Why will interest rates remain low?

As I shared previously, the interest rate will stay low for a long time due to 2 reasons.

1. A debt laden world

The world’s leading financial centre, US, has a government that is in debt of over USD$27 trillion. Furthermore, the amount of debt is showing no signs of slowing its growth.

Joe Biden has been elected as President and is leading the Democrats. They have decided to increase stimulus for the people while also increasing stimulus for the economy. To do so, they must borrow money from other countries as they currently do not have any savings.

In borrowing money, US will also owe other countries interest. Hence, to minimise the interest expense that is incurred, US will have to keep the interest rates low.

2. A large amount of unfunded liabilities

The balance states that unfunded liabilities are debt obligations that have insufficient funds set aside to pay them. An example is pensions, regular payments made to people by the government after they have retired. Although it is necessary for pensions to be paid out to the US citizens, the government is currently unable to afford it.

US currently has USD$160 trillion in unfunded liabilities. With such a massive debt, it is unlikely that the US government can fund this. Hence, the government will try to jump start the Wealth Effect[1]. By keeping interest rates low, the asset prices will move in the opposite direction and increase. This will prompt the Wealth Effect, whereby consumers will spend more as the value of their assets rise.

This will be the primary interest of most developed countries that have difficulty funding unfunded liabilities. Increasing the prices of assets would allow them to use those assets to fund their unfunded liabilities in the near term. Since these plans will take some time to take effect, the interest rate is likely to remain low through the mid-term too.

However, we must dive deeper and ask what effect the low interest rates will have on our investments. Essentially, what is favourable or unfavourable to invest in in this environment.

Unfavourable assets to invest in now

The unfavourable assets to invest in are likely what you think of as unsafe assets like Cash and the long-term debts of developed countries.

Why Cash is not a good investment now

Currently, the general interest rates given by our banks are very low. For example, your POSB savings account will only pay you 0.25% interest per annum (pa). In contrast, the forecasted inflation in Singapore by 2025 is 1.5% pa. Ultimately, you will get a guaranteed loss over the long term if you put your money in Cash.

As such, it is obvious that Cash will be a terrible asset class to hold in your investment portfolio. And though you might argue that there is no volatility, it is still one of the riskiest assets to hold in this low interest rate environment.

Why Long-term debts of developed countries is an unfavourable investment now

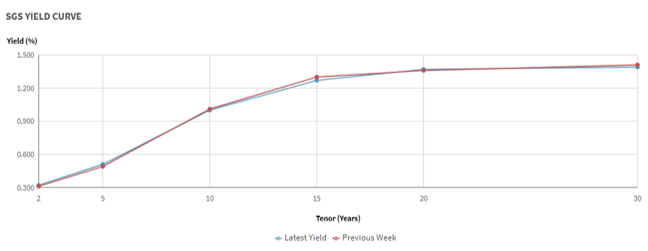

Government bonds will also yield less than the forecasted inflation rate. For example, a 30-year long term Singapore government bond only pays the investor 1.3% pa. However, with the forecasted inflation by 2025 being 1.5% pa, the locked in cash will not give enough returns to beat inflation. Hence, we should only invest in this asset sparingly and for specific purposes only, even if it is a safe asset class.

Favourable assets to invest in now

In line with my post title, I believe that now is the time to find safety in volatility. Although it seems oxymoronic, it is true. However, before we proceed, there is a need to understand that risk does not equal volatility. Volatility refers to the rapidity of the price fluctuation a security endures. Risk, on the other hand, is the probability that the investment will experience permanent loss of value[2].

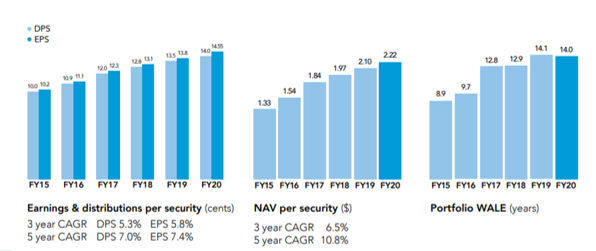

Hence, it is possible for your investment to be volatile yet relatively risk-less. For example, Arena REIT invests in childcare centres in Australia with a dividend yield in excess of 5%. They lock in their operators for 14 years, with the increase in the rental being 3.4% pa. Hence, it has a dividend yield of 5% and will increase by 3.4% every year over the next 14 years. It is ultimately a superior investment compare to Cash or long-term government bonds although it is volatile.

This era forces us to accept volatility and embrace it if we want to invest in safe assets.

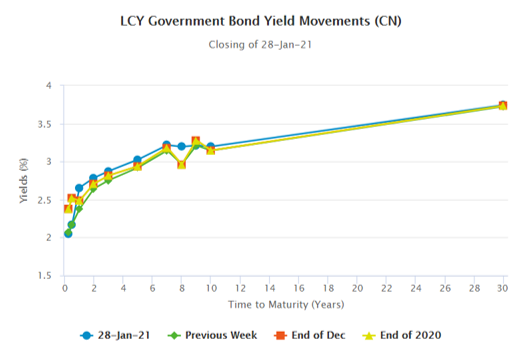

If you are still unsure about highly volatile assets and want to invest in low volatility assets, China government bonds has potential. The yield currently stands at 3% pa whereas Singapore’s bond yield is only at 0.5%. There is a stark difference of 6 times. This is due to China not needing to raise a lot of debts to fund their spending. As such, they can afford to keep interest at a reasonable rate instead.

So, if you want to invest in an interest-bearing low volatility asset, China government bonds might be good place to start.

How does this play into your portfolio?

Having said this, we must have proper diversification too. We must diversify wisely but not blindly. Diversifying blindly is randomly placing money into all asset classes. Diversifying wisely, in contrast, would mean that we must analyse the different class of assets. Subsequently, we must place the money wisely into the different baskets.

We may not know which class of assets may perform well in the following years. Hence, it is important that we diversify wisely to preserve our wealth. I frequently write on how to diversify your portfolio depending on the changing economy, so do follow my newsletter for any updates.

[1] If you want to read more about the Wealth Effect, read this article by Investopedia.

[2] If you want to read more about Risk vs Volatility, read this article by Lyn Alden.

Dear Rhino,

Thank you for your sharing. So happy that you are back for the latest market update and outlook. Looking forward to more of your episodes.

Wishing you and all a happy, healthy and prosperous Chinese New Year.

Best wishes

Grace

Thank you for the well wishes Grace,

I look forward to creating more content that will help everyone to invest more wisely in these turbulent times.

I deeply appreciate your support and I wish you a happy Chinese New Year too! 🍊

Good Thoughts to ponder

Thank you for stopping by and supporting the blog Richard. 🦏

If you want to, please subscribe to my newsletter to stay updated with more interesting thoughts to ponder.