In the previous 2 posts, I talked about the first 2 factors affecting the macroeconomy; interest rates and liquidity.

In this article, we will be looking at the 3rd factor: Economic Growth. When we look at history, economic growth has been the biggest factor that drives stock market prices over time. I will be telling you my predictions on how the economy will grow this year and beyond. And subsequently, how it affects the type of stocks you should invest into.

Economic Growth in 2021

Economic growth is going to pick up. Growth experienced a decline in 2020 because of the Covid-19 pandemic. As such, growth must pick up in 2021 to go back to the normal state. However, this rapid growth is further spurred on by 2 additional factors.

1. Pent up demand

After being deprived from doing a certain activity for some time, we will start to do it excessively once restrictions are lifted. For example, when the ban on travelling is lifted, we will start to travel more than usual. More people starting to take vaccines will pave way for more social economic activity to occur.

2. Fiscal Stimulus

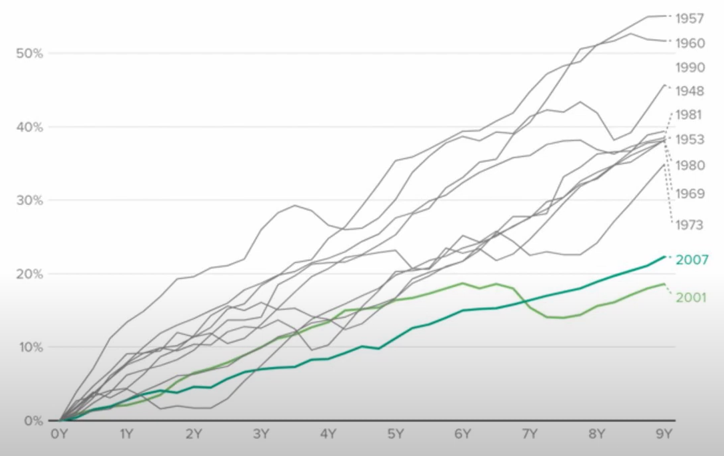

Joe Biden has gotten Congress to approve a $1.9 trillion fiscal stimulus[1]. This stimulus is going to rapidly boost up the economy in the short term. However, in the long term, economic growth will slow down. This is same as what occurred during the great recession.

2009 to 2019 saw the slowest post-recession recovery, with US averaging at around 2.3% growth per annum[2]. Additionally, Covid-19 will slow down the economy even further.

However, we must note that the economy has already been slowing down for the past 10 to 15 years.

Economic Growth in the past 10-15 years

1. Aggregate Demand

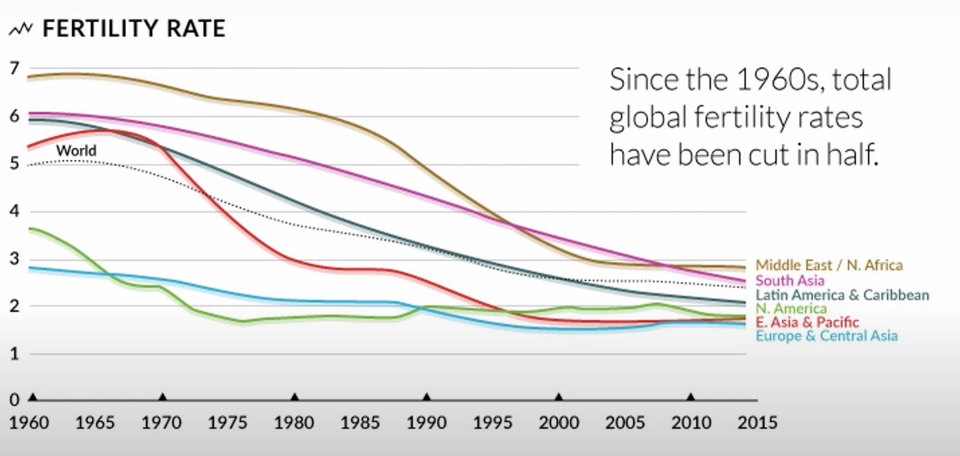

Most wealthy nations are increasingly facing lower fertility rates. This lower fertility issue is often coupled with an ageing population, and hence these countries have shrinking populations[3]. This means that demand will continue shrinking across the next few decades or so.

2. Lack of significant growing economies

The world saw fast economic growth from the early 2000s to the end of 2007 because China was growing fast. China, being a huge country, would have inevitably pulled the world’s economic growth along. However, there is currently a lack of such economies; economic that are not only growing very fast but are large enough to sway the global economy.

3. Debt Trap

The concept of debt trap is linked to the idea of diminishing marginal utility. Utility is the total satisfaction gained from consuming something. The law of diminishing marginal utility then states that the additional utility declines as you consume another unit of good. For example, the joy you get from eating the first bite and will be much higher than the tenth bite of the same chocolate.

This idea can similarly work for debt[4]. When debt is first churned out to fund the economy, it goes to the companies that need the funds the most. These businesses will then use it to fund their productive assets. This, in turn, will spur economic growth.

However, as debt continues to be churned out, the businesses that needed it the most will no longer have any use for it as they are fully funded. The debt will then be transferred to companies with unproductive assets. The easily obtainable debt will then support them even though they are not thriving. In turn, these companies do nothing to spur economic growth.

For these sustained reasons, the next 10 years will see the same situation of slow economic growth.

How will this affect the stock market?

I previously said that economic growth will drive profit and by proxy, the stock market. However, this might not be the case these next few years. This is because the stock markets have 2 types of companies.

Disrupted Companies

These companies will be disrupted by the substitutes or disruptors and will experience a difficult time growing because of the slow economic growth. Hence, I would advise us not to invest into these types of companies.

Structural Growth Companies

Structural growth companies, or disruptors, are companies that are not only growing fast but take away market share from existing companies. As such, they do not need fast economic growth to grow their profit. These companies will be good to have if you want fast growth in your portfolio.

However, like I stated in the last post, a lot of speculation is happening within this group of companies. It has become even more complicated because high levels of liquidity has allowed people to invest heavily into these companies even though they have yet to be successful. Of course, it is possible that these companies could be highly successful in future. However, I do not recommend speculating. Instead, I advise that we invest in companies with real revenue and profit to support the success of the company.

[1] Learn more on the fiscal stimulus: Biden Sees ‘No Time to Waste,’ Urges Senate to Pass $1.9 Trillion Covid-19 Stimulus Package

[2] Read about USA’s growth post-recession: Trump’s claim that this is “the worst and slowest” recovery isn’t true

[3] Gain more knowledge on the shrinking populations in the developed world: A demographic deficit emerges, as global fertility rates decline

[4] Debt in this context refers to liquidity or cash loaned to companies by the government.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.