Recap of the 1st Quarter of 2021

The most prominent occurrence in the last 3 months has been the rising treasury yield.

Before we dive in, we must understand the difference between the short-term interest rates (Official interest rates) and long-term interest rates (Market interest rates).

1. Official Interest Rates

Official interest rates are the interest rates set by the Central Bank. They have been set and maintained at 0% up till today. The Central Bank increases and decreases the money supply accordingly to adjust the interest rates.

The Central Bank is currently engaging in a monetary policy. They have been buying back USD$120 billion worth of bonds monthly. They then compensate the previous bond owners with money, hence increasing the money supply in the economy. Since there is more supply, money lenders will be more willing to lend money for less interest, hence decreasing the interest rates in the short term.

2. Market Interest Rates

Market interest rates are set by the market and are built up because of market expectations for the future. This has risen over the year.

At the trough of August 2020, the 10-year US treasury was at 0.5% per annum (p.a.). At the start of 2021, it went up to 0.9% p.a., and is now approximately 1.6-1.7% p.a. It has increased by 3 times since August 2020.

This is a result of a decrease in demand for a relatively safe investment like US treasury bonds. Hence, the bidders will pay less than face value and this increases the yield.

Why is there less demand for US treasury bonds?

1. Vaccinations

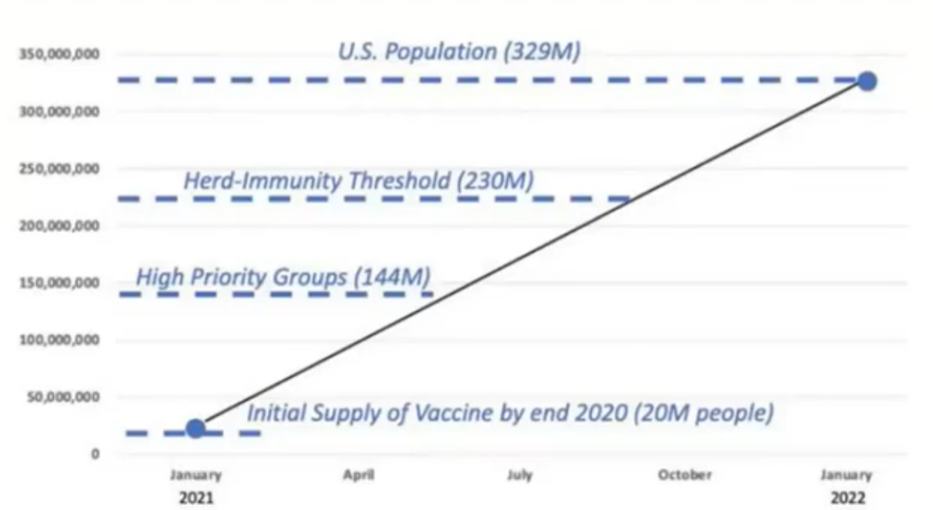

The first bout of vaccinations started in November 2020, with the vaccine rollout efforts being increased rapidly after. Hence, there is an expectation that Covid-19 will pass us soon.

This is based on the statistic that, by the mid-2021, we should reach the stage of herd immunity. This will then spur the gradual reopening of the economy with there being almost full vaccination by early 2022. The US is still on track, and the vaccine has proven effective, so people are still very confident about the growth of the economy.

2. Fiscal Policy

Joe Biden has implemented a fiscal stimulus of USD$1.9 trillion. This will aid the US citizens by giving them stimulus checks to spend and boost the economy. This will then lead to inflation, with the market interest rates having risen ahead of the inflation.

Overall, looking at the rising interest rates and inflation, we can be certain that we are at the start of an economic recovery.

How will this impact bonds?

There has been a downward pressure on bonds. This is especially so for the bonds of developed countries, especially US 30-year treasuries, that is down by 20%. This is a huge reduction for a supposedly safe asset.

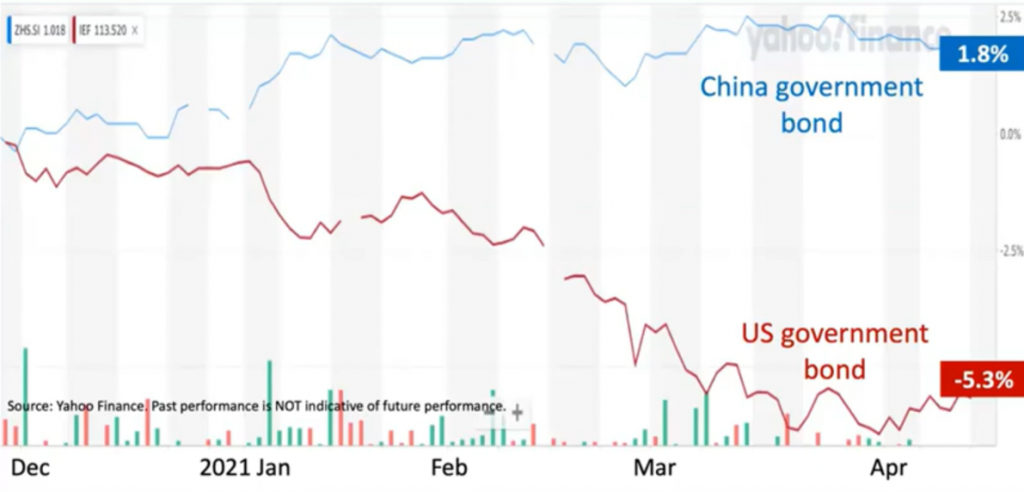

I suggested that China Government Bonds might be a good investment in this low interest rate environment if you wanted to buy something relatively safe. This was through my television interview in November 2020. US and European bonds were out of the question because of their ultra-low interest rates.

China Government Bonds then proceeded to increase by 1.8%. In contrast, US Government Bonds, had fallen by 5.3%.

Ignorant vs Wise Diversification

Ignorant Diversification: Carelessly diversifying by generalising your investment choice within the asset class.

Wise Diversification: Understanding the need for diversification to reduce risk while choosing the best investment within each asset class intelligently.

This decision between China and US Government Bonds illustrates the need to diversify wisely since it could reap substantial returns. The investment portfolio created by my company also has the China Government Bonds and has benefitted from this huge 7.1% difference in these past 3 months.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.