I was at that stage of life when Google‘s algorithms decide to throw a few ads on diamond rings along my way. One commercial presents a sparkling diamond in all its glory, with a voice over touting how a Tiffany’s “diamond is so rare and beautiful that 99.96% are rejected”.

Another takes the form of a wedding montage where a beaming bride shows off her shining diamond ring in every pose. Regardless of the marketing spin, they all share one thing in common: a de-saturated edit to evoke nostalgia. Perhaps, it is to gloss over the fact that diamonds being a symbol of eternal commitment is a pretty recent trend, started by a company called DeBeers.

If the name “DeBeers” sounds like one too many beers, you are not alone in not recognizing this powerful cartel. DeBeers is one of the largest diamond producers in the world. Since 1888, it has restricted its diamond supply to make diamonds appear scarce, and hence, rare.

“A diamond is forever” – how a marketing campaign changed the world

A diamond advertisement in 20th century.

Source: Guide Book to Life

Through a clever marketing campaign which associated diamonds with eternal love, DeBeers created a perceived value for diamonds that had never existed. Ever since, many people have come to regard a marriage proposal without a diamond ring as a big no-no.

Are diamond rings actually worth months of salary?

What a tricky question! After all, how do you measure love? But, if it is just the money talk, the average cost of a diamond ring is about S$8,000, easily worth 2-3 months of salary in Singapore. The moment you walk out of a jewelry shop with a new purchase, its monetary value drops. Suppose you buy the ring at S$10,000, you will typically be able to resell it at S$2,500 to 5,000 – a 50%-75% loss.

The reason is that jewelry shops buy diamonds at wholesale prices, probably even on consignment, which means they do not have to pay the wholesaler until they make a sale. Since it only costs them a fraction of the price which they sell the ring to you at, if they are to risk buying your diamond ring back, they must buy it cheap.

Of course, the sentimental values are hard to measure. But, at this juncture, if you wonder whether there are other options, feel free to check out the following for an inspiration.

Are there financially savvy alternatives?

1) Singapore Savings Bonds

How about buying some bonds to celebrate the forming of eternal marriage bonds?

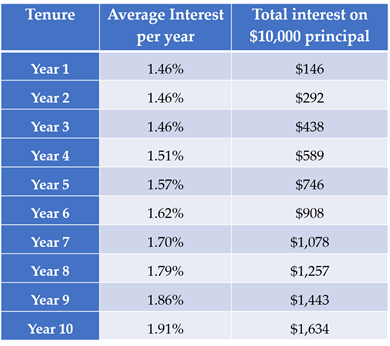

Below is an illustration of how much interest you can earn from a S$10,000 investment in Singapore Saving Bonds. If you decide to cash out your “bonds” after 10 years, there is still some profit to share.

Source: Monetary Authority of Singapore

However, if you are considering savings bonds as an investment option, you may want to think again. I have shared my thoughts in my previous article, 3 Reasons NOT to invest in Singapore Savings Bonds.

2) Gold Exchange-traded funds (Gold ETFs)

If you wish to add some symbolism to mark the occasion, gold is an excellent alternative. In fact, in many Asian societies, the practice of giving gold as gifts is common. But instead of physical gold bars, I am talking about gold ETFs.

Sounds intimidating? Fret not. Imagine you and I, plus a few other people, put together some money in a fund. The fund uses this money to buy gold bars and keep them in a safe place. Each of us is, therefore, owning some physical gold indirectly. At any point in time, if we want our money back, the fund sells away our shares of gold bars at the current market price in order to pay us. This is how gold ETFs work.

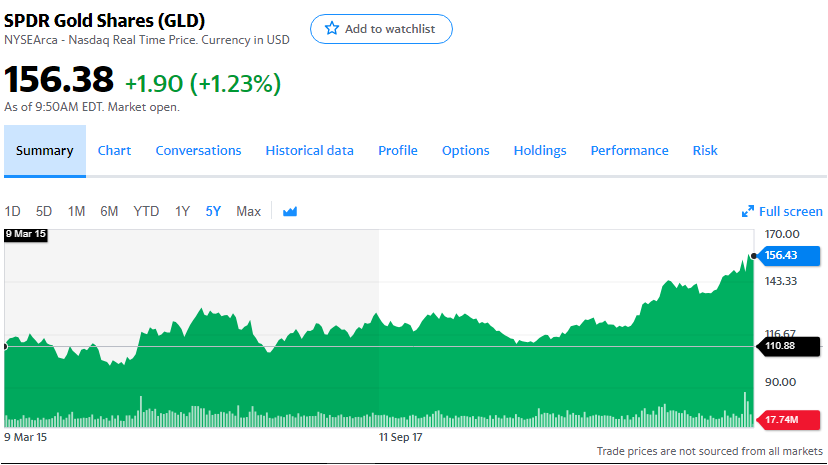

As an illustration, SPDR Gold Shares (a gold ETF)’s price has risen 40% over 5 years since 2015, with year-to-date return of 9.74%.

3) Stock

If you want to up your game, you may consider buying a part of the company that controls the diamonds. While you cannot own DeBeers, you can own a part of LVMH, DeBeers’ parent company. If you had spent S$10,000 on LVMH’s shares in 2015 at USD36 per share, by the time this article is written (Mar 2020), your share is worth S$ 22,000, a whopping 2.2 times increase over 5 years.

A word of caution: choosing the right company to buy at the right value requires knowledge and experience. If you are new to stock investing and would like to learn more, stay tuned for upcoming posts.

Whether to buy a diamond ring for your engagement, the call is yours. After all, love is not measured by money. But making good financial decisions does lay the foundation of a happy marriage.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.