Why did the pullback occur?

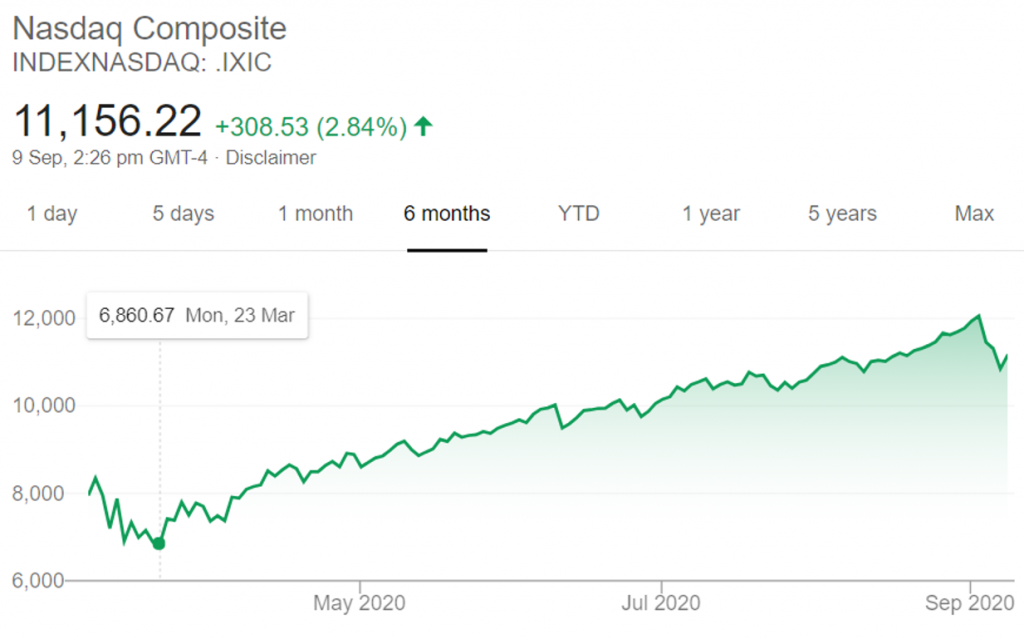

There has been no fundamental reason for this pullback. NASDAQ declined by 7% over the last 3 days after rising about 73% from the trough on 23 March 2020.

NASDAQ has risen about 32% from the start of the year. This is generally considered a big rally [1]. In my opinion, the rise is taking a rest and a correction[2] is happening. Hence, there is a sudden decline in NASDAQ.

Is the pullback here for the long-term?

I do not think that there will be a crash as the monetary policy[3] previously implemented by the FED is still active. Additionally, there is no fundamental reason for this correction, meaning that tech is still a very lucrative industry to invest in and this correction is merely temporary.

What are the investor’s sentiments?

When looking at investor sentiments for the future, I generally look at 2 indicators: 10-year Treasury Bond yield and CBOE Volatility Index (VIX).

Firstly, the 10-year Treasury Bond yield shows us the return on investment (ROI) on the US government’s issued bonds. However, the yield also tells us about investors’ economic outlook. Since US Treasury bonds are regarded as safe securities with low risk, a decrease demand would mean that investors expect a positive trajectory for the economy and are willing to invest in risky stocks.

A fall in demand for the bonds would mean that the US government would offer more ROI to attract more investors. As such, the spiked increase in yield for investors seen recently would indicate that investors are still optimistic.

Secondly, I also looked at the VIX. The VIX is an index that represents the market’s expectation of 30-day forward-looking volatility. Similarly, there was no big spike that would generally indicate market stress.

Even though both indicators do not show signs of any abnormality, there is still a need to recognise that there is always the risk of a black swan effect[4] from this pandemic.

Are tech stocks still an attractive buy?

It is a risk to be either under or over invested during this point of time. Additionally, Tech stocks have always been stretched in terms of their valuation, with their stock price troughs and peaks generally being very large in difference. As such, this might seem more like an opportune time to buy before the prices increase again.

[1] Rally: a period of sustained increase in the prices of stocks, bonds, or indexes. However, a rally will typically follow a period of flat or declining prices.

[2] Correction: A decline of 10% or more of the price of the security from its most recent peak. The decline could go on for a sustained period.

[3] The FED is lowering interest rates, buying a range of securities and conducting Quantitative Easing amongst other things in order to stimulate the economy.

[4] Black swan effect: An unpredictable event that is extremely rare, but has severe impacts if it occurs.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.