China’s economy and stock market has reached an all-time low after a decline of about 22% in 2021. However, with Xi Jinping preparing to continue with his 3rd term of presidency, I believe that he would want to ensure that the economy and stock market is stable and growing as his term starts. Hence, I think this is a good time to start looking into investing in Chinese equities again.

Ping An Insurance fell by 41% in 2021. That said, is it the opportune time to purchase this company that was previously lauded as a market darling?

These are what I will cover in the analysis:

1. Business Overview – Ping An’s business

2. Market – Ping An’s potential to grow in their addressable market

3. Moat – Ping An’s capability to stave off competition and maintain their profit margin

4. Risk – Ping An’s possible risks and their probability of occurring

5. Financial Valuation – Ping An’s financial health and stock valuation

Lastly, I will share if I will invest in this company myself.

Business Overview of Ping An Insurance

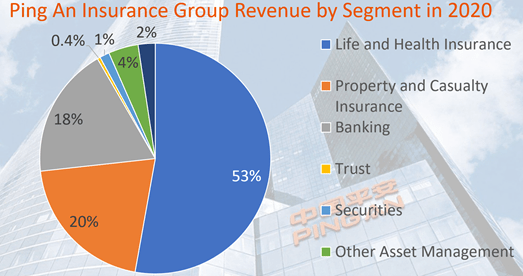

Like their name suggests, a bulk of Ping An Insurance’s business is in insurance. Their largest revenue segment is Life and Health Insurance while their second largest is Property and Casualty Insurance. These segments make up almost 75% of the company’s revenue. The next largest portion is their banking business and other smaller businesses contribute to the rest.

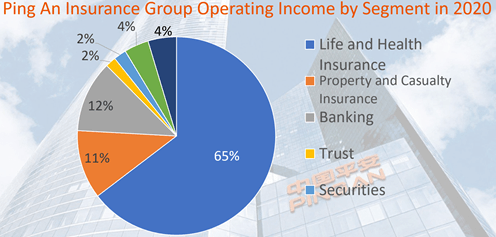

Looking at their operating income, we see an even greater portion of 76% of it consisting of their insurance businesses.

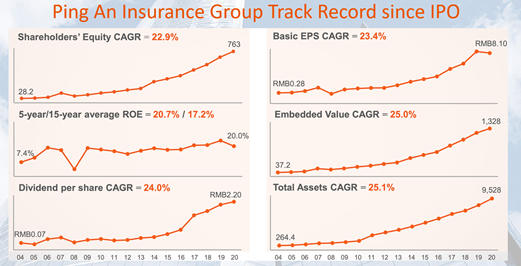

Overall, Ping An Insurance has gradually moved upwards across the past 5 years. Shareholders’ equity and Return Of Equity (ROE) has maintained a stable Compound Annual Growth Rate (CAGR). Additionally, their dividends and earnings have also been growing. So, Ping An Insurance is a growing company and their setback in 2022 is only temporary.

Ping An Insurance’s Market

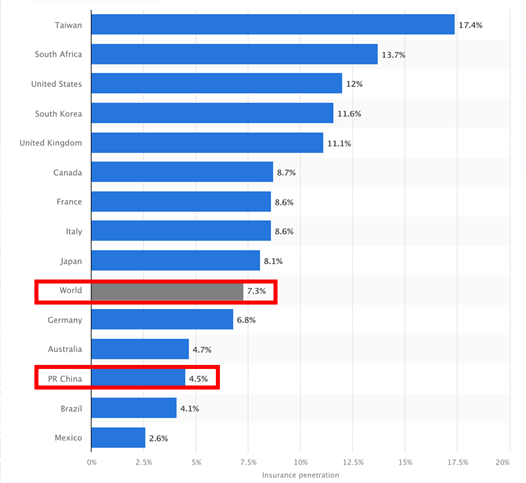

The world’s average insurance penetration rate stands at 7.3%. However, for China, it is currently at 4.5%. This indicates space for the China to catch up to the world average which will double Ping An’s business. Additionally, if we were to compare China to more develop countries like Taiwan, there is even more room to grow. Hence China is still in its initial phase of insurance penetration and Ping An Insurance has much more room to grow.

Moats of Ping An Insurance

#1 Moat – Intangible Assets

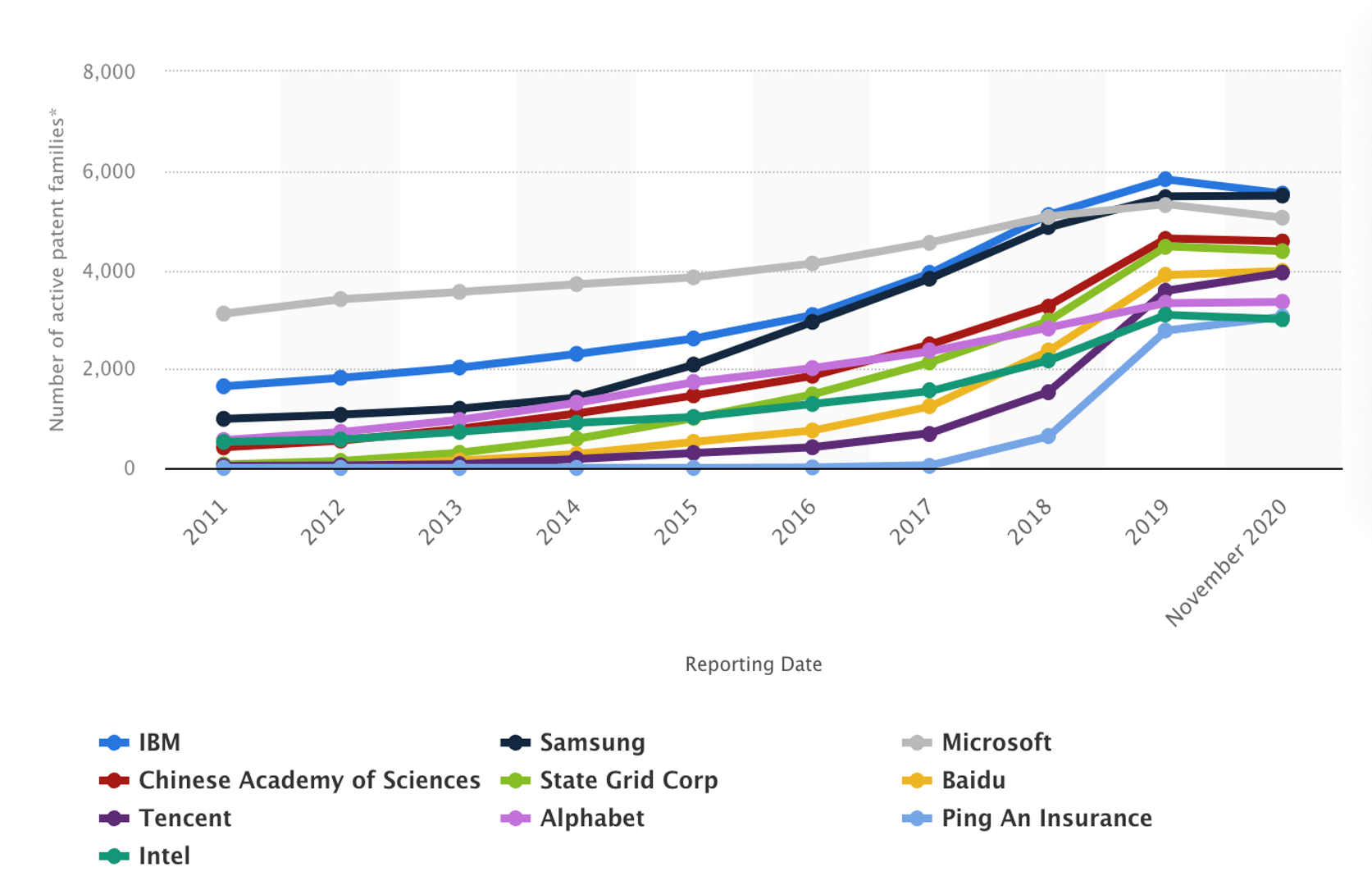

Ping An Insurance, in my view, is the most technological advanced insurance company in China. This chart tracks the number of AI patents companies have. Technological giants like Tencent and Microsoft are at the top. Surprisingly, Ping An is also on this list even though it is an insurance company. This is evidence that Ping An is very technologically driven.

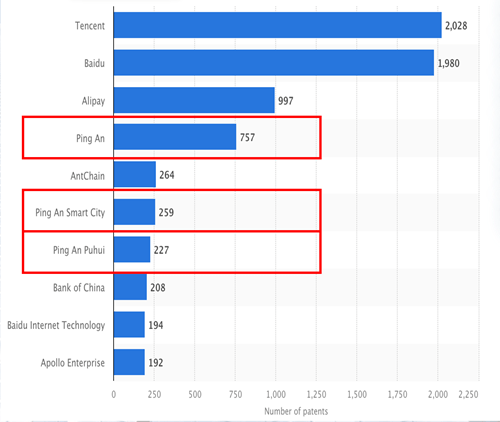

Additionally, if we combine Ping An Insurance’s blockchain patents in the 3 boxes, they will be ranked 3rd in China after Tencent and Baidu. Yet again, this shows how technology-centered Ping An Insurance is.

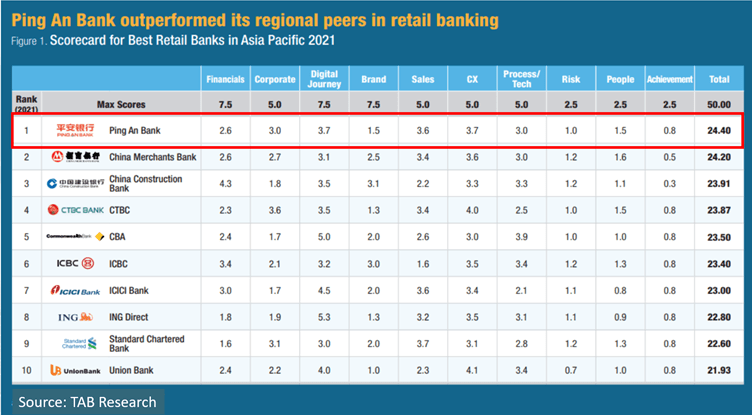

The next intangible asset is their reputation wherein they were ranked the number 1 bank. This shows that Ping An has extremely good reputation amongst Chinese banks.

#2 Moat – Cost Efficiency

Ping An Insurance uses technology to drive down cost.

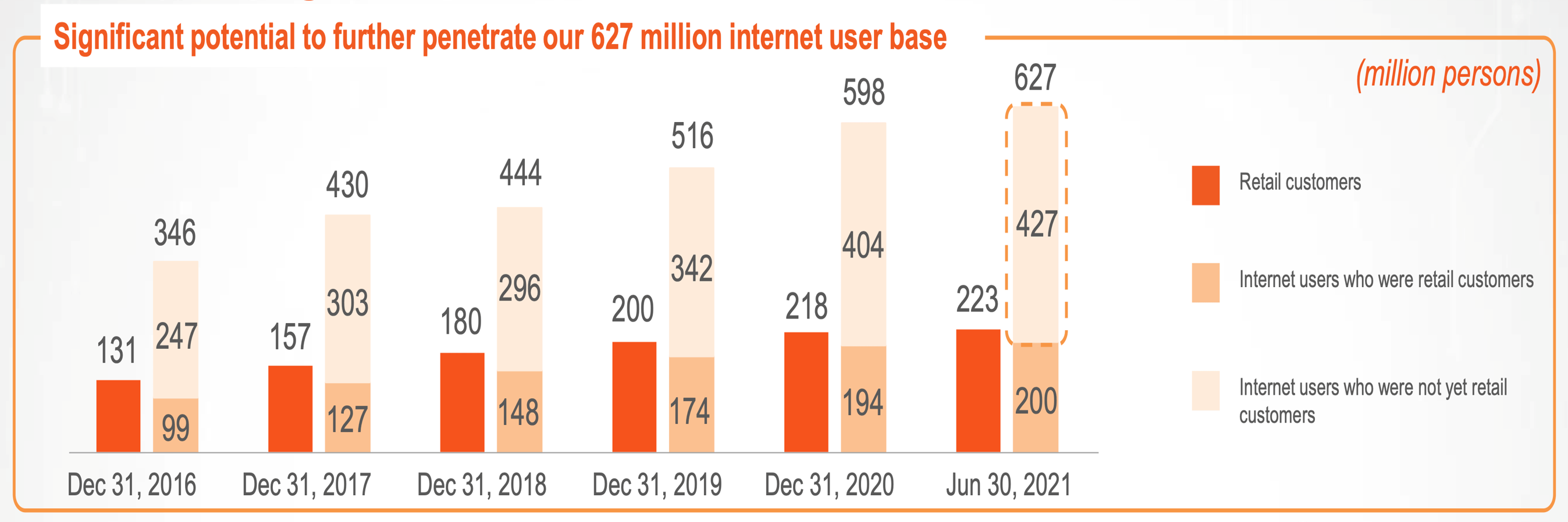

1. Selling insurance online – Ping An Insurance uses the web to sell insurance plans.

This method of selling is increasing at the same pace as internet penetration. This will ensure that as penetration grows, Ping An Insurance will be able to get more business via the internet. We must also note that this method is low-cost in nature.

2. Using AI to drive business – Ping An uses AI to improve operational efficiency.

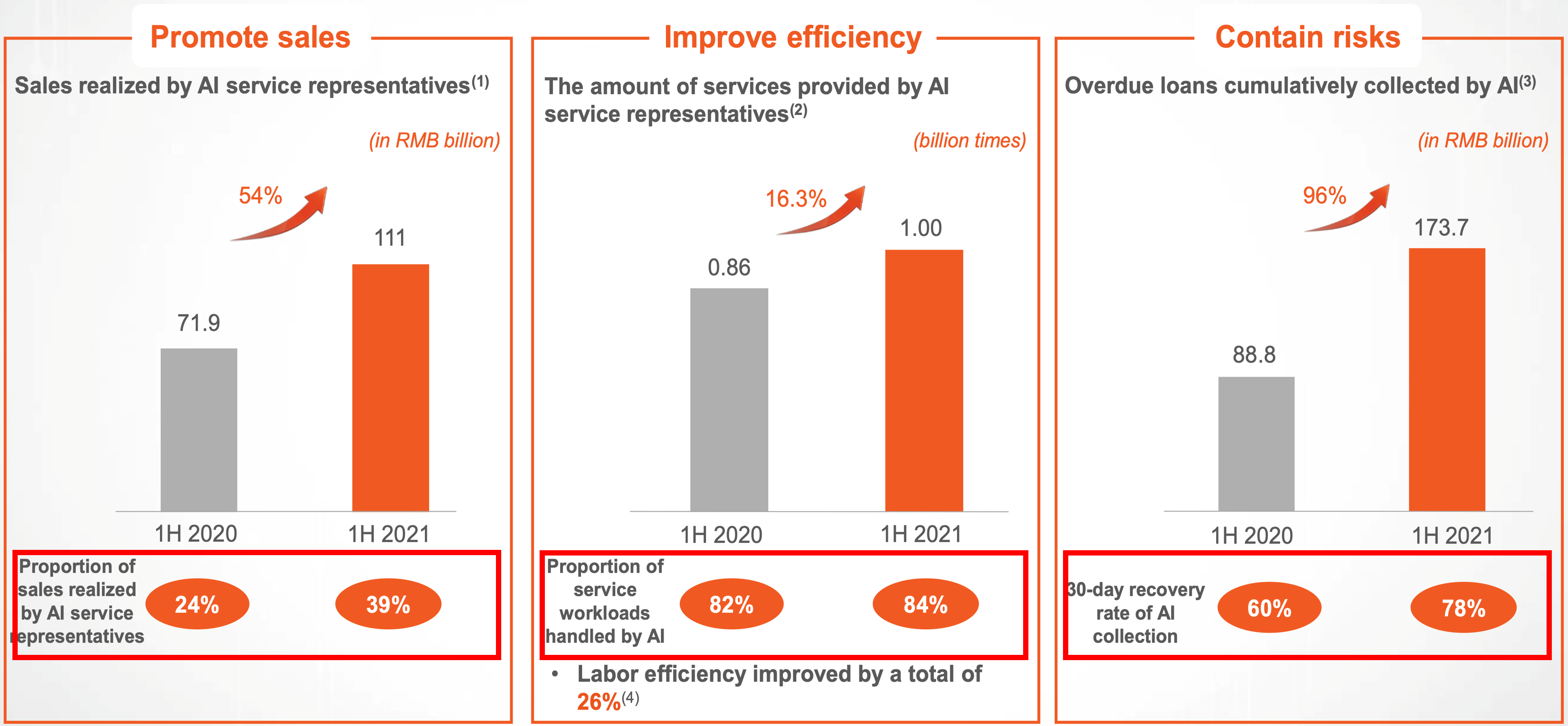

The amount of sales generated from utilising AI service representatives has increased by 54% from 2020 to 2021. There has also been an improvement of 16.3% in terms of efficiency after using AI. Lastly, there has been a 96% improvement in containing risks by collecting overdue loans after using AI. AI is then used to drive business at a much lower cost.

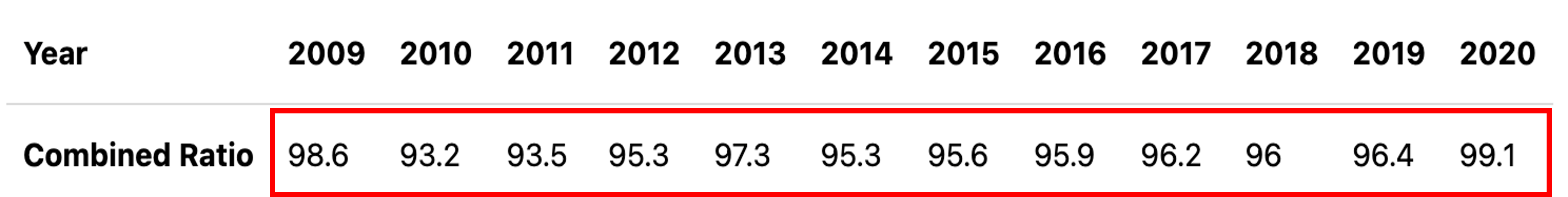

The combined ratio measures the profitability of an insurance company by analysing their daily operations. It is the income from premiums less the pay outs and operational costs. Ping An Insurance’s average combined ratio across 2009 to 2020 is about 96%. This means that Ping An Insurance is able to earn 4 cents per dollar of premiums.

The industry average is about 100.6%. This means that the average insurance company does not make money as the cost of pay outs exceed the premiums. An insurance company that scored 97.4% and below is considered superior, with Ping An Insurance achieving 96%, they are considered a superior insurance company in terms of cost efficiency which is fuelled by their technology use.

#3 Moat – Ecosystem

Ping An Insurance cross sells into the healthcare sector and online doctors. The number of customers sourced via healthcare services has increased from 18% in 2018 to 26% in 2021. The number of policies held by customers using their healthcare business platform is higher than the number held by customers who do not use the platform. This also means that the premiums paid by those who use their online platform is also more.

This shows how Ping An Insurance is becoming successful in cross selling via their online platform. There is also an additional advantage from using these platforms as access to this medical data allows them to underwrite better to correctly price their insurance premiums.

Overall, the cross selling penetration rate has been increasing from 24% in 2016 to 39% in 2021. This is because Ping An Insurance also has additionally ecosystems they cross sell in: Financial services (customers can borrow from banks to purchase insurance), Auto services (auto insurance), and Smart city services (smart care services). Hence these ecosystems really help Ping An Insurance to bring up sales and lower costs more easily than their competitors.

Risk experienced by Ping An Insurance

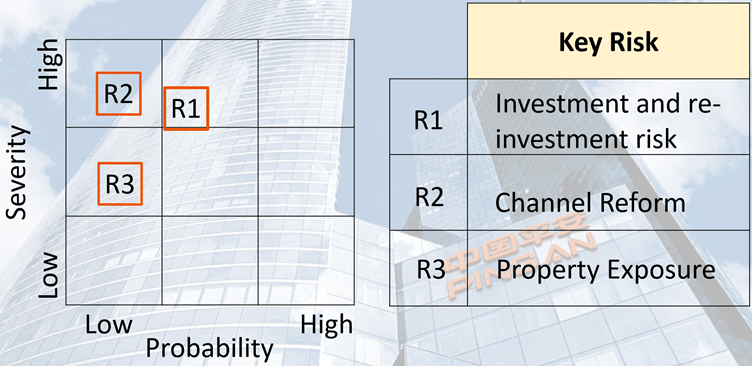

#1 Risk – Investment and Re-Investment Risk

This risk is generic across the insurance industry because as investments mature, they will be re-invested into a favourable or unfavourable environments. The severity for this risk is high but its probability is moderate. This is an unavoidable risk you will face when investing in an insurance company.

#2 Risk – Channel Reform

Ping An Insurance has been removing agents who are less productive. This resulted in a 40% reduction of agents from 1.3 million to 800 thousand. They wanted to shift their focus to use technology to aid the productive agents and to sell insurance via their online platform. This could be a lower cost method of achieving the same revenue, but this has also resulted in the 10-20% decline in the acquisition of additional premiums.

Ping An Insurance aims to finish this Channel Reform by the end of 2023 and subsequently grow their business again. In my view, this is a temporary and the increase in technology usage will ultimately be beneficial in the long term. This has low probability risk as it will pass but the severity could be high as of now.

#3 – Property Exposure

The clampdown on the property sector by the government in 2021 impacted Ping An Insurance badly. Ping An has equity and loans in China Fortune Land. The clampdown meant that Ping An had to write-off the last part of their equity stack.

This served as a lesson for management to have better diversification and to look at the combined exposure of their investments. Similarly, this risk has passed with moderate severity and has low probability risk.

Financial Valuation of Ping An Insurance

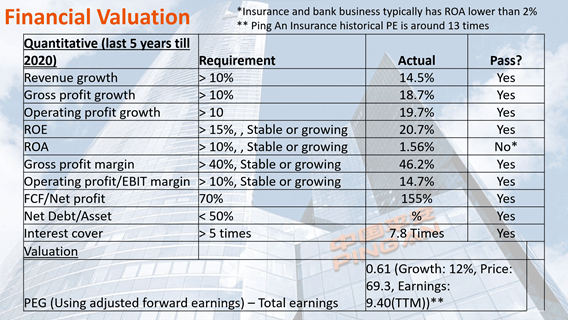

The table summarises Ping An’s key financials. Their revenue and net profit growth is great at 14.5% and 18.7% respectively for the last 5 years. The ROE and Return On Assets (ROA) can be analysed to determine if it is productive.

ROA receives the only “No” but a low ROA of less than 2% is very prevalent across insurance and banking businesses. This is because they highly leverage assets to earn their profits. Other factors also indicate that Ping An is quite healthy.

The higher the historical Price Earnings (PE) ratio, the more expensive. Ping An’s was 30x however it is currently at about 7x after their share price fell by 40%. This means that it is currently very cheap, and I think many of the risk factors will pass.

Ping An Insurance: Yes, No, or Yeto?

YES, I will invest in Ping An Insurance in this environment as their long-term prospects is unimpacted, but their price has fallen significantly. Hence, now is the window of opportunity to buy in.

I hope you enjoyed this article. Do note that this sharing is just my view, and you should consult your financial advisor before investing in Ping An Insurance.

I hope that this article provides you with more insight into Ping An Insurance. If you would like me to review your investment strategy and financial portfolio, feel free to reach out to me at heb@thegreyrhino.sg or 8221 1200, I would love to connect with you.

Subscribe to my newsletter to stay updated with the latest news and insights and share valuable knowledge with your loved ones.