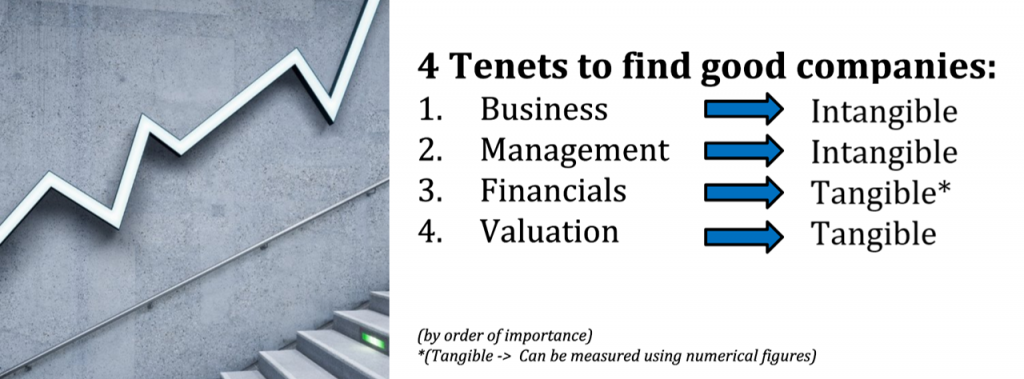

Have you ever wondered what you must factor in when selecting company to invest in? These are the 4 factors you should focus on.

The most important tenet will be the quality of Business while Valuation stands at least important. Although quality is the most crucial point, this can be quite intangible. Hence, we must also look at the Financials and Valuation for a more tangible gauge of the company’s prospects.

What is Valuation?

Valuation is a method of determining the true or intrinsic value of the stock, whereby it is assumed that the actual price of the stock will not match its intrinsic value. Valuation is then a benchmark to see if you are over or under-paying for a stock.

The most common method of valuation will be the Price-To-Earnings (P/E) ratio[1] method.

However, it is not the determinant of whether you should buy the stock. Instead, it should be used as a measure to ensure that you do not overpay for the stock.

The Evolution of Valuation as a metric

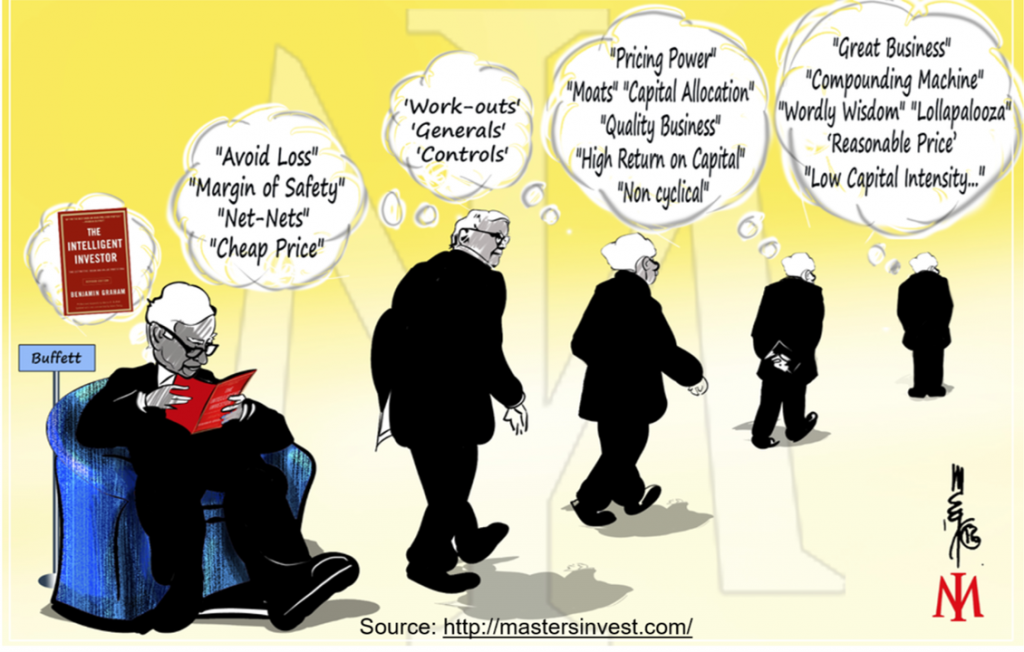

Valuation as a metric for purchasing a company’s stock has changed over the years. This progress can be illustrated by the relationships that Benjamin Graham and subsequently his student, Warren Buffett, had with Valuation.

Benjamin Graham and Valuation

Let us look at Benjamin Graham. He was an investor that avoided loss and prioritised margins of safety when he invested. He also invested in stocks that were sold at cheap prices. To understand why Benjamin Graham advocated strongly for these guidelines when investing, we must look at his background.

Benjamin Graham was born during the Great Depression and saw his family almost go bankrupt. A story that was deeply engraved into his heart was the story of his mother buying bread for $5 on credit from the grocery store. He felt heartache and gradually used this experience to fuel his determination to never fall close to bankruptcy again. From this, we know why he was very focused on avoiding losses.

His investment decisions were grounded in the tangible assets of the company and he did not believe in future earnings. If the company had $1 million and he could buy it at half that price, that company was then a good investment for him. Even if the company was making losses, so long as many of such companies could be bought at a cheap price, it would have made you a good investor.

As you can see, the valuation in this era was very easy. If the assets of the company were worth $1 million, one could easily set a benchmark price of buying the company at a maximum of 60% of their assets. As such, valuation was very important when choosing a company to buy and could be easily defined.

This investing philosophy that he stuck to served him well and made him a lot of money. Subsequently, his protégé, Warren Buffett, started out investing with this methodology too.

Warren Buffett and Valuation then

Although Warren Buffett did begin investing by using his mentor’s guidelines, he did not follow it strictly.

At the start, Warren Buffett focused instead on buying good quality companies that had consistent growth in profits and a high competitive advantage. He treasured near-term earnings that could grow regularly. He chose to invest like this as the financial markets were somewhat stable. The last revolution that shook the financial markets during those times was the Industrial Revolution in the early 19th century.

As such, he could only buy into mature and stable companies that grew at 5-10% per year. These companies did well over time and were companies that you could buy cheaply.

Using Valuation when investing today

When we invest today, we should not focus only on competitive advantage or consistent growth in profits. We should also focus on current earnings.

The type of company we want to invest in has to be a high-quality business that can experience compounding of up to 15-20% per year. Many of these companies have arisen over the last few years as we have been experiencing a technological revolution. These companies leading the revolution experience such rapid compounding effects because they are structural growth companies[2] that take away market share from existing players.

As such, we should focus on the current earnings to gauge the future earnings that we can get after the current earnings have gone through the compounding effect.

However, the price to pay for exponential future earnings are hard to define in comparison to the valuation method that Benjamin Graham used. Indeed, if you can find a company that can grow 20% per year perpetually, no price is too high when buying the company’s stock.

The most important factor when contemplating a purchase is then to find the right company. If the company can grow 15-20% for a period of 10 to 30 years, then the high price to pay is relatively cheap in comparison to its growth and earnings. Hence, when we invest now, what we are looking for is not to buy at a cheap price but rather, a reasonable price.

How I use Valuation in my investments

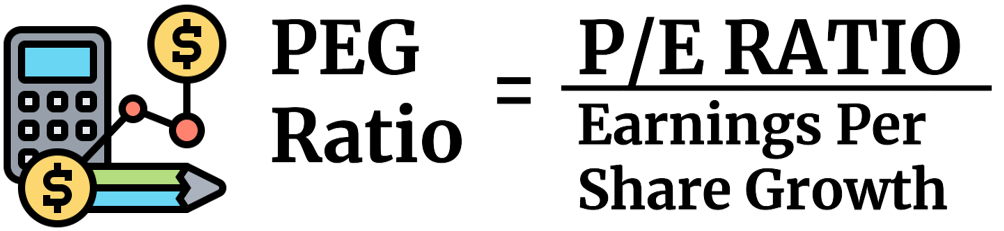

I will normally use the metric of Price Earning Growth (PEG) Ratio[3] not exceeding 3 times. However, I must reiterate that this is merely a yardstick to ensure that you do not over-pay. The factor that you should prioritise is the quality of the business with the financials and valuation to support your decision making.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

[1] The Price-To-Earnings ratio (P/E ratio): Price for the share/ Earnings per share. It indicates how much an investor is willing to pay for each dollar of earnings.

[2] Structural growth company: They are disruptors in their respective industries and grow much faster than their peers.

[3] Price Earnings Growth Ratio (PEG ratio): (Price/Earnings per share [EPS])/EPS Growth. It factors in both the stock’s value and the company’s expected earnings growth.

[…] [2] To find out more on previous value investing methodologie, read: All you need to know about Stock Valuation […]