What does the breakdown of Business components tell us about Microsoft?

Some won’t make it

No Comment

Common investing risks and mistakesEconomy and Asset AllocatingStructural Growth Investing

What does the 4 Big Tech companies maintaining their earnings growth during a pandemic say about the future of investing?

Investment lessons from reviewing the first half of 2020

4 Comments

Common investing risks and mistakesEconomy and Asset AllocatingStructural Growth Investing

Find out what is affecting the current economy and how to tweak your current investments in preparation for the post Covid-19 economy.

All you need to know about Stock Valuation

What role should Stock Valuation play in your investment decisions? Read this article to find out more.

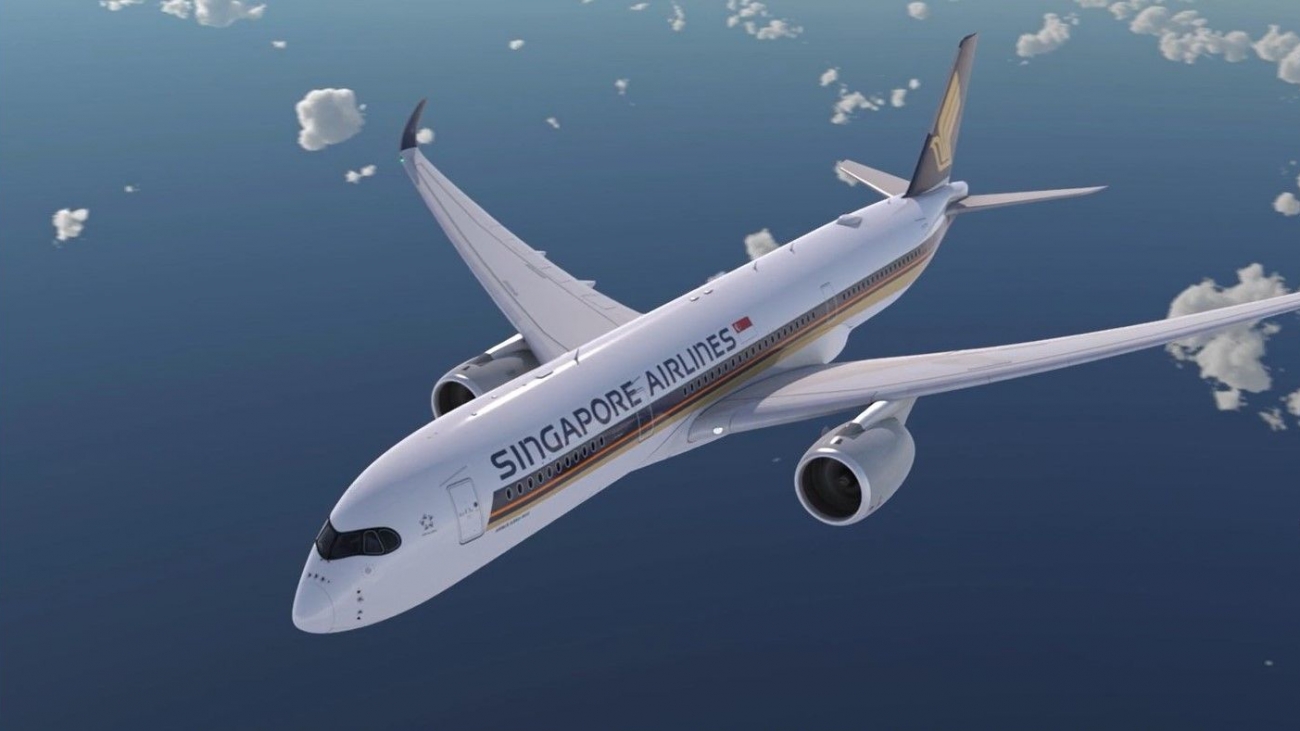

Why SIA might not be the best investment for you

No Comment

Common investing risks and mistakesEconomy and Asset AllocatingStructural Growth Investing

Although SIA has projected 5-20% gains as the economy starts improving, it is not the best investment for the long term. Read more to find out why.