What is Treasury Yield?

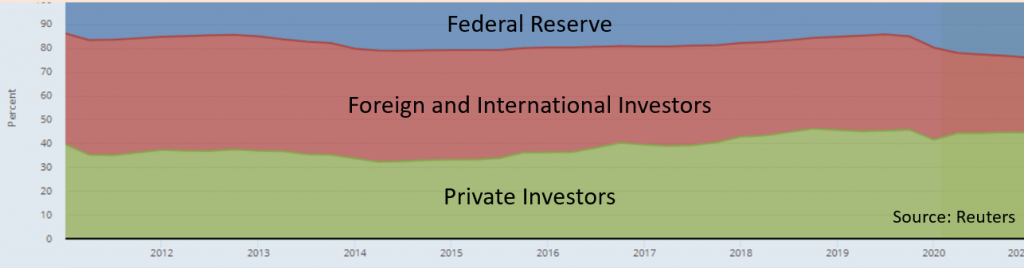

Treasuries are debt issued by the US Government. This allows them to borrow money to fund government spending as they have been in a deficit for many years. The treasuries are generally bought by the Federal Reserve (FED), foreign and international investors, and private investors (banks, mutual funds, and more).

Treasury yield is then the return on investment that investors get periodically when they invest in the treasuries. It has been experiencing volatility, especially during the recent announcements that the FED made.

US Treasuries and Inflation

Inflation diminishes the purchasing power of the Treasury’s future cash flow. With a higher than expect Inflation, more compensation will be demanded by investors, leading to a rise in the yield.

The US Treasury Yield has experienced a lot of volatility during this period. After declining during Covid-19, it peaked on 31st March at 1.745%, but went down again to 1.5%. Why is it decreasing even though Inflation was more than expected?

There are 3 reasons:

1. Inflation might be transitory

The FED has said that Inflation would be transitory (although I think otherwise). This means that the Inflation will be short lived, and many are buying into this story. Hence, the interest rates are coming down for more people will borrow and spend.

2. Massive Liquidity

Since 31st March this year, the same day as the peak, there was a stop in the previous exemption for Capital Requirement the FED allowed the US Bank. This means that the bank cannot take in the deposits or must reduce intake. And since people are unable to put the money in the bank, their money goes outside the banking system, flooding the system with liquidity. This flood is in addition to the massive amount of liquidity pumped in by the FED since the end 2020.

US has also borrowed more than what they need. End 2020, they had about USD$1.6 trillion that they had yet to spend. They need to keep to their debt ceiling, hence by August this year, they will need to reduce their spending to USD$500 million. They have been moving their savings into the market as a result.

Part of this excessive liquidity could have found its way to the Treasury, hence the excess demand has kept yield low.

3. Low Treasury Yield for other countries

The start of 2021 saw the US Treasury Yield after hedging rise above the yield of the domestic treasuries for other countries. Hence, foreign institutions like Japan or European Institutions, were attracted to the US Treasury Yield. This created additional demand. Thus, there has been a capping of the US Treasuries Yield.

However, this is only temporary. By end August, we will probably start seeing the liquidity dwindle. Hence, it will be good to be cautious in case the investors are not ready to raise the interest rates.

What is the direction of the interest rates?

This equation holds for productive assets like equities, bonds, and real estate.

The numerator is Growth Rates and the denominator is Interest Rates. Normally, Inflation is stable at 2%, if it climbs higher than that, asset prices will go down. However, we must keep in mind the numerator too. If the company or real estate rental can grow faster than the interest rate, and faster than initial expectation, the asset prices should go up.

I think interest rates are likely to go up from here. Joe Biden favours using fiscal policy, hence the government will need to borrow a lot of money to spend on the economy, hence they must issue more treasuries.

The FED is also thinking about tapering their intake of the Treasuries, hence with the supply increasing but demand decreasing, the rates will go up. However, it is likely that the FED will be more accommodative, keeping a loose monetary policy.

How do I position my portfolio?

Tweak your portfolio as I explained previously. Reduce the assets that are currently not making money, with growth that is very far out. Take out assets that are also not growing, as interest rate rises will lead to the fall in the value of this asset.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.