What are Singapore Savings Bonds (SSB)?

Singapore Savings Bonds (SSB) are special bonds issued by the government of Singapore. The bond has a credit rating of AAA from S&P. It pays out interests twice a year and the maximum duration of the bond is 10 years. Given its top-notch credit rating status, it is considered risk free investment instrument for retail investors seeking to gain exposure in bonds.

Every Singaporean, Singaporean Permanent Resident (PR) or foreigner can apply up to $200,000 worth of SSB. There is no lock-in period for these bonds and they can be redeemed directly from the Monetary Authority of Singapore (MAS).

What are the reasons NOT to invest in SSB?

1) Long term returns cannot offset inflation rates

Let’s take a deeper look at the December 2019 SSB (SBDEC19 GX19120T).

At the end of the 10-years holding period (i.e.g without withdrawing the money), your average returns will be 1.71% per annum. This translates to 18.5% total cumulative returns for the whole 10 years (1+0.0171^10 = 1.185). In other words, If you put $10,000 into SSB, you will get back $10,000 of your principal plus about $1,850 of interests over the course of the 10 years.

What is the inflation rate in Singapore?

According to a DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) survey released jointly by Singapore Management University (SMU) and DBS on 16 April 2019, the inflation expectation for the next 5 years is around 4%.

Weighing the average 1.71% per annum long term investment returns of the SSB against the 5-years average inflation expectation of 4% per annum, it is obvious that investing your money in SSB is not an optimum investment option.

2) Short term returns cannot match bank deposit rates

If you considering SSB for short term (i.e.1-3 years), the average return is 1.56% per annum.

What is the deposit rate for typical banks?

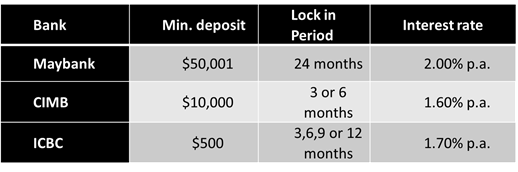

Let’s take a look at the table below for comparison:

Although the banks require your cash to be locked in for a specific period, they do offer more attractive rates than SSB. If you think that the banks are not risk-free in the event of a financial crisis with a magnitude larger than that of the Lehman Brother crisis. I have a news to share with you: For small depositors, Singapore Deposit Insurance Corporation Limited (SDIC) guarantees money in your bank up to $75,000 per bank per person. SDIC insures deposits only in Singapore Dollar held in standard savings, current or fixed deposit accounts.

3) Redemption process is not immediate

Unfortunately, the redemption process for SSB is not immediate. There is a one-month notice period when you redeem your SSB before maturity.

SSB has a redemption request window period: 1st business day of the month to 4th last business day of the month. The redemption request may be sent anytime within the window period. SSB holders only get to receive their principal (plus interests if any) the 2nd business day on the following month.

Before investing in SSB, I encourage you to consider other investment alternatives.

Remember, the ultimate aim of investing your money is to at least offset inflation and grow our cash!

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

Thank you for taking time to view the blog!

Feel free to share this with interested friends or to subscribe to the newsletter to receive updates! 🦏

[…] However, if you are considering savings bonds as an investment option, you may want to think again. I have shared my thoughts in my previous article, 3 Reasons NOT to invest in Singapore Savings Bonds. […]

I like your article sharing. Thank you.

Hi Ting,

Thank you, for your message!

Hope the articles could empower you in knowing about investments. Your appreciation is a fuel to The Grey Rhino’s success!