Today, I will explore the effect of an overwhelming amount of liquidity[1] on our assets and investment decisions. Previously, I spoke about how the low interest rates will affect these 2 aspects in my article: Can you find safety in volatility.

Liquidity trends in the market:

Historical trends for liquidity in the market

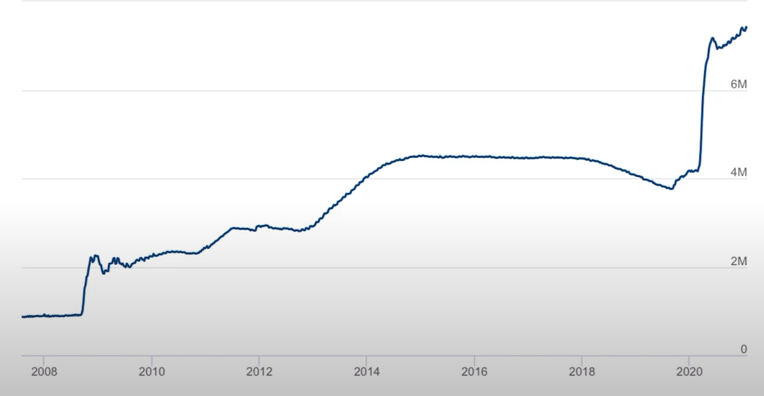

The Federal Reserve (FED) balance sheet has increased from USD$900 billion to USD$7.4 trillion today over the last 13 years. Starting from the recession in 2007, the amount that has been created[2] has increased by a whopping 7 times. This great amount of money has led to an increase in asset prices; driving up the prices of stocks, properties and more.

Future trends for liquidity in the market

The FED chairman, Jerome Powell, shared on this topic at a web symposium with Princeton University recently. He stated that the monthly money creation of USD$120 billion is unlikely to end soon. This was due to the previous experience that taught him that stopping the creation ahead of the correct time will impede the re-growth of the economy. Since this pumping of massive liquidity into the market is yet to end soon, how will it affect our asset prices?

Massive liquidity and our investment decisions:

Speculative investing: Quantum Scape

Quantum Scape invents and manufactures solid lithium batteries. These can be used in electric cars. The urgent need to go greener and other factors has led to an increase in the popularity of electric cars. For example, Tesla, a producer of electric cars, has seen their stock price go up by 750% over the last year.

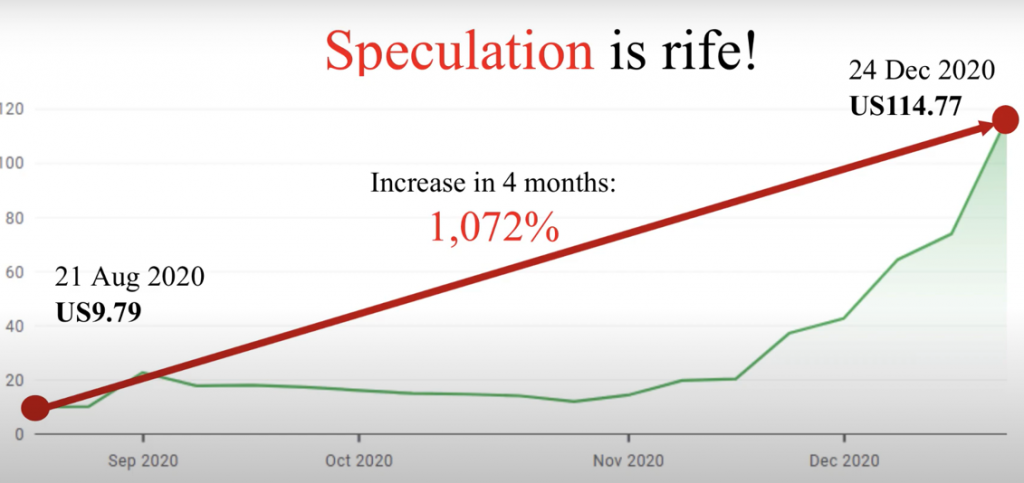

Going back to Quantum Scape, they IPO-ed in September of 2020 at the price of USD$9.80. However, merely 4 months later, their stock price rose rapidly to USD$114.77. The company has yet to make a single dollar of revenue, yet they have managed to see a 11 times increase in their stock price. The founder has even said that he has yet to find a solution on how to commercialise the product.

How should we position ourselves in a Speculative market?

With a massive amount of liquidity chasing limited assets, these asset prices tend to run ahead of reality. This means that prices tend to shoot up abnormally due to speculation of the future performance of the company.

To circumvent this, there are 2 issues we must tackle:

1. Equity

We must differentiate a company who is already successful and a company whose success is still a concept. Examples of companies whose success is already a reality are companies like TSMC and Microsoft. If crisis hits these types of companies, they will get wounded but will recover after a while. This also means that their stock prices will experience volatility, and it may be a small or large fall. However, they are likely to recover and as such, you will not lose a lot of money if you hold these companies through a crisis.

On the flipside, companies whose success is still a concept have a higher probability of getting wounded during a crisis and never recovering. These companies might ensure a permanent loss of the capital that you invested.

Thus, before we take a leap and invest into a company, we must ensure that we separate these 2 types of companies. Subsequently, we should invest in companies that already have success as their reality.

2. Diversifying our investment portfolios

Even if we were to invest only in companies with success as their reality, we should not place all our money into it. Diversification of our portfolios is still very important. This is because if a crisis were to happen, the volatility might be too sharp. Hence, we should place at most 50% of our wealth into such companies while the remaining 50% should be placed into assets like cash, safe bonds or gold.

The prices of these “security” assets might not rise very fast. However, they cushion the impact of volatility created by the other half of our assets. When the liquidity rush is over, and the stock price falls rapidly, only half of the assets will be impacted while the rest will remain intact.

Additionally, when stock prices fall, the holding of these “security” assets will allow us to buy stocks at a very attractive value and ride the wave up while the stocks start to recover.

Moving on…

I hope that I have given you some insight into the current situation; the risks and how to position your assets.

As Lei Jun, the founder of Xiaomi, mentioned: a pig can fly when it is at the center of the whirlwind, but the whirlwind dies down, the pig will fall down very quickly. So long as the liquidity rush is here, asset prices will continue to rise, and investors will continue to enjoy good returns. However, when the liquidity rush stops, the asset prices will start falling rapidly.

[1] Liquidity: In this article, liquidity will only be the

[2] The FED generally creates money through the Quantitative Easing; the introduction of new money into the money supply, typically through printing money and buying bonds, by the central bank.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

Kek Wee, your thoughts on liquidity is well thought-off. Bond may not be attractive at the moment but at 30% of my portfolio is OK , in case of the crash in Equity. Together, is to maintain Liquidity as a back-up to pick up stock when prices are Low! Cheers

Richard Ng

Thank you for your comment Richard,

Yes, I think it is best if we hold some of these “safe” assets, like bonds, to give us a safety landing if there ever was a liquidity crash.

However, the 50/50 divide is just a guide, and I am glad that you have found a way to diversify your portfolio and that you are very comfortable with it.

Thank you as always for supporting the Grey Rhino! 😉