Last week, I gave an update to our investors on my firm’s portfolio performance amidst the financial crisis. Our investors were glad and assured our carefully curated portfolio was still making profits since the start of the year, while the global stock markets have declined 20-30%. The reason of this stark contrast was due to the ample preparation for the lean years as the fat years never last forever.

In the investment world, the fat years tend to last longer and the lean years shorter. But the lean years are usually extreme. As the saying goes “The bull climbs up the stairs and the bear jumps out the window”.

I think a question that is on everyone’s mind now is:

What is ahead of us? Is this the dusk before dawn, or are we staring into an abyss?

To answer this question, let me draw an analogy to the last financial crisis. Let’s be clear, this crisis will be different from the previous one as the causes of the crisis are different. However, they will rhyme.

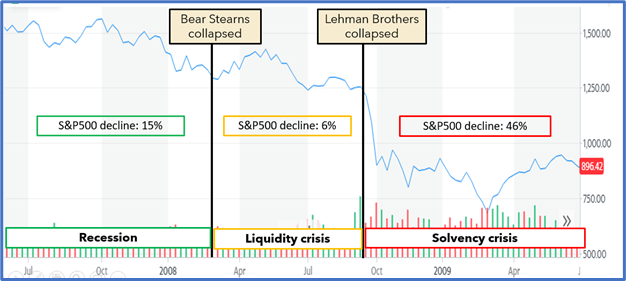

The last financial crisis, the Subprime crisis, lasted from October 2007 to March 2009. There were 3 distinct phases:

Phase 1: The crisis started as a usual recession.

In this phase, the share prices of companies fundamentally affected by the recession fell. The prices of defensive companies remained stable, while the prices of safe havens like gold and silver rose.

Phase 2: The collapse of Bear Stearns in March 2008, an 85-years-old investment bank.

A recession progressed to a liquidity crisis. In this phase, everyone wanted to sell, but nobody wanted to buy financial assets. Fund managers who faced redemption request by their investors ended up selling those previously unaffected assets like the defensive companies and safe havens to raise money to give back to their investors who asked to redeem their investments. During this phase, assets prices behaved abnormally.

Phase 3: The collapse of Lehman Brothers.

Citigroup and AIG almost defaulted and needed the US government to bail them out. A liquidity crisis became a widespread solvency crisis, where any company could be a default candidate. The banks, which were the heart of the economy, stopped lending. Like a patient with cardiac arrest, the economy fell flat on its face with the sudden freezing of liquidity.

WHERE ARE WE NOW?

We are currently in Phase 2 of the crisis.

If a vaccine for COVID-19 is not found within the next few months, we would likely move to the third and potentially most devastating phase of the crisis, the solvency crisis. This would be a time where the pain or opportunity is greatest, depending on your state of preparation. If you are prepared, like Egypt in the story earlier, it would be a time to usher in great prosperity. If you are unprepared, like those neighbouring countries in the story, it would be a time of pain and sorrow.

At the same time, the selection of investments is vital in this environment. To certain companies, this crisis is but a blip in their long-term growth. To others, this crisis could be a death knell. I would share this in my upcoming article.

Financial crisis is a period of mass transference of wealth from the unprepared to the prepared.

I am progressively investing into high quality, structural growth companies as their prices declined. Fear regarding the long-term prosperity of these large, strong and growing global companies makes no sense. These companies will soar again once this storm blows over. During this window of opportunity, we are given a chance to invest in these wonderful companies at temporary marked-down prices.

How are you investing in this period of opportunity so far? I would appreciate you share with me in the comment section below.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

In the end, we only regret the chances we didn’t take, relationships we are afraid to have, and the decisions we waited too long to make. Let this not be an opportunity we regret missing.