When inflation rises, most assets dip in value. But have you ever wondered if there are assets that can defy this? In this article, I will touch on whether REITs can protect your portfolio during a high inflationary period.

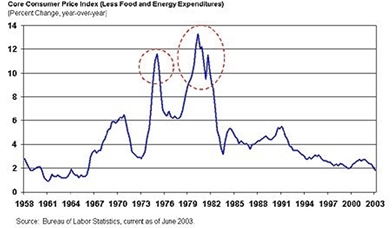

Previous periods of high inflation: 1970s-early 1980s

During this period, inflation was in the double digits for many years. At its worst, inflation reached as high as 13% annually. Today, inflation hovers around 2% annually.

What caused the high inflation during the 1970s to 1980s?

President Richard Nixon inherited a recession from President Lyndon Johnson in 1969. Richard Nixon zealously wanted to uplift the economy from recession and simultaneously fight the Vietnam war. Hence, he embarked on an unorthodox monetary experiment of massive budget deficit spending. 2 years later in 1971, the USA was running out of money. To allow the US to print more money to fund its spending, Richard Nixon took the extraordinary measure to delink the US dollar from the price of gold, a regime created by the Bretton Wood Accord in 1944. This caused a raging inflation that was combatted by the US Federal Reserve raising interest rates to a ridiculously high level of 20%.

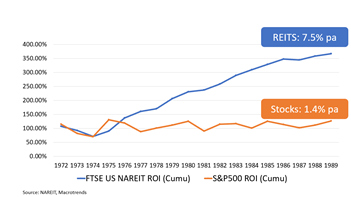

How did REITs perform against stocks during this period?

The orange line represents US stocks (S&P 500), and the blue line represents US REITs. US stocks returned approximately 1.4% per year over the 2 decades. REITs outperformed stocks by a large margin, returning approximately 7.5% per year over the same period. Both stocks and REITs had a decline of close to 30% in the initial 2 years when inflation raged. Thereafter, stocks experienced years of volatile returns while REITs had positive returns every year.

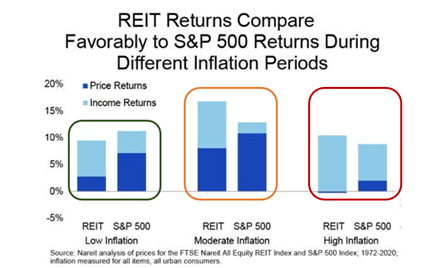

How did REITs perform against stocks in various inflationary scenarios?

During low inflationary periods, stocks outperformed REITs. However, in moderate and high inflationary periods, REITs outperformed stocks. This outperformance is contributed largely by the higher dividend yield offered by REITs.

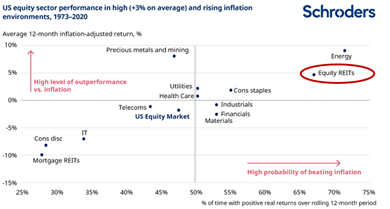

In this analysis, REITs again fared well during inflationary periods. The X-axis shows the probability of a sector outperforming inflation. The closer it is to the right, the higher the probability of outperformance, and vice versa. The Y-axis shows how much the asset will outperform inflation. The further up it is, the larger the percentage of inflation-adjusted returns from the asset.

REITs are at the top right corner. This means they have both high probability of beating inflation and high inflation-adjusted returns.

In summary, the data shows that REITs are good investment assets to own during inflationary periods. They outperformed stocks in moderate to high inflationary periods, had high probability of beating inflation and had high inflation-adjusted returns.

The analysis is derived from historical data. Hence, it should only be used as a reference, rather than accepted as a gospel. Over the years, the environment has changed. It would be wise to evaluate whether the past will still hold true today.

Will REITs likely outperform inflation in the current environment?

I believe it will. However, this is only true for certain types of REITs.

REITs do well in inflationary periods largely due to their ability to increase rent. Hence, to identify REITs that can do well in today’s environment, we need to ascertain their ability to raise their rents, especially during inflationary periods.

REITs that possess such qualities have 2 important characteristics:

- High demand in this era of disruption. I think Data Centres and Healthcare REITs are 2 of the sectors that fulfil this criterion.

- Possess inflation-indexed rental escalation clauses in their tenancy contracts to enable rental growth in excess of the rate of inflation.

Conversely, REITs with low pricing power or have fixed rental rates would suffer in inflationary times.

I hope this article has given you the insights to differentiate winners and losers in REITs today. The next time a REIT is recommended to you, remember to use the criteria above to evaluate them for yourself. The devil is often in the details, but so too is the angel!

Important notice

The information and opinions available in this presentation has been obtained from sources believed to be reliable and is for educational purposes only. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. The presenter accepts no liability whatsoever for any direct/indirect or consequential losses or damages arising from or in any connection with the use or reliance of this presentation or its contents. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving or investing money nor is there any guarantee that you may experience any lost when investing. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Presenter does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.