade has seen the slowest economic growth since the great depression. Even if we were to tide through the pandemic, the growth post Covid-19 will still be slow, especially in the initial years after the pandemic has died down.

As mentioned before, the FED is conducting QE but it cannot drive growth.

This is extremely important as companies that rely on economic growth to drive profits will not be able to grow fast. Slow economic growth will cause people to be more cautious when buying goods which will slow down economic growth again. Hence, there will be a vicious cycle of slow spending and slow growth in the economy. This means that cyclical growth companies[4] will probably face years of slow economic growth and slow profit growth.

How does this impact investments?

We should not focus on cyclical growth companies and instead focus on Structural growth companies.

Structural growth companies serve previously unmet needs and create new demands. They increase people’s efficiency and take away demand from other players in their respective industries. They are innovators that disrupt the industry and take away market share from companies that rely solely on economic growth to sell more goods and services.

Jeffrey Gundlach, a hedge fund manager of over $100 billion in sum, shared with Yahoo! Finance that the record second-quarter rally[5] was driven by the super 6. This consists of Facebook, Amazon, Apple, Alphabet (Google), Netflix and Microsoft. Without these companies, the US stock market will not experience any earnings growth.

He might be exaggerating but this is by and large, true. Although some big companies, apart from these 6, have also grown, the growth is highly concentrated in the 6 companies. Hence, these 6 are the main cause of earnings growth in the US stock market.

What sets these 6 companies apart are the fact that they are structural growth companies. As such, these companies will continue to grow but a bulk of the cyclical growth companies will be left behind in the next 5 to 10 years.

Even as we continue to weather this pandemic, I will explore more on how to identify these structural growth companies to guide you in making better investment decisions. So, feel free to subscribe to my newsletter to stay up to date on the latest articles that I will be posting.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

[1] https://www.ishares.com/us/products/239600/ishares-msci-acwi-etf

[2] Read my previous article: What is happening with the Economy and Financial Markets to better understand the divergence between the 2.

[3] Quantitative Easing is the introduction of new money into the money supply, typically through printing money and buying bonds, by the central bank. In this article, we will focus on the Quantitative Easing conducted by the FED.

[4] Cyclical growth companies often sell discretionary goods. Hence, they follow the economy closely. Their stock prices increase when the economy does well but decrease when the economy faces a recession.

[5] A rally is a period of sustained increase in the prices of stocks, bonds, or indexes. However, a rally will typically follow a period of flat or declining prices.

This is my first time pay a quick visit at here and i am

truly impressed to read all at single place.

Thank you for the compliments. Be sure to subscribe to the newsletter if you want to support me and get more updates 😀

An excellent post, congratulations !!

Thank you for reading this post!

Remember to share it with your friends if you find it useful!😊