The quarterly earnings of Big Tech companies have defied everyone’s expectations but what does this mean for the common investor?

Exceeding all expectations

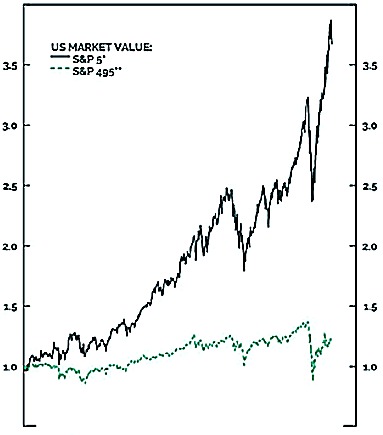

S&P 495: S&P 500 excluding the companies mentioned above

Source: BCA research

Apple, Amazon, Facebook and Google recently announced their results on 30th July, with Microsoft announcing theirs a week earlier on 22nd July. Their results completely crushed analysts’ expectations as they continued to hold onto a constant revenue stream while other conventional businesses suffered.

A prominent example would be how Amazon earned so much that they even defied their own expectations and reached a record high sales of $88.9 billion. This was much more than the $75 to $81 billion they were expecting to rake in during the pandemic.[1]

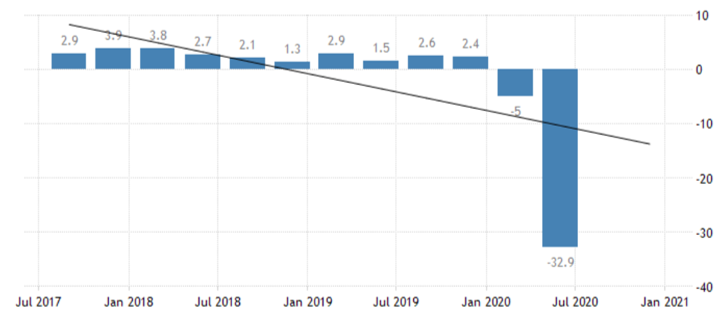

As expected, these companies do not follow the same trajectory as the economy they are in. On the same day the Big Tech companies announced their record earnings, the US economy announced that it had experienced a reduction of 9.5% when compared to the previous 3 months.

How does this relate to the future?

These contrasting fortunes are signs that we are in an era of disruption. These 4 major tech companies are innovative disruptors that are displacing increasingly larger shares of the economy. These disruptions began during the Dot-Com boom at the turn of the century, but many brushed it off as a fad at that time. However, the force of disruption has been gaining momentum since then and has only been further amplified by the Covid-19 pandemic.

From this, we can understand that crises do not merely weaken economies. They also play a part in accelerating trends, like the trend of innovative disruptors mentioned above. Subsequently, the stimulation of this trend has also driven the nail into the coffin for many conventional businesses. There will be an upcoming tide of disruption bearing down on these businesses, forcing them to go through permanent alteration because of this crisis.

In fact, if you were to observe closely, you would see that there are already some signs of possible alterations that could become permanent fixtures in the future.

To name a few examples:

- Companies will accustom their employees to work from home after this “trial” period during the pandemic. This will mean that companies will look for many ways to reduce their rental cost through a hybrid of the work-from-home and work-from-office models. This will ultimately reduce the demand for office spaces.

- E-commerce has increased over this period as most people would have turned to online shopping to buy their things while brick-and-mortar shops were closed. The convenience of online shopping will inevitably reduce the footfall in shopping malls.

- People have started to communicate via Video conferencing and Webinars more often, so much so that this mode of communication has become the norm. These conveniences would possibly reduce the demand for air travels and business hotels as people will start to think twice before embarking on an overseas business trip for a conference or meeting.

How does this impact my investment decisions?

If you are an opportunist, you might want to make a quick buck by buying businesses disrupted by the Covid-19 pandemic. These businesses might be attractive to you as their stocks would be selling at a discount during the pandemic. However, before you take a leap and buy these stocks, you might be disappointed in the long haul as they are likely to continue their plummet over time.

If you rely on the previous versions of value investing, you might get frustrated as those methodologies[2] no longer apply in this era of disruption. The previous value investing methodology focused on investing into mature and stable companies that give a steady flow of dividends to shareholders. However, these dividends from conventional dividend-paying stocks or REITs[3] might eventually dissipate as the cash flows from these disrupted companies will take a permanent hit.

How can I utilize this prediction?

As the common investor, it is critical that we are flexible and adapt our investing methodology to this new environment of rapid disruption if we want to thrive and prosper. Structural Growth investing[4] will help you adapt. It retains the ageless principles of value investing while evolving in its application. This method of investing will allow you to select companies that can grow multi-fold over the next decade.

Subsequently, if you are interested in Structural growth investing, consider subscribing to my newsletter for updates. I will be posting case studies on Structural Growth investing.

[1] To read more on Amazon’s revenue growth recently, read: Amazon promised to spend its profit amid pandemic, but ended up with record earnings anyway

[2] To find out more on previous value investing methodologie, read: All you need to know about Stock Valuation

[3] REITs: Real Estate Investment Trusts own, operate or finance income-producing properties, with a large proportion of their profit normally being distributed as dividends to shareholders.

[4] Structural Growth investing: The investing methodology of selecting and investing in structural growth companies that are disruptors in their own industry and grow much faster than their peers.

If you are uncertain whether your investments run a risk of permanent impairment because of disruption, it is still timely to act. Feel free to drop me an email at heb@thegreyrhino.sg or a message at 8221 1200. I am happy to have a discussion to explore this with you.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.