Aptly defined by Nareit; Real Estate Investment Trusts (REITs), are companies that own or finance income-producing real estate over a span of property sectors.

What to look for when investing into REITs

1. Tomorrow’s REITs

These REITs will thrive because of the current megatrends; for example, technological disruption.

2. Reputable REIT managers

These REITs managers must have a good track record and a sustainable pipeline of new properties to be injected into the REITs for their future growth. REITs managed by reputable managers often pay lower dividend yields than those managed by unproven REITs managers. Retail investors should invest in REITs managed by reputable managers.

Industry overview for Data Centre REITs

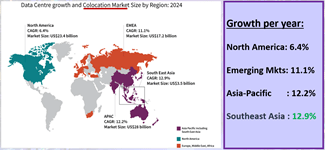

Data Centres are expected to grow by 4.5% per year globally. Asia Pacific will grow by 6% per year, while Southeast Asia is expected to experience the highest growth of 8% per year.

Colocation Data Centres are expected to grow faster than the general Data Centre industry. North America has expected growth of 6.4% per year, Emerging markets by 11% per year and Asia Pacific by 12.2%. Again, Southeast Asia is expected to grow at the highest rate of 12.9% yearly.

Types of Data Centres

1. Colocation

Multiple tenants are situated in Colocation Data Centres. Each tenant will occupy a few racks, placing their own servers to operate their data. The Data Centre will provide the equipment and manage the facility.

2. Fully-fitted

Single tenants rent entire Data Centres, manage the Centres, and operate their own servers. The Data Centre providers only supply equipment.

3. Shell & Core

Single tenants fully furnish the Centres. The Data Centre providers only provide the bare buildings with the necessary specifications. The leases for these Data Centres are generally longer.

Competitor Analysis in the Data Centre Market

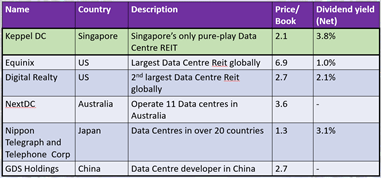

Singapore houses a pure-play Data Centre REIT – Keppel Data Centre REIT (Keppel DC REIT).

1. Price-to-book ratio and Dividend Yield comparison

We compare Keppel DC to their peers globally to understand how attractive they are. We use price-to-book, or P/B, ratio, that is calculated by dividing a company’s stock price by its book value per share. The lower the ratio is, the better and cheaper.

Equinix is the world’s largest Data Centre REIT. Equinix and Digital Realty, the second-largest, are situated in the US. Keppel DC REIT has the second-lowest P/B ratio. The lowest is Nippon Telegraph and Telephone Corporation.

Dividend yield is how much dividends a company pays relative to its stock price. Currently, Keppel DC REIT offers the highest dividend yield amongst the major Data Centres.

Keppel DC is a prime candidate for consideration to invest in.

2. Keppel DC REITs vs Mapletree Industrial Trust

- Data Centre Portfolio: Keppel DC REIT is the only pure-play Data Centre REIT in Singapore. Their competitor, Mapletree Industrial Trust, is growing their Data Centre portfolio. Today, Data Centres make up about 40% of their portfolio. We favour Data Centres; a property category that is expected to grow very fast in the next few decades.

Winner: Keppel DC REIT. We prefer a pure player in Data Centre.

- Geographical Diversification: Keppel DC REIT has a broader geographical diversification, with 56% in Singapore. The rest are in Europe, Australia, and Malaysia. Mapletree Industrial is less diversified with most of their properties in Singapore, and 35% in North America.

Winner: Keppel DC REIT.

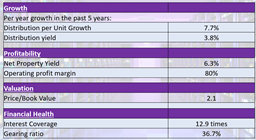

- Price-to-book ratio: Mapletree Industrial Trust has a lower Price-to-book ratio.

Winner: Mapletree Industrial Trust.

- Property yield: Property yield looks at the returns properties in the portfolio give. Comparing the same property types, Keppel DC gives a higher return.

Winner: Keppel DC REIT.

- Dividend yield: Mapletree Industrial Trust has a higher dividend yield of 4.2% compared to 3.8% for Keppel DC REIT.

Winner: Mapletree Industrial Trust.

- Weighted Average Lease Expiry (WALE): This represents the average contracted lease duration of the properties in the REIT. The longer the WALE, the better the visibility of future recurrent rental income. Keppel DC has a WALE of 6.5 years compared to 3.7 years of Mapletree Industrial Trust.

Winner: Keppel DC REIT.

- Portfolio occupancy: High portfolio occupancy means the properties are in demand. Keppel DC REIT has a 98% occupancy rate, edging Mapletree Industrial Trust, with a 94% occupancy rate, out.

Winner: Keppel DC REIT.

- Company sponsor: Keppel DC REIT is managed by Keppel, while Mapletree Industrial Trust is managed by Mapletree. I favour Mapletree as it is government-linked – the government has a good pipeline of properties that can be injected into Mapletree. Keppel has a good pipeline too, but it is inferior to Mapletree’s. Looking at their track record, I also think Mapletree is a better REIT manager than Keppel.

Winner: Mapletree Industrial Trust.

Overall, Keppel DC REIT wins. Our investment analysis will focus on Keppel DC REIT. Globally and locally, I think Keppel DC REIT stands out as a Data Centre REIT.

Keppel DC REITs’ Investment Analysis

1. Strong secular tailwinds will drive the long-term growth of Data Centres

- Data Analytics: Many companies are investing into data analytics, where data can be mined to provide valuable insight. This is slated to grow at 25% per year for the next decade. Capacity requirements will need to double every 2.5 years.

- Cloud computing: It is slated to grow at 18% per year.

- 5G Smart Phone: Singapore will move most of our smartphones to 5G in the next few years. 5G requires a lot more data and the 5G grid’s growth rate will be at 58% per year.

These trends show an increasing need for data storage. The demand for Data Centres that store these data will also increase.

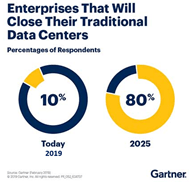

This survey done by Gartner indicates that by 2025, up to 80% of enterprises will want to close their own internal Data Centre and outsource their data storage. This will cost less as external Data Centres benefit from economies of scale. With professional management, the external Data Centres can maintain the most updated and suitable software to manage the data. They also have good access to resources, negotiating for the best people to manage their Data Centres and for the best software. Lastly, the Data Centres are extremely secure as they invest a lot to ensure that the data is safe, preserving the trust of their tenants.

2. Singapore’s strategic location as a Data Centre hub of Southeast Asia

Southeast Asia has the fastest growth rates for Data Centres. 56% of Keppel DC’s Data Centres are in Singapore. Singapore has a very strategic location to house Data Centres because of its connectivity to the rest of the region. Singapore is connected to 6% of the world’s underground cable, this well-connectedness ensures a very high speed of data transmission.

Additionally, Singapore’s good corporate governance eases doing business here and ensures high security. Our low tax rates also attract enterprises to set up here. Lastly, we have energy stability and have almost no natural disasters.

Singapore is the second most desirable place to set up Data Centres in the world. It is the only mature Data Centre market in Southeast Asia and currently accounts for 60% of the Data Centre supply in Asia Pacific. Hence, Singapore is vital as a Data Centre location. Keppel DC has access to this very strategic resource, which is expected to grow at about 18.5% annually until 2024. Singapore government has temporarily halted the building of new Data Centres in Singapore. They consume too much energy and generate a lot of carbon footprint. This will likely increase the rental rates of Data Centres in Singapore given the high demand and limited supply. This will benefit Keppel DC REIT.

3. Growth and resilience of the Keppel DC REIT

When Keppel DC REIT was listed in 2014, Keppel DC had $1 billion of assets under management. Today, it has $3 billion in assets under management. This shows that Keppel DC is a growing REIT. They have a portfolio of 98% occupancy with a long WALE of 6.5 years.

Data Centres are a defensive and attractive asset class. They have a relatively long lease period with automatic renewals and rental escalation that is linked to inflation. During the COVID-19 period, many REITs were affected but Data Centre REITs were not. They will continue to command good price escalation because of the growing demand and limited supply.

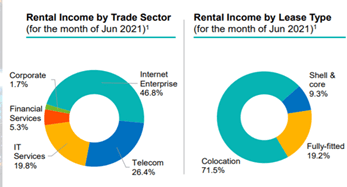

Keppel DC’s portfolio has a diverse group of tenants – Internet Enterprises, Telecom, Financial Services and more. Their lease type shows that Colocation facilities account for 72% of their portfolio. The diverse group of tenants provides stability. Their fully-fitted and Shell & Core facilities provide stability with longer lease terms and have single tenants. This results in a diversified and resilient portfolio.

Keppel DC also hedges interest rates and currency fluctuation as they have Data Centres all around the globe. It has a low cost of debt at 1.5% per year and 67% of its current borrowings are at fixed interest rates. Hence, it has a safe debt profile.

Data Centres have good competitive advantages. The barrier of entry into the industry is high as it has a high need for power and high capital requirements. It is difficult to set up one as regulatory approval is required. Data Centres need stable places that are free from natural calamities and have good access to power.

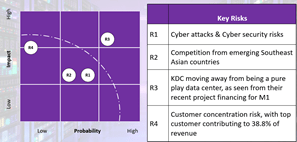

Key Risks of Keppel DC

The Y Axis looks at Impact of Risk and X Axis looks at Probability of Risk.

- R1 looks at the risk of cyber-attacks and cyber security risks. The probability of this risk occurring is moderate as Keppel DC equips their Data Centres with updated security features to mitigate these attacks. The impact is moderate as Keppel should have contingency security measures in place in case of these attacks.

- R2 looks at the competition from other emerging Southeast Asian markets. There is low probability and impact as Singapore is the only mature Data Centre location in Southeast Asia.

- R3 looks at Keppel DC moving away from being a pure-play Data Centre. Keppel recently acquired M1 and have done some project financing for them. This risk has relatively high probability and impact. As of now, it makes up a small proportion of their assets, amounting to half a year of their income. It will become worrying if Keppel DC expands into these potentially higher-risk assets. Investors should monitor this closely.

- R4 looks at customer concentration risk. Currently, the top customer contributes about 39% of their revenue. However, given the high demand for Data Centres, Keppel DC should be able to fill the void should their customers decide to stop using their Data Centres. Hence, the probability of the risk is low and the impact medium.

Keppel DC’s summary of Financials

Keppel DC has grown its Distribution per Unit at about 8% per year historically. The distribution yield is 3.8%. Distribution yield is the ratio of all the distributions of a fund paid in the past year to its current share price. Hence, an investor investing Keppel DC today should be able to enjoy an immediate dividend yield of 3.8% per year, with a relatively good growth of the dividend yield over time.

YES, NO, YETO?

Would I include Keppel DC REIT into my portfolio? Yes, no or YETO (yet to)?

I would include Keppel DC REIT in my portfolio!

This is the first company in the line-up of our company analysis that I will conduct monthly. At the end of each analysis, I will decide whether to invest in it (YES), not to invest in it (NO), or keep it in my watchlist (YETO). I will build, monitor, and learn from this portfolio. I will review it at the end of the year and share with you the intelligence I gain from it.

Important notice

The information and opinions available in this presentation has been obtained from sources believed to be reliable and is for educational purposes only. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. The presenter accepts no liability whatsoever for any direct/indirect or consequential losses or damages arising from or in any connection with the use or reliance of this presentation or its contents. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving or investing money nor is there any guarantee that you may experience any lost when investing. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Presenter does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

One Response