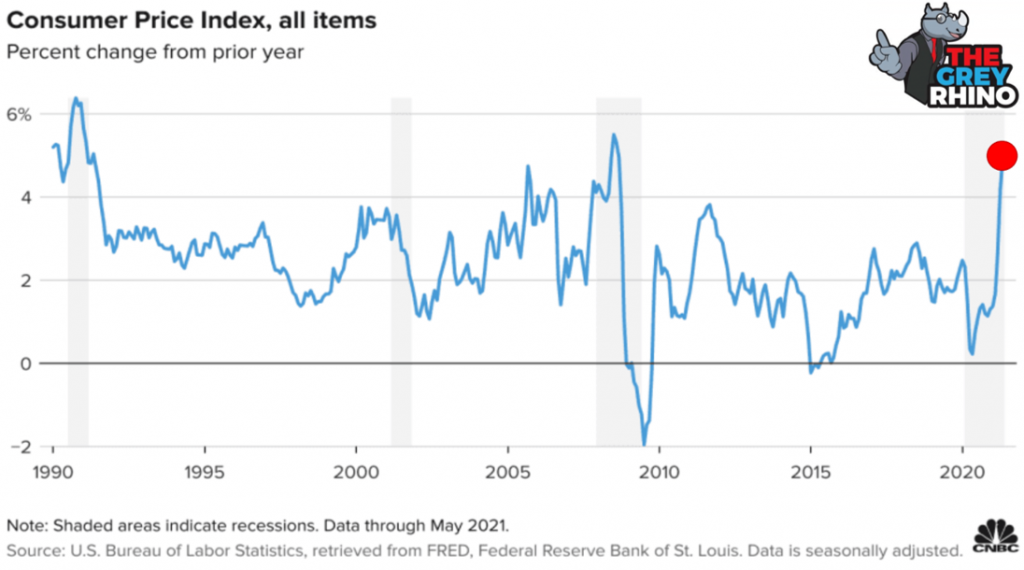

May’s Inflation data in the US indicated that Inflation has spiked up to 5% year-on-year. Above the expectation of 4.7%, the stock market shockingly reacted positively to the news.

Reasons for the Inflation spike

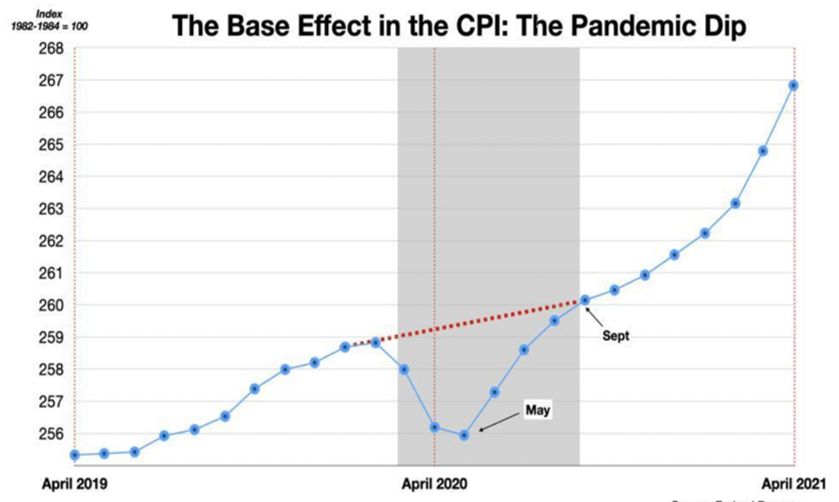

1. Base Effect

Inflation will only have increased by 3.5% instead of 5% if we observe the red line which does not account for the large drop last year. This difference in 1.5% was caused by the Base Effect, wherein last year’s lowered Inflation rate gave a lower starting point for the Inflation growth this year, hence increasing the extend of the Inflation rate spike.

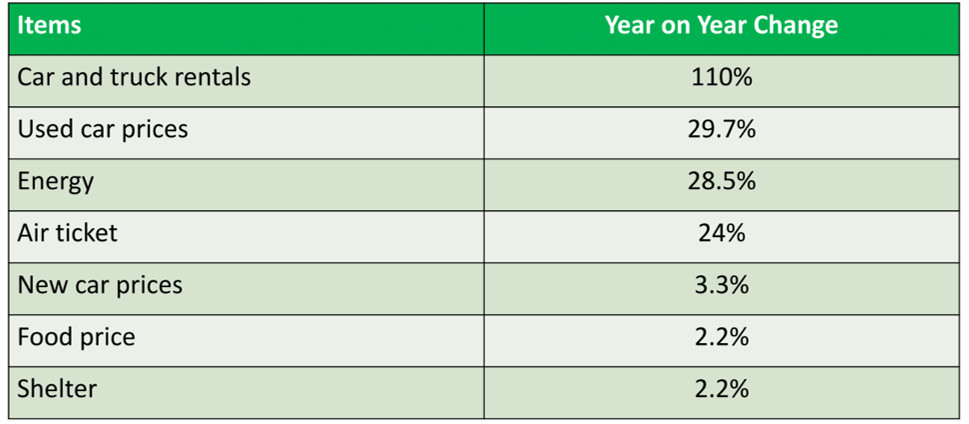

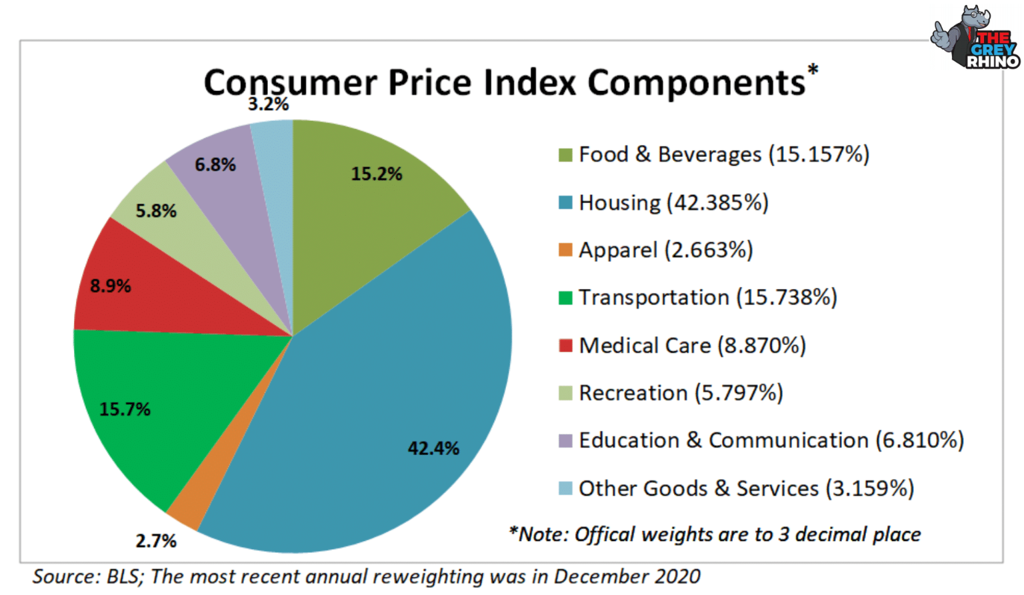

2. Consumer Price Index (CPI) Components

CPI studied the weighted average of a price of a basket of consumer goods and services, it is a common determinant for Inflation. Cars and truck rentals and used car prices with heavier CPI weightages have driven the increase in Inflation because of the pent-up demand from the supply shortages. Since there is a shortage of chips to make cars and people cannot travel overseas. So, they either take domestic flights or buy or rent a car to travel, wherein the shortage of cars will inflate prices.

Inflation: Transitory or Long drawn

The Federal Reserve (FED) predicts a transitory Inflation since other components like shelter or food have not increased much. Hence, there is no need to curb the Inflation yet. As such, the monetary policy is still loose and interest still low to support the asset prices. This explains why prices in the stock market went up even though the Inflation data was more than expected.

Causes for the possible long drawn Inflation

Contrary to the FEDs opinions, I think that the Inflation will be more long drawn. We can observe this through looking at the trajectory of the various Inflation components.

1. Housing Inflation

Housing is the largest component of the CPI, and Housing Inflation will have the largest impact on overall Inflation. It is determined by Owners’ Equivalent Rent (OER). This measures the how much a property owner must be paid to substitute a currently owned house as a rental property. However, there is a lag in how informed the house owners are of the actual prices.

There has been a spike of more than 10% in the house prices due to housing shortages but this has yet to be reflected in the Housing Inflation rate as this will only show when homeowners start to realise that the prices of their houses have appreciated.

2. Increase in Wages

The US government has been giving stimulus cheques, prompting people to stay at home without working. Hence, companies have been paying employees more by increasing minimum wages and giving bonuses to encourage them to work. Companies like Bank of America, Amazon, and McDonalds are some of the examples. However, wages are quite sticky as it is difficult to reduce the wages again, after the stimulus checks stop coming, without alienating the employees.

3. Change in government

Under Donald Trump, policies benefitted the rich. When money remains with the rich, the price of necessities that make up the CPI do not increase as the rich do not spend more on these necessities.

However, under Biden, the policies aim to redistribute wealth to the middle and lower income by taxing the rich. Hence, by taking from the rich and dividing it amongst millions, each will increase their consumption of necessities, inflating the prices of food and beverages and transportation, the next two largest CPI components.

He has passed a USD$1.9 trillion fiscal stimulus, and is now planning to pass another USD$2 trillion infrastructure plan and a USD$6 trillion budget in 2022. This means that more money will be printed to flow down to the lower and middle income, raising the velocity of money (the speed at which money exchanges hands) as consumption increases.

Positioning your portfolio

The extent of Inflation increase

Inflation will be long drawn but will not enter the double digits as underlying forces still depress the Inflation. Industry disruptions and technological advancements have improved productivity. Hence, supply will be able to catch up with demand, lowering Inflation. The declining population in wealthy nations, that stems from low fertility, will also result in the reduction of aggregate demand, hence also lowering Inflation.

In view of this, it is possible that the FEDs will increase interest rates in to reduce the velocity of money, hence reducing the Inflation too.

Optimising your portfolio diversification

Be cautious about making major changes in asset allocation. Since Inflation seems to be rising, if your investments compose of 50-60% equities, you should not change it. If you hold ONLY equities, you could sell some off.

We can, however, make some allocation tweaks. Some equities will be more at risk than others, with these equities being from companies that are not earning any money. Thus, their PE ratios, current share price relative to earnings per-share, are very high with the price of the share being based largely on future earnings. These companies will be the most affected by interest rate raises.

Another type of company to remove are companies with fixed earnings and dividends. The 0% interest environment might make a 5% dividend look attractive but in an environment with raised interest rates, it no longer looks attractive. Since they cannot give more dividends, the only way to increase their dividend yields will be for their share price to drop.

Lastly, government bonds should be avoided. I have warned against it since last year. Safe government bonds like the US Treasury bonds pay a low 1-2% return. When prices rise, they can get punished further, for example 30 years Treasury Bonds have declined by 20%. However, this does not mean all bonds should be avoided, do choose wisely.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.