Since US discovered the ability to print money without causing much chaos, they have been using it repeatedly. Covid-19 was initially predicted to cause something akin to the great depression. However, the depression only lasted 2 months because the US Federal Reserve (FED) decided to send their printing machine into overdrive.

Growth companies have been getting more expensive to invest in if we analyse them through the valuation matrix. This is a result of the loose monetary policy. Additionally, low interest rate and the printing of money have also brought up asset prices.

Even as Inflation continues to rise, the FED thinks that it is transitory. However, nobody really knows how long it is going to last as inflation can take on a life of its own.

US 10 years treasury peaking on 31st March

The US 10 years treasury is frequently used to price assets. This rate peaked on 31st March this year at 1.74%. The FED wanted to form an alliance with the bank to float the system with liquidity. Hence, they allowed the bank to temporarily waive certain requirements, but this stopped on 31st March.

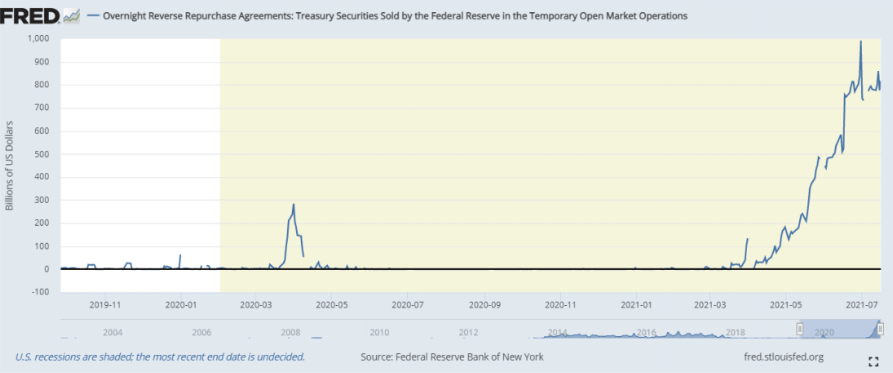

Hence these banks have plenty of money as the FED printed a lot. However, too much money is a problem for the bank as cash is a liability to them. Hence, they will not want to take in anymore, and the excess liquidity will flow into the market.

Increasing price of treasury bonds

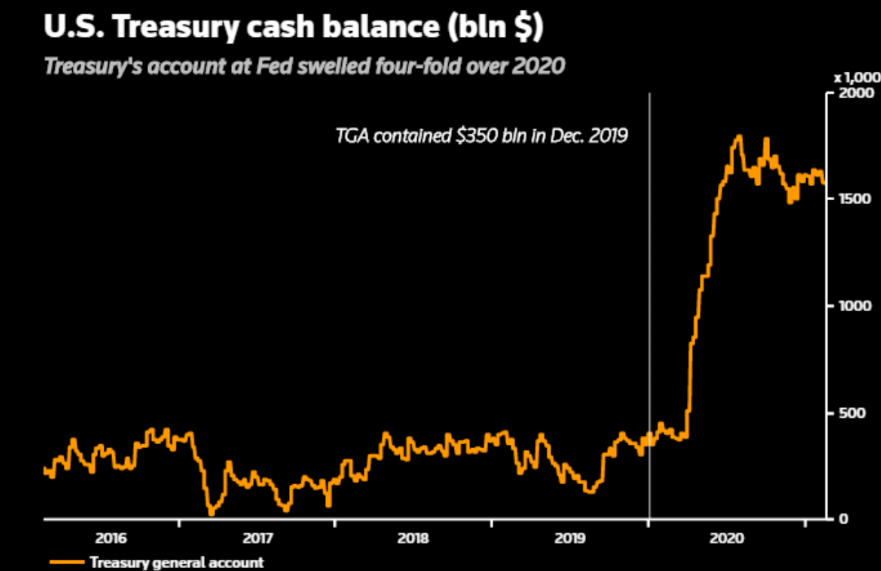

The treasury has been borrowing money in excess. They had USD$1.6 trillion in their account end 2020.

And, by August, they will need to pare down to USD$500 billion because of the debt ceiling. Some of the excess liquidity has gone in the system. However, part of the money has also been used to buy treasury bonds, leading to the rapid increases in the price.

However, this is only temporary.

How do I position my portfolio now?

You will not need to completely change to your portfolio, but you will need to be precautious.

In the long term, there will be 2 additional deciding factors:

1. Joe Biden

He had already passed a USD$1.9 trillion fiscal stimulus after he became president. Recently, he also had an infrastructure stimulus of USD$1 trillion passed. And currently, he is proposing a USD$6 trillion budget plan for 2022. All this money will come from borrowing.

Since the US does not have the money, they will borrow by issuing a lot of debt. If that coincides with the FED reducing their treasury purchase, then the treasury yield will increase to incentivise people to invest in US treasury bonds.

2. Stimulus Cheques

“Nothing is so permanent as a temporary government programme”

This is a saying by the renowned economist Milton Friedman. Most temporary government programmes become permanent. Printing money was initially intended to be a temporary fix to a short-term problem. However, when they got too used to it, they made the programme bigger and longer.

Currently, the government has been temporarily giving out stimulus cheques to people. However, this might be hard to stop. If the government starts to tell the US citizens that they are not going to receive stimulus cheques anymore after a prolonged term of them receiving it, they are not going to be happy. Joe Biden will be cautious of inciting this unhappiness as he is going to be afraid of his own votes. So, this stimulus cheque provision might persist even after Covid-19 is over. With more money to spend, companies will need to jack up their wages to attract people to work.

High inflation will be more heightened and more prolonged, but it will not be exceedingly high like in the 1970s. This is my concern about inflation. If it does not happen then it is good. We will continue to have plenty of money to increase stock prices. But if it does happen, stock prices are going to plummet.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.