People often advise avoiding Tech stocks during times of inflation. However, surprise, surprise, I think certain Tech stocks represent the best kind of businesses to own during times of inflation.

What are they? Let’s find out!

Characteristics of great businesses to own during inflationary periods

Warren Buffett said the best businesses to own during inflationary periods can raise prices during periods of higher inflation and have low capital needs.

1. Ability to raise prices

Inflation causes the price of goods and services and more to rise. This results in an increase in the cost of raw materials and salaries. This will then increase the cost of running businesses. If the business is unable to raise its prices accordingly without losing customers, its profit margin will be under pressure. Additionally, if inflation worsens, they may end up making losses if the cost of creating the goods and services exceeds their selling prices.

2. Low capital needs

Companies that need not make many investments, like buying machinery and equipment, have low capital needs. Inflation will cause the cost of these investments to rise. Subsequently, this would require the business to reinvest increasing amounts of profits back to replenish these machinery and equipment when they wear out.

The technology sector is fertile with companies with such characteristics. Let us use Microsoft as an illustration.

How Microsoft is affected during inflation

1. Microsoft has the ability to raise prices

If Microsoft raises its Microsoft 365 subscription rate, would you stop your subscription? Stopping your subscription means that you will not be able to use your Microsoft Outlook, Word, Excel, PowerPoint, and Teams anymore. I believe most would not terminate their subscription despite an increase in the rates. In fact, Microsoft did just that recently on 19 August 2021. Microsoft said that it will raise Microsoft 365’s subscription rate by as much as 25%. For its basic package, the price will be raised from US$5/month to US$6/month starting 1 March 2022.

2. Microsoft has low capital needs

Microsoft’s major cost when developing software is the upfront research and development costs. After the software is developed, it costs almost nothing to add new subscribers. As such, Microsoft is hugely immune to rising costs due to inflation.

Performance of Tech companies against non-Tech companies over time

During inflationary periods, central banks usually increase interest rates. Higher rates of borrowing will result in higher prices of end goods and services. Hence, there is moderate inflation. This could reduce the price-earnings multiple of stocks or their price-earnings ratio (PER).

This is due to the discounting mechanism of asset pricing. The stock market considers all present and potential future events. When unseen developments occur, the market considers the new information very fast. The increase of interest rate affects the earnings multiples of growth companies (high PER companies) more than value companies (low PER companies).

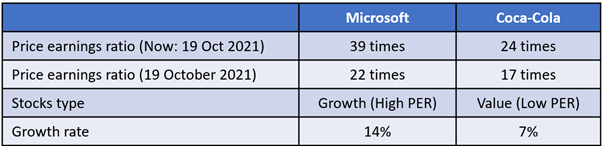

Let us compare 2 quality companies, Microsoft and Coca Cola. We will compare their state now (US Fed interest rate 0.08%) and that on June 2007 (US Fed interest rate 5.3%).

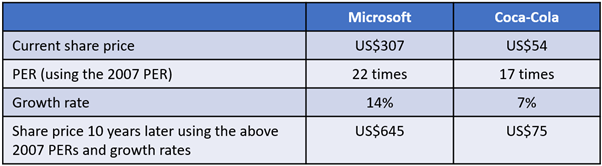

If the interest rate rises and Microsoft’s PER reverts to its PER in 2007, its share price could decline from the current US$307 to US$173. This is a whopping 44%! However, let us look at how Microsoft and Coca-Cola will compare over the longer term of 10 years.

However, how will Microsoft and Coca-Cola compare over the longer term of 10 years?

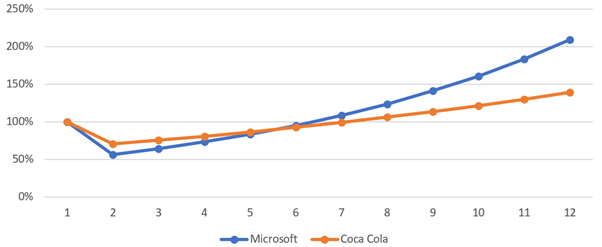

Microsoft, a growth stock, would have a larger initial decline in its share price as the price-earnings multiple adjusts due to rising interest rates. However, over the longer term, investing in Microsoft will yield greater rewards. As you can see, Microsoft’s share price grew 109% compared to Coca-Cola’s 39% at the end of the 10th year.

The technology sector is a fertile ground for high-quality growth companies. As seen above, it is one of the safest sectors to invest in in the long term, in both deflationary and inflationary periods. However, investors need to understand the long-term investment horizon and be prepared for a volatile journey ahead.

Is the impact the same for all Tech companies?

The simple answer is no because the quality of the company matters. And not all Tech stocks are high quality. The prior explained probable high growth is only applicable for high-quality Tech stocks.

But what makes a high-quality Tech stock? Well, I shall leave that discussion for another day.

3 categories of Tech stocks:

1st category: Likely to stay unprofitable for the foreseeable future (5 years)

The company’s share prices will experience a gut-wrenching initial decline when interest rates rise. Concurrently, for most lay investors, it is difficult to differentiate between the company’s actual future and the hype of a rosy future. As such, it is probable that an investor might buy into a fairy tale instead.

2nd category: Profitable but trading at a very high PER (above 100x)

Investors who can stomach huge volatility could consider investing in these companies. However, I believe these kinds of investors are the minority. Additionally, these companies are often priced for perfection. This means that any disappointment in the actual growth rate will cause a huge price decline, in addition to any effects from rising interest rates.

Investors investing in such companies should thoroughly research the company to ensure their high earnings multiples are backed by proven success and growth. And for the majority, they should represent only a fraction of our portfolio.

3rd category: Profitable and trading at a moderate PER (50x and below)

The companies in this category are the ones I am currently keen on investing in.

So what should you invest in?

To sum, the technology sector is a fertile ground to uncover companies that would thrive in inflationary and deflationary periods. Their share price might decrease initially when interest rates are adjusted to curb rising inflation. However, over the longer term, they are one of the safest assets to invest in.

I would propose for lay investors to invest in high-quality Technology stocks and trade at a reasonable PER of below 50x.

Such companies are also available in other sectors, and you should be able to uncover them with careful research. I will share case studies of companies that I want to own, avoid, or are good but not at the current price. These case studies will be available on YouTube. Stay up to date with them by subscribing to my YouTube Channel. Alternatively, you can also stay up to date by subscribing to my newsletter.

Design your life, Defy poverty!