In this article, we will be covering the last 2 factors: Financials and Valuation, for both Alibaba and Tencent. Be sure to read part 1 and part 2 before continuing with this article.

Tencent vs Alibaba: Financials

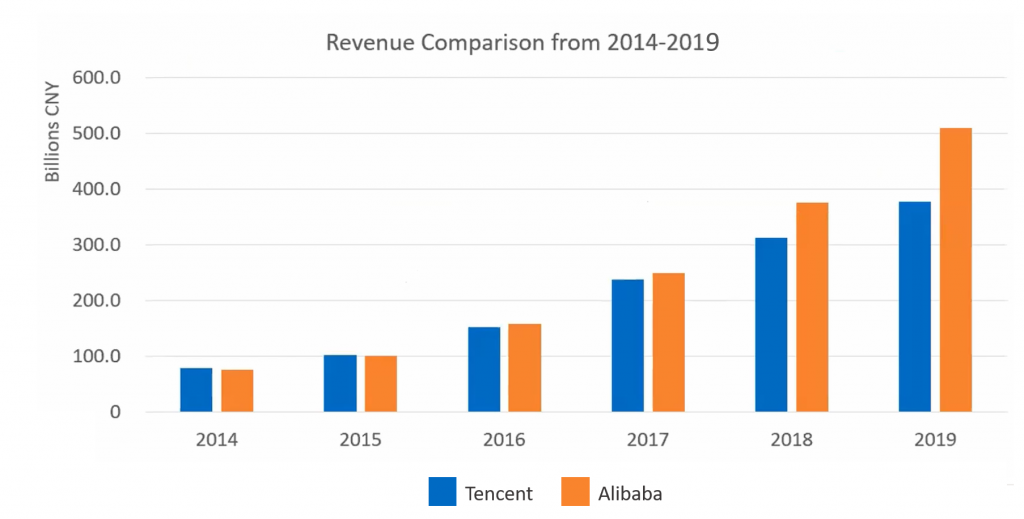

Revenue Growth

In 2014, the revenue of Tencent was slightly more than that of Alibaba’s. However, in 2019, Alibaba’s revenue easily surpassed Tencent’s. This means that the revenue growth of Alibaba is a lot faster than Tencent’s. As such, it is easy to see that Alibaba is the clear winner in terms of revenue growth.

Operating Income Growth

Operating income[1] growth wise, both are relatively close. Tencent is growing at around 29.66% per year while Alibaba is growing at around 31.52% per year. From this, we can observe that both are growing relatively fast, but both are growing at approximately 30% per year. Hence, there is no winner regarding the company with the fastest operating income growth.

Operating Profit Growth

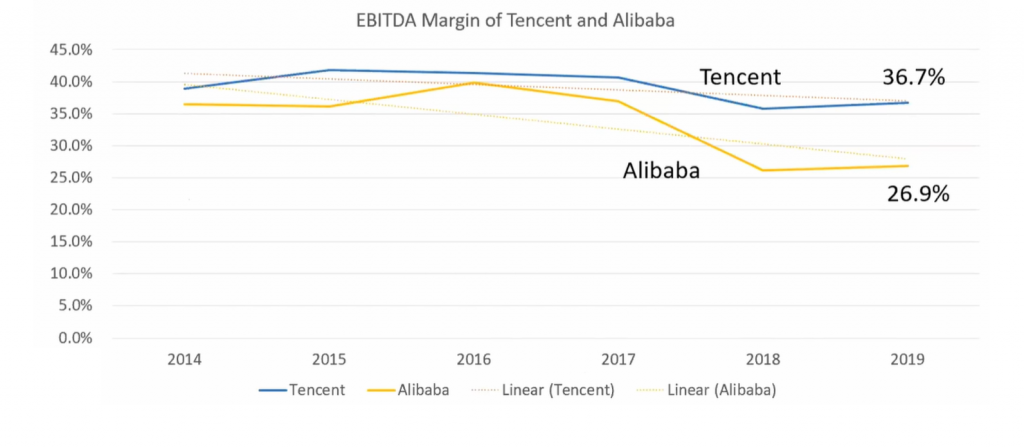

In terms of profitability, Alibaba is growing much faster. However, when we look at operating profit growth[2], Alibaba is on par with Tencent. A major reason is that Alibaba’s profit margin has been coming down faster than Tencent’s.

Tencent’s EBITDA margin dropped from just below 40% to 36.7%. In comparison, Alibaba’s EBITDA margin was 37% but it dropped drastically by around 10% to 26.9%. As we can observe, Alibaba’s profit margin[3] has declined at a much faster rate, meaning that Tencent is the most profitable company.

Company Performance during a Crisis

This pandemic has disrupted many businesses; however, these 2 companies have done quite well. In fact, Tencent has done better than Alibaba. Tencent’s share price has gone up by 50% during Covid-19. It came down to 34% because of the trade bans that Trump imposed on China. However, the ban has been restricted so the share price will start to rebound soon. In comparison, Alibaba has grown by only 21.81% during the pandemic.

A reason why Tencent could be growing faster than Alibaba would be because staying at home favours food delivery, gaming, and communicating through messaging systems. As such, since Tencent is a leader in these various sectors, it has benefitted during this pandemic.

Financial Health

Financial Health is the ability of a company to service their debts. In order to measure this, we will be looking at the debt-to-equity ratio (D/E ratio): the ability of a company to use its equity to cover all outstanding debts in the event of a recession. It is normally calculated by diving the total liabilities of a company by their total shareholder equity[4].

Tencent’s D/E ratio is about 45% whereas Alibaba’s is about 18%. Since Alibaba has a lower D/E ratio, this means that it is depending less on borrowing from lenders and instead depending more on distributing equity to shareholders. Hence, even though both have healthy ratios, Alibaba is the winner as it has the lower D/E ratio.

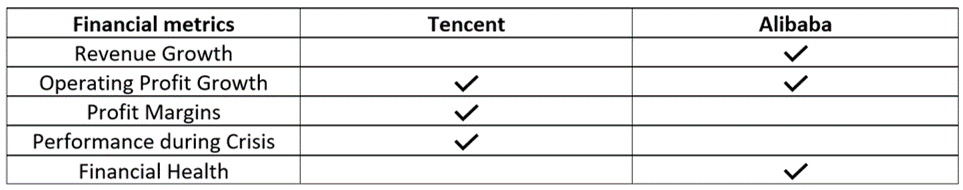

Financial metrics summary

Tencent vs Alibaba: Valuation

We will be looking at the Price-To-Earnings (P/E) ratio[5] to determine the stock valuation for both companies. Both are growing fast at around 30% per year. Tencent’s P/E ratio is about 43 times, whereas Alibaba’s P/E ratio is about 33 times. If we factor in the growth[6] of each company, Tencent will be 1.4 times while Alibaba is around 0.8 times. Looking at both metrics, Alibaba is more attractively valued.

However, before we conclude, I would like to give a forewarning that we should be careful with Valuation. Especially when we factor in growth, we must ensure that the growth is sustainable, otherwise it might not give the true valuation of the stock in the future.

Tencent vs Alibaba: Conclusion

In terms of Competitive Advantages, Tencent is the winner because it has stronger Competitive Advantages that their competitors cannot easily overcome. Additionally, within their overlapping competing businesses (Cloud and Food Delivery), Tencent has the edge against Alibaba.

In terms of Financials, both companies end up in a tie and Alibaba wins for Valuation.

Which company will I invest in?

I will choose to invest in Tencent.

Tencent’s trajectory is more predictable as it has strong Competitive Advantages. Additionally, all its businesses are profitable and diversified, whereas Alibaba’s only profitable business is E-Commerce. This could be due to Jack Ma, their regional leader, having left the company. As such, Tencent seems like a better investment for the future.

[1] Operating Income: Revenue – operating expenses – cost of goods sold. It measures the company’s total profit gained from the businesses’ operations.

[2] Operating Profit Growth: Revenue – cost of goods sold – operating expenses. It is the profitability of the business before accounting for interest and taxes.

[3] Profit Margin: It is the percentage of sales that has turned into profits.

[4] Shareholder equity: The amount that the company has been financed with the help of shares.

[5] Price To Earnings ratio (P/E ratio): Price for the share / Earnings per share. It indicates how much an investor is willing to pay for each dollar of earnings.

[6] Price Earnings Growth Ratio (PEG ratio): (Price/Earnings per share [EPS]) / EPS Growth. It factors in both the stock’s value and the company’s expected earnings growth.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.