What is ESG?

E – Environment: How the company treats the environment

S – Social: How the company treats their stakeholders

G – Corporate Governance: How the company manages and directs its operations

Environment:

Environment looks at how the company is adapting to handle climate change, sustainability, and animal welfare.

Social:

Social looks at whether the company’s workforce is diverse in terms of race, gender and more. Additionally, Social looks at whether the company abides by human rights standards in its main company and along its supply chain. Lastly, it enforces consumer protection; whereby services and products are faithful to what was promised.

Corporate Governance:

Corporate Governance includes management structure, culture, employees’ relations, and whether executive employee compensation is fair.

*This list of factors for ESG is not exhaustive.

ESG is not very tangible as it includes many non-financial factors. However, many companies have started to quantify it. Companies with a higher ESG generally have lower risk, a higher probability of success and is more sustainable. In contrast, companies with a lower ESG rating might do well financially but has higher risk and a lower level of sustainability. Furthermore, there could also be backlash from consumers who disagree with the unfair practices.

The rise of ESG

ESG began in 2005 but only rose to prominence recently.

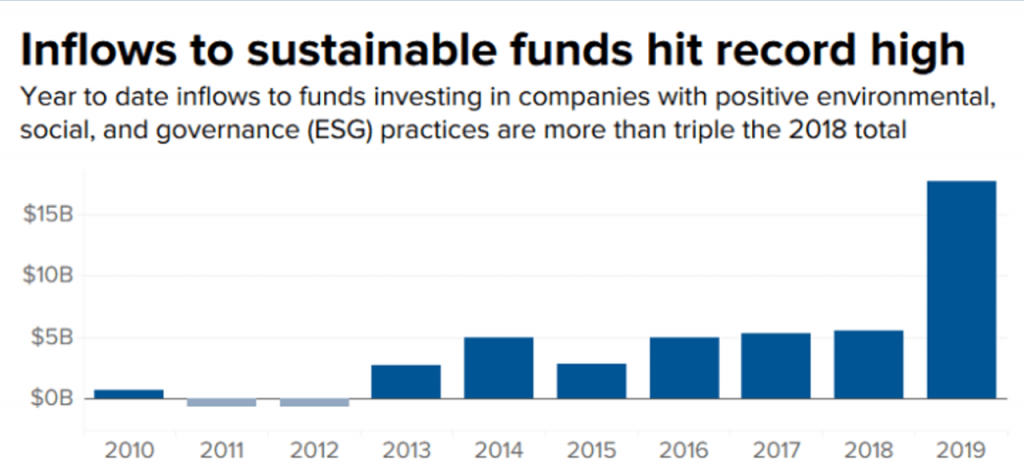

Looking at the amount of funds companies have been spending on ESG, we can see that there was an exponential rise in 2019, with 2020 following this trend. Additionally, fund managers have also shared with me that ESG is gaining traction, especially with expats in Singapore.

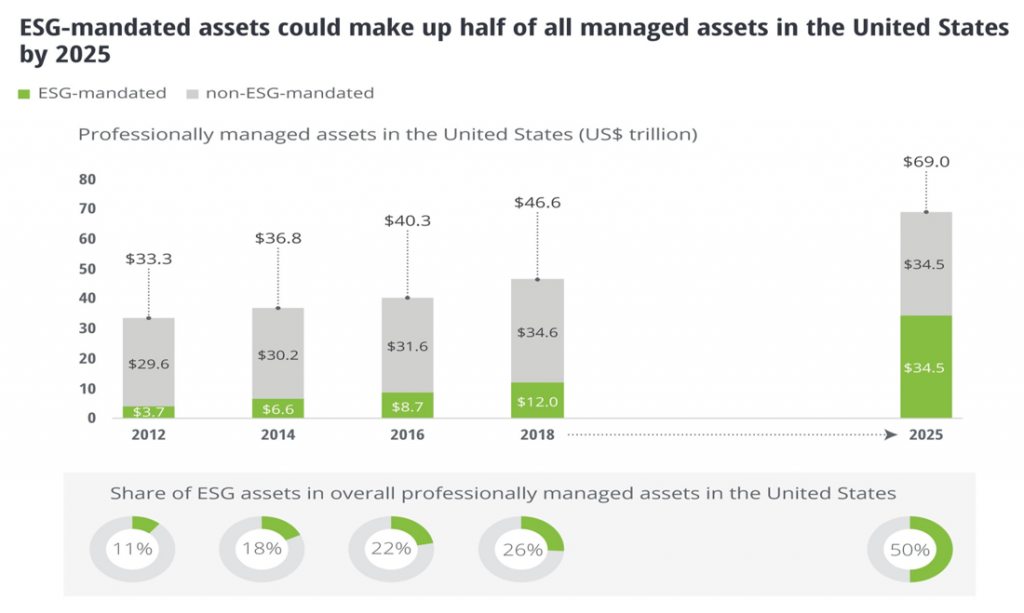

This research conducted by Deloitte in 2018 shows that ESG mandated assets could make up half of all managed assets in the US by 2025. This is quite a large amount of money when observed in relation to the non-ESG mandated funds, both funds being equal in 2025. This follows the established trend of spending in ESG gaining traction since 2019.

Why has ESG become so prominent?

1. To do good

Europe has become more aware and has been finding innovative ways of using renewable energy, recycling and more. With European companies leading the trend in being more environmentally conscious, more and more consumers have become more aware of the effects of consumerism on the world. The younger generation, in particular, want their investments to be aligned with their own values because their investments are an extension of themselves. As such, people can invest in ESG funds if they want their investments to play a part in helping the environment.

2. Better performance: Outperformance against traditional index

The Blackrock Report shows use that the annualised returns for the ESG focused funds have a slight edge, regardless of whether it is for US, the world excluding US, or emerging markets.

3. Artificial Intelligence (AI): Availability of Big Data to mine for non-financial information

Since ESG consist of non-financial information, it is not easy to find. Some companies are mandated to produce sustainability report to share their non-financial and intangible data. The rise of AI has also allowed the mining of this Big Data to put it in measurable terms for investors to understand.

Does ESG investments have better performance?

There is no conclusion on whether ESG investments perform better. This is because the gap between ESG focused funds and traditional funds is not big. Additionally, the lack of a clear definition for ESG and its short history does not give us conclusive information to work with.

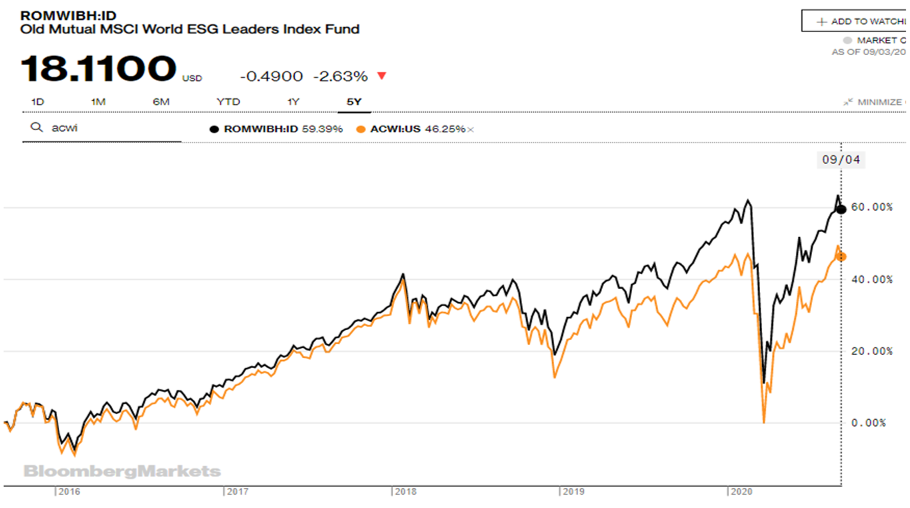

However, the Old Mutual MSCI World ESG Leaders Index Fund[1] outperforms the MSCI All Country World Index[2] over the past 5 years. The Blackrock Report also supports the idea that there are some outperformances for ESG funds.

Positive ESG example: Microsoft

When Steve Ballmer took over, Microsoft became proud and stopped innovating because it was already dominant in its own sector. Hence, it stopped collaborating with others, insisted on its own culture, and did not treat customers and suppliers well.

However, when Satya Nadella took over, he decided to makeover Microsoft’s culture to be more inclusive in collaborating with other developers like Apple. It has also become more empathetic, embraced open source development, and listened to what their customers and suppliers wanted. Subsequently, it also created services and products that their customers needed.

This is an example of the “Social” part of ESG, whereby a company treated their stakeholders better and had a change in its’ whole value. This progress in the company is further shown by how Microsoft’s share price rose by 5 times in 6 years after Satya Nadella’s take over.

Is ESG an important consideration for choosing stocks?

I think the result is inconclusive due to ESG’s relatively short history and lack of common standards to define it. Additionally, the degree of outperformance is bound to be negligible in the short term.

However, over the long term, companies with better ESG will have better adjusted returns with significantly lesser risk. They will have the consumer’s trust and cooperation. They will also have lesser fines because they contribute less pollution and do not take bribes or have corruption.

Currently, around 26% of US funds is ESG mandated. If the Deloitte research is accurate, there will be a higher demand for ESG mandated expenditure[3]. This means that companies that spend more on ESG will have higher valuations and will do well over a longer period.

How do you apply ESG investing?

There are 2 ways to apply ESG investing, negative screening and positive screening.

Negative screening

I will firstly look at the company I want to buy using my usual metrics. After I have formed my portfolio, I will look relook at my decisions using the ESG risk rating with systems like Morningstar to ensure that none of them scored too low in terms of ESG risk rating. If any of the chosen companies do, you might want to think twice as the company’s risk will be higher over the long term or it might go against your principles.

Positive screening

This is a philosophy used by my friend Koon Boon. He uses the HERO methodology framework. H is for Honourable, whereby they solve high-value problems with integrity. E is for Exponential growth, R is for Resilient and O stands for Organisation; having a good culture.

This is like using the ESG framework as HERO is derived from the sustainability index created by the UN. We then use this to sieve out the companies fulfilling these sustainable goals. Subsequently, we can also use the ESG as a part of our positive screening for stock selection.

Conclusion:

A high ESG score is not a good enough reason to invest into a company. Instead, it needs to be coupled with other factors like innovation, good business model, strong competitive advantage and management that is driven and hungry for growth.

ESG will then play a part in making the company more sustainable, with the management treating stakeholders well and having good governance. In conclusion, incorporating ESG into your stock selection will be beneficial in the long run.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

[1] Old Mutual MSCI World ESG Leaders Index Fund: It measures the stock market performance of the companies with high ESG performance compared to other companies in the same sector in developed markets worldwide.

[2] MSCI All Country World Index: It tracks the global stock market performance, with stocks from 23 developed countries and 26 emerging markets.

[3] If you want to read more about the ESG investing: Unregulated ‘greenwashing’? ESG investing is under the microscope as the money rolls in