It is almost impossible for investors to overlook US and China, 2 of the largest countries in the world. However, their fortune and dynamics are very different. So how should we invest into companies in these countries and position our portfolios?

China: the growing superpower

China is a superpower that has been growing rapidly for the last 20 years. There are 2 key trends that will drive China’s growth for the next few decades.

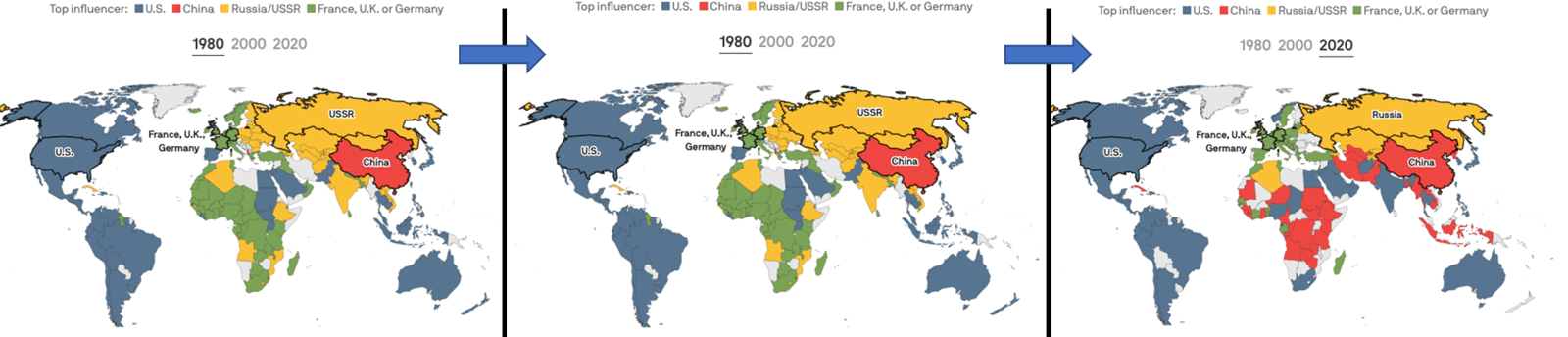

1. Growing clout

Source: Atlantic Council

China did not have influence outside in the 1980s. However, in the 2000s, China started to grow external influence and currently has a huge influence on big parts of the world. It has been expanding its influence largely via the Belt and Road initiative. This will allow China to export its goods and services to these parts of the world, further expanding its markets.

2. Wealth redistribution

Xi Jin Ping has been mentioning the idea of common prosperity, which in essence is wealth redistribution. In the short term, this transition looks chaotic, and many investors do not like the changes. But if you look beyond, into the long term, it will create prosperity for a much larger part of China, especially the middle class. And as they get wealthier, they will be able to consume a lot more.

Hence these 2 factors will expand China’s market and increase the number of affluent consumers. This will create a lot of consumption and economic growth in the next couple of decades.

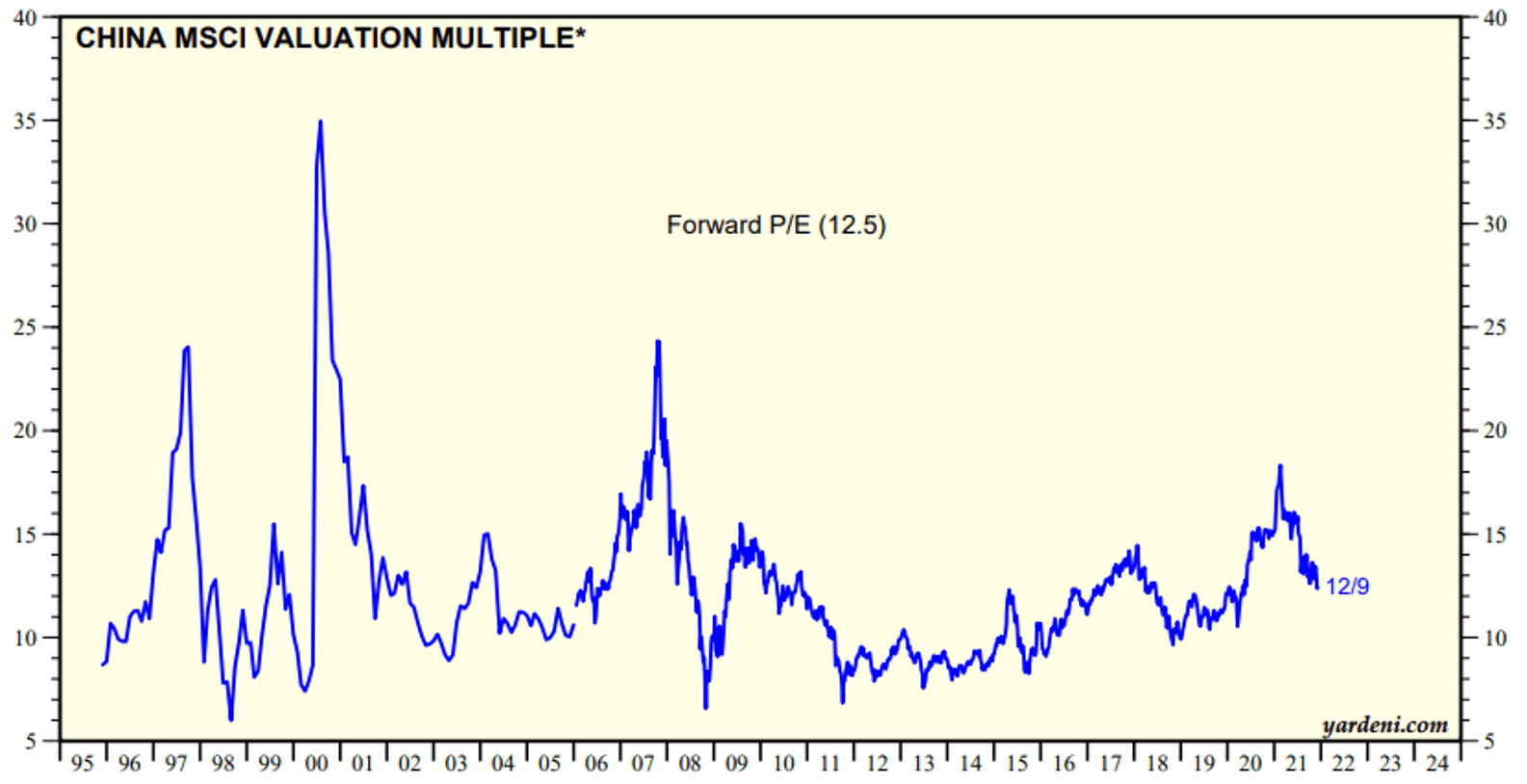

Valuation of Chinese equities

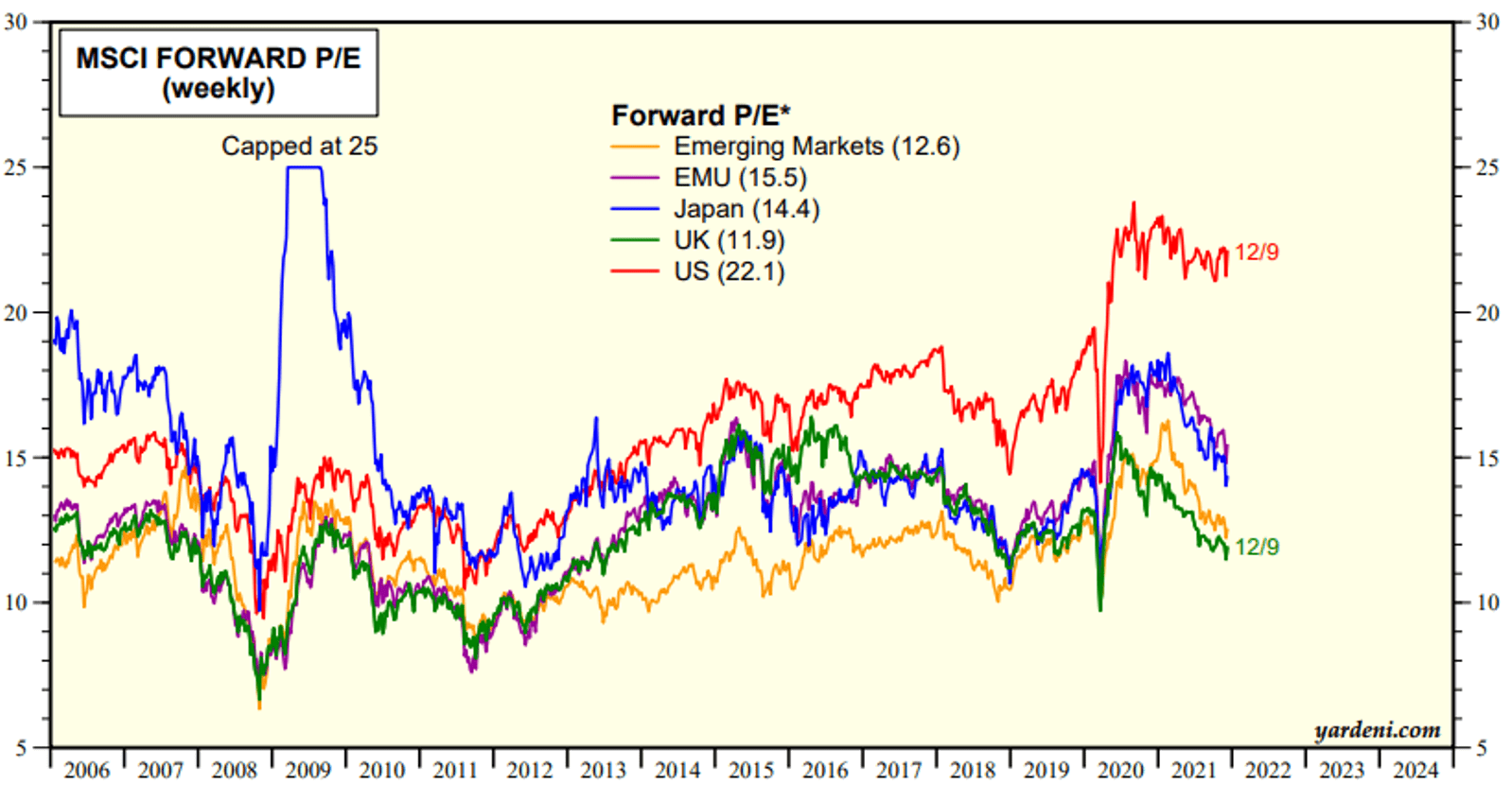

The valuation of Chinese equities is currently very reasonable. Based on the Yardeni research, as of September in 2021, it was 11% below its median valuation. Additionally, it went through a correction in 2021.

US: the largest superpower

US is currently the largest superpower have 2 key strengths.

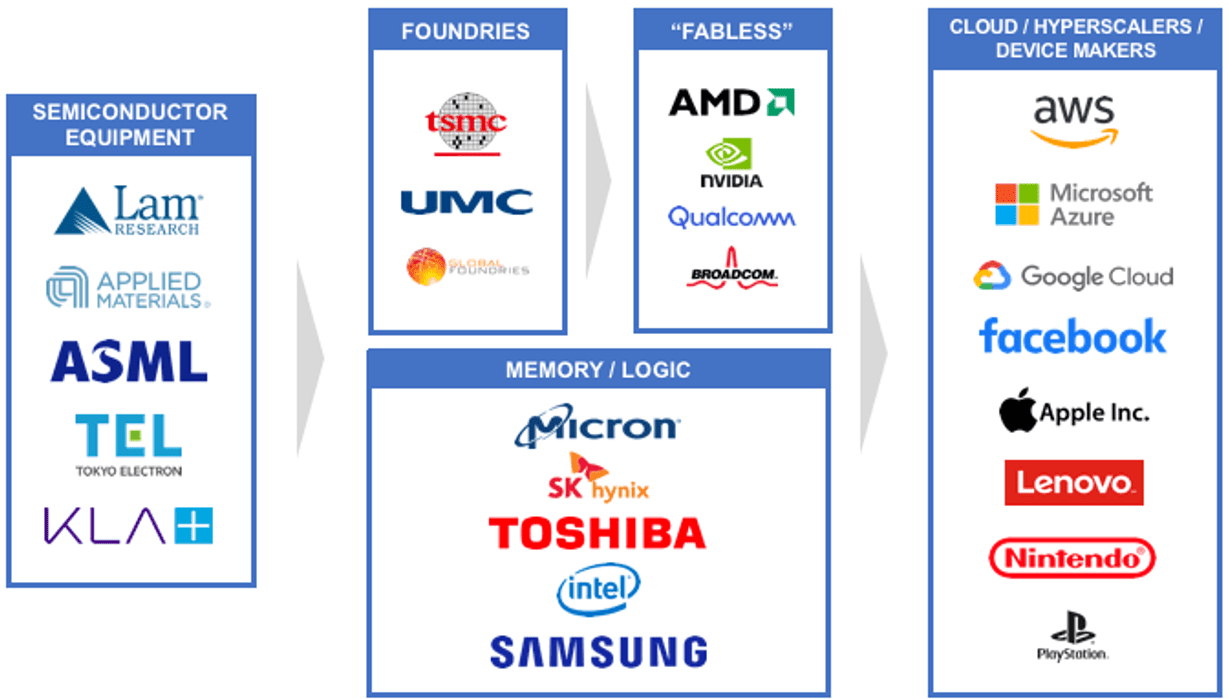

1. Technology supremacy

The world has been talking about the China-US trade war. However, I will say that it is more of a technology war because the country that is able to win in technology in the next few decades will reign champion. As of now, US seems to be winning and has been able to halt the imports of many key technologies into China.

Let us look at the semiconductors as an example. Semiconductor chips are required in all technologies and are hence their “brain”. All the semiconductor equipment producers are based in the US, or in allies of the US, like Japan and Korea. Hence, US controls this part of the market. The central part of the value chain, which consists of the foundries, also currently see Taiwan (TSMC) and Korea (Samsung) reigning supreme.

TSMC is now producing 3 nanometer semiconductor chips wherein the smaller it is, the more advanced. US has then restricted TSMC and Samsung from exporting their advanced chips into China, leaving China with its most advanced 12 nanometer semiconductor chips that are a few generations older.

This will slow down China’s technology growth and allow big technology giants in the US to continue flourishing. And US is also investing a lot more than all countries, safe for China, into technology development. Hence US will continue to stay in the lead, technology wise, if this continues.

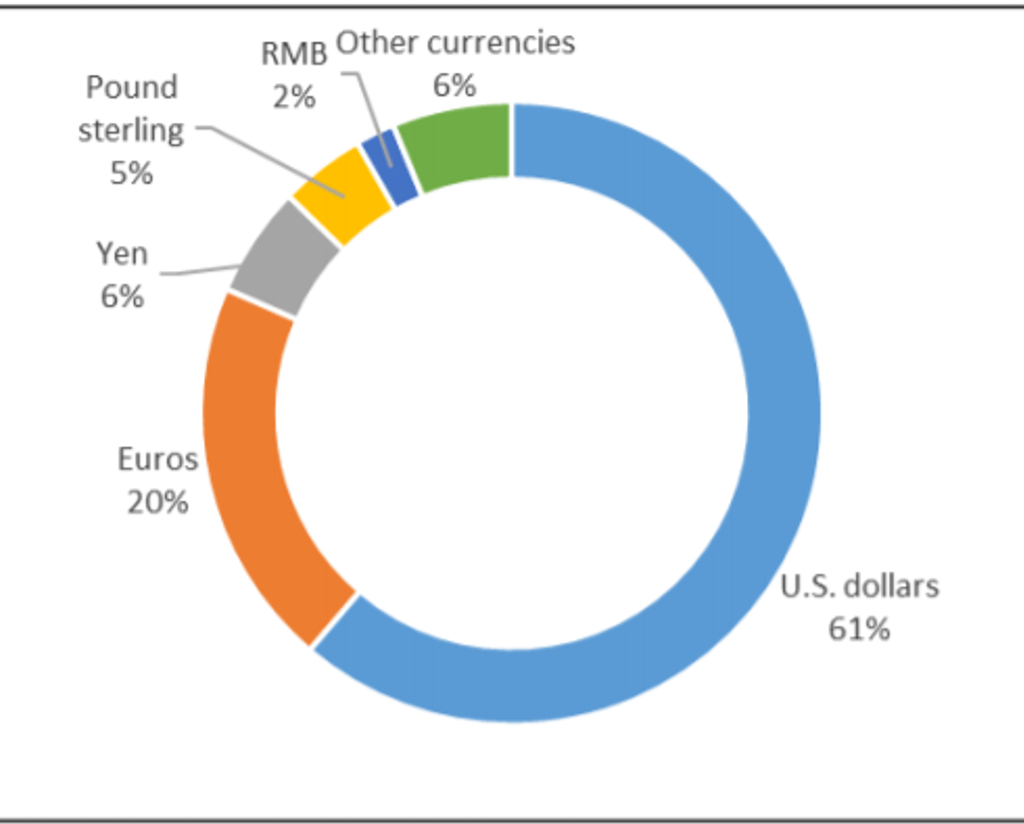

2. Got Money = Got Power

US currently holds the biggest world reserve currency; the US Dollar. 61% of the Central Bank’s reserves is held in US dollars. 90% of world trade is also done in the US dollar. Hence the US dollar is very strong. This gives US the ability to print a lot of money to sustain its economic grow without depressing the US dollar. Although the US dollar should weaken in the long term, the threat is not there yet.

Valuation of US equities

That said, the valuation of US equities has risen a lot. When compared to other major economies, it has the highest valuation. So, the US equities are not cheap now.

How should you invest in US and China?

Investing in China

China is going to be very attractive in the long term. I am very excited about it because of its growing influence on the world, and the effects of wealth redistribution. These make China a great country to invest in when they are coupled with China equities’ attractive valuation.

Since China has great and high diversification across sectors, I think it is good to have a broad-based investment into China. This allows your investments to be a general proxy of the whole economy.

Investing in US

US is home to some of the highest quality technology companies. However, its equities valuation is a tad high currently. However, we should still invest in the champions in US’ technology sector and hold it for the long term. It might be volatile but in the long term it is going to do well.

This is also how the firm that I am the Head of Investment of, Unicorn Financial Solutions, is positioned. If the prices do lower, we will seize the opportunity to buy into more of these.

Important notice

If you would like to seek advice on your personal investment portfolio, get in touch with me at heb@thegreyrhino.sg or 8221 1200, I would love to connect with you.

Stay updated with the latest news and insights, subscribe to my newsletter, and spread the word.