What are REIT Managers?

REIT managers manage REITs and collect a fee in the process. Investing in them is wiser as they are better in quality and enjoy a higher growth rate compared to REITs. Today, I will talk about a REITs manager in Australia called the Charter Hall Group.

Charter Hall Group’s Business Overview

Charter Hall Group’s Business Segments

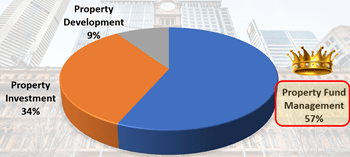

Charter Hall operates in 3 main segments:

1. Property Fund Management

2. Property Investment

3. Property Development

In the first segment, they manage the REITs and the property funds, earning fees from it. They then invest the excess funds into their REITs and develop their own properties, which is their second and third business segments respectively. The properties they develop can then be included as part of the REITs they manage in the future. This will allow them to continually earn more fees from their REITs. This is a self-contained ecosystem. And as the Property Fund Management segment has very low capital needs and very high growth, it is the crown jewel of Charter Hall Group. Low capital needs and high growth are what we look out for in this section.

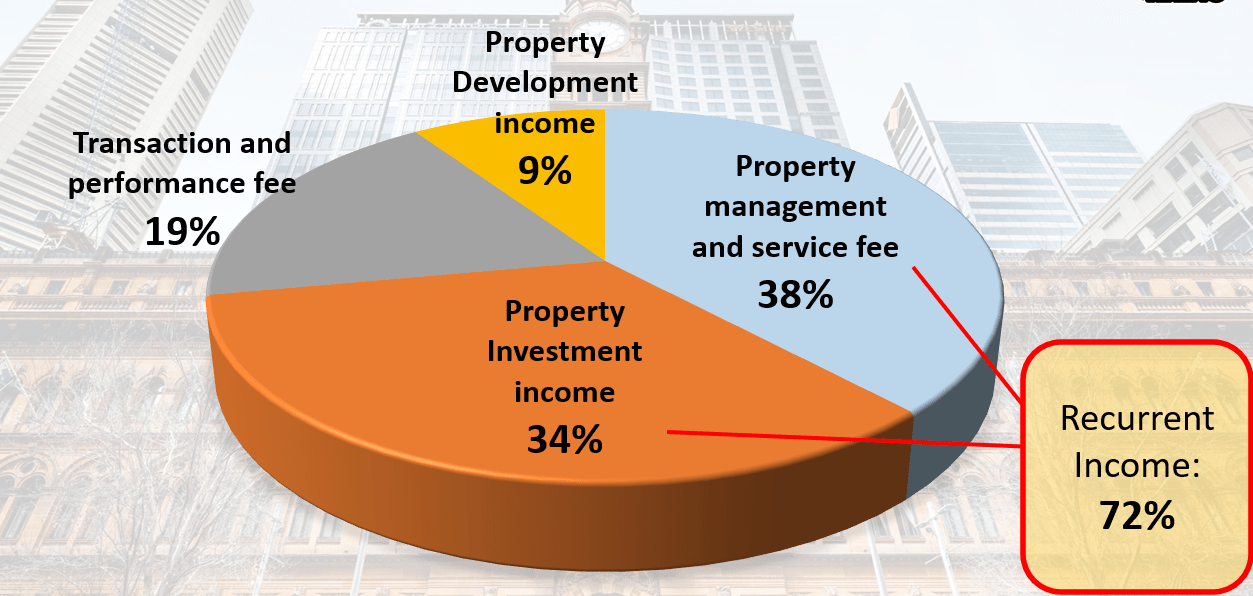

Charter Hall Group’s Income

In this next section, the main thing we are looking for is recurrent income. The higher the percentage, the better it is for investors. Recurrent incomes are of very high quality as they are persistent year after year, even during a recession.

72% of Charter Hall Group’s income is recurrent. These are made up of Property management and service fees and Property Investment income.

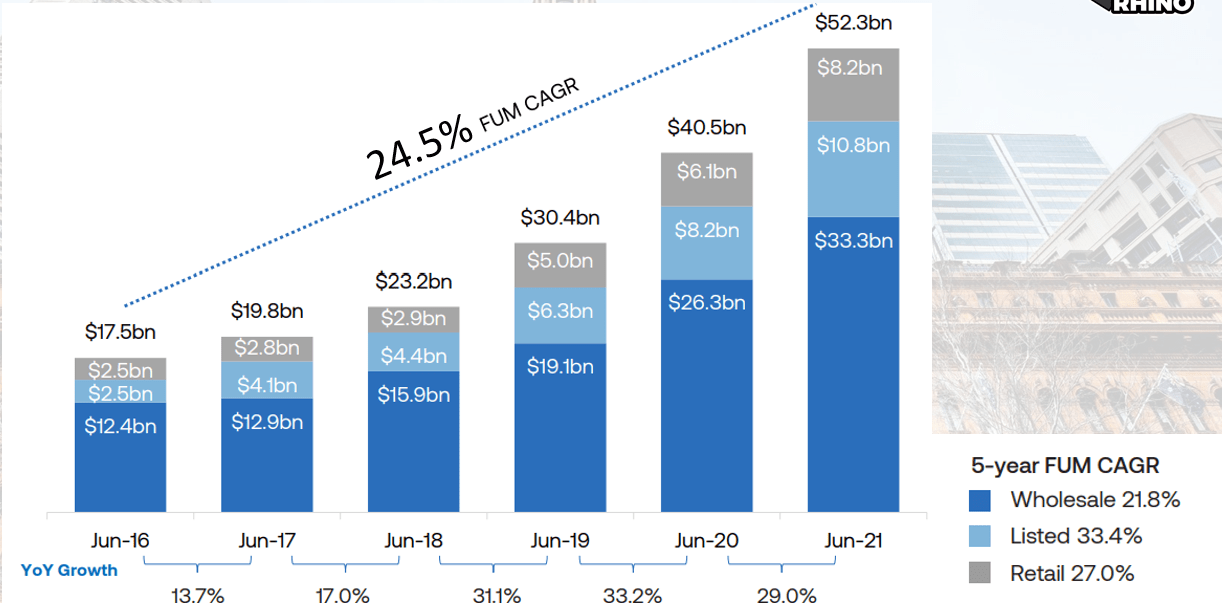

Charter Hall Group’s Fund Under Management (FUM) Growth

Their FUM has been growing fast at 25% yearly. And I think this growth rate will continue in the future.

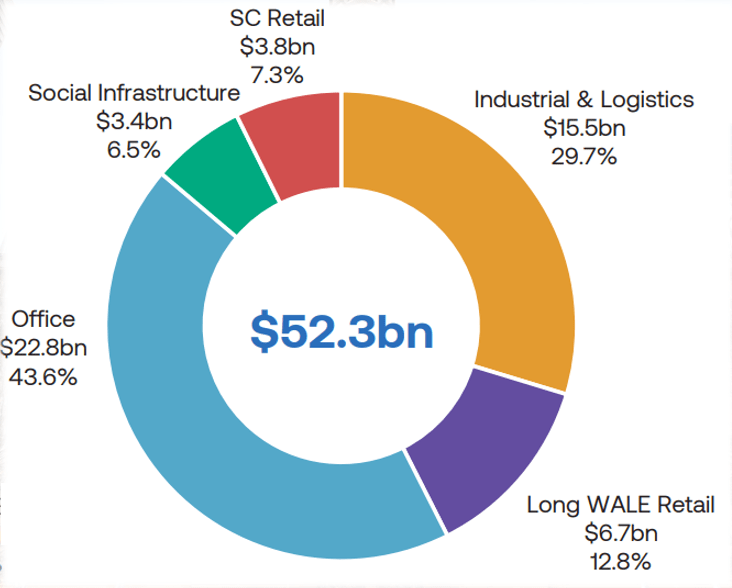

Charter Hall Group’s FUM by Property Sectors

In this section, we look for diversification. A larger portion of their REITs and properties should be made up of “tomorrow” properties – such as industrial properties and those involving logistics. Currently, “tomorrow” properties still do not make up a huge proportion. They make up about 30%, but we think this is diverse enough.

Overview of Industry and Competition

Charter Hall Group’s FUM is currently AUD$52 billion, which is 4% of Australia’s Commercial Real Estate market. This means that there is room to grow as they acquire more property over time, develop new properties, and increase their FUM.

2 main sources of future growth:

1. Ability to develop and acquire commercial real estate

This puts their FUM on a brisk growth path. For Charter Hall, it has been growing about 23% annually for the last 5 years.

2. Surplus funds are reinvested into their own property portfolios

After distributing the dividends, their excess profits are reinvested into their property and REIT funds. These have been growing at 9% annually for the past 5 years.

Charter Hall Group’s Investment Analysis

Let us look at Charter Hall Group’s Market and Moat. Market means their ability to grow, i.e. how fast the Group could grow. And Moat is their competitive advantage – attributes that allow Charter Hall Group to outperform their competitors.

Their FUM grows at 23% per year. However, their investment of surplus funds into their own property portfolios only grows by 9% yearly. However, these will build on each other and accelerate growth. Hence, investing in a REITs manager is superior as they will grow faster than REITs.

Reasons for faster growth:

1. REITs managers are very asset light

They use money from others to grow their REITs, develop properties, and sell them to the REITs property funds. Since they do not need new money to grow new business, they can grow very fast. And with the right expertise, reputation, and management, they can continue to grow at a rate of 23% per year.

In contrast, REITs cannot grow as fast as they are a capital-intensive business. REITs must progressively increase their rental rates to ensure that tenants stay. They will also need to put more money in to acquire more properties. If they do not have funds, they cannot grow organically. They will only be able to grow at a high single-digit rate, whereas FUM can grow at a double-digit rate. Over time, this makes a huge difference.

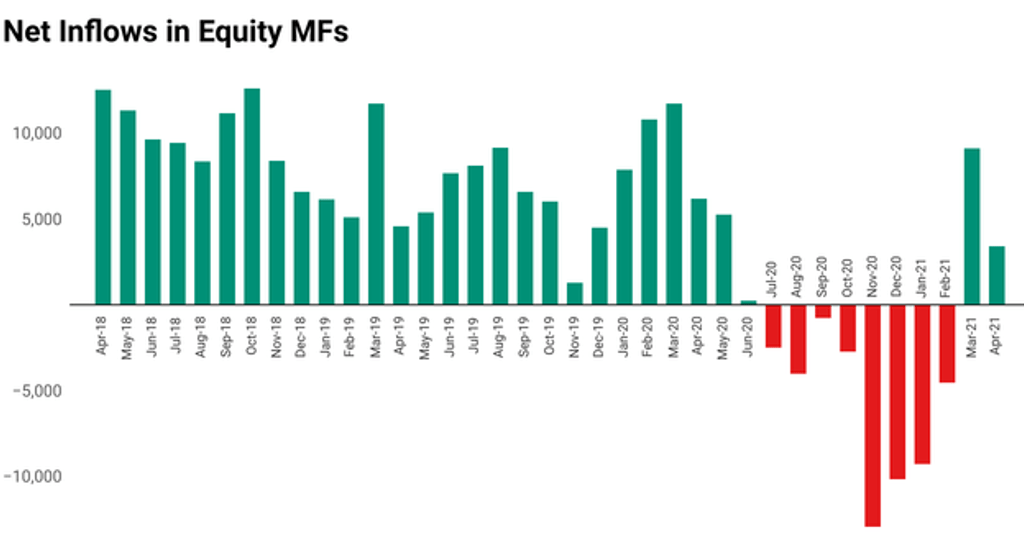

2. Stickiness of assets

For mutual funds, in good times, more units can be created for people to buy. The drawback is that in bad times, people can also redeem their investment. So, in bad times, mutual funds suffer a double whammy from a price fall and redemptions, resulting in large volatilities in the management fees.

REITs and property funds, however, are stickier. Investors cannot redeem REITs and can only sell it on the stock exchange. Thus REITs will continue to have the same number of units. This is very beneficial. Property funds too usually have a lock-in period of 5 years. This specified redemption period will also stem the fund outflow. Thus, Charter Hall Group’s assets under management are much stickier compared to a mutual fund.

As property funds can still be redeemed every 5 years, we must investigate the performance of Charter Hall Group’s property funds.

All the funds that Charter Hall manages have been outperforming the market. This means that when the 5 years is up, there is a very good chance that the investors will stay invested. Hence, there will be no fund outflow. This is very important as the management fees is earned based on the assets under management.

3. Stickiness of fund managers

To change the REITs fund manager, there needs to be a 50% majority vote. Additionally, the fund managers cannot be changed as these are their own funds. Hence, they are sticky, and it’s most likely that Charter Hall will continue to manage their own funds and REITs.

4. Stickiness of management fees

This income is high quality as the management fees are based on the fund’s Gross Assets Value (GAV). Many Property Funds and REITs are valued according to professional appraisals with cash flow analysis. The Net Asset Value (NAV) tends to be more stable as it is not subjected to investors’ sentiments. And since the NAV is not volatile, the management fees are also less volatile. This is a huge plus.

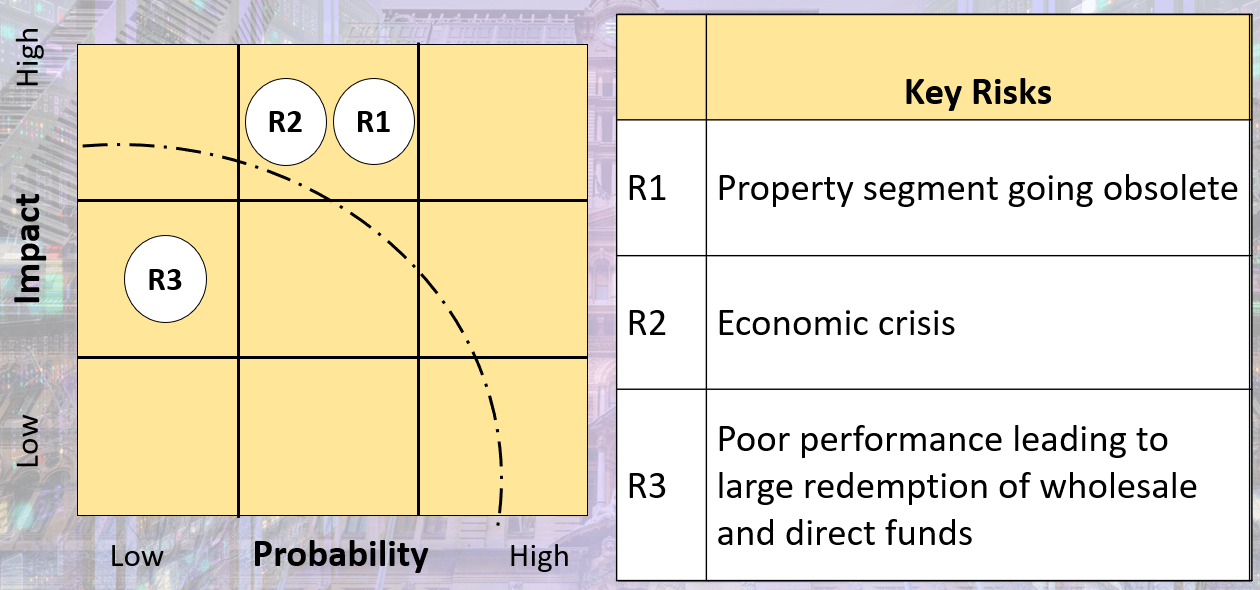

Charter Hall Group’s Risks

1. Their property segment going obsolete

We are more concerned with the retail and office space. This is because demand for retail spaces is being disrupted by e-commerce. And the demand for office spaces is also disrupted by COVID-19 as more might shift to work from home. So, we’d rate their property segment going obsolete as having moderate probability and a high impact.

Fortunately, Charter Hall Group’s REITs and property funds have a very long WALE (Weighted Average Lease of Expiry). Their WALEs, or lock-in periods, range from 7-16 years. Tenants cannot release themselves from their lease during the lock-in periods. This gives us time to observe how disrupted the retail and office segments will be. And subsequently, we would also have sufficient time to diversify our stake in the Charter Hall Group.

2. Economic crisis

The worst kind of economic crisis for REITs is usually a credit-led crisis. In this case, the banks become unwilling to lend money to REITs and property funds as they usually borrow a lot. They will also need to roll over their loans, where the unpaid loans are carried over into a new one. If the banks are unwilling to roll over their loans in an economic crisis, the Charter Hall Group could be in trouble due to a lack of funds. This risk is of medium probability and has a high impact if it occurs. We will need to manage it through asset allocation. Our assets cannot then be all in stocks as stocks will face similar risks when a crisis occurs.

3. Poor performance leading to a sizeable redemption

Every 5 years, investors have a chance to redeem. Fortunately, the funds have performed very well in the past. Hence, the probability of this occurring is low and the impact if it does occur is medium.

Charter Hall Group’s Financials

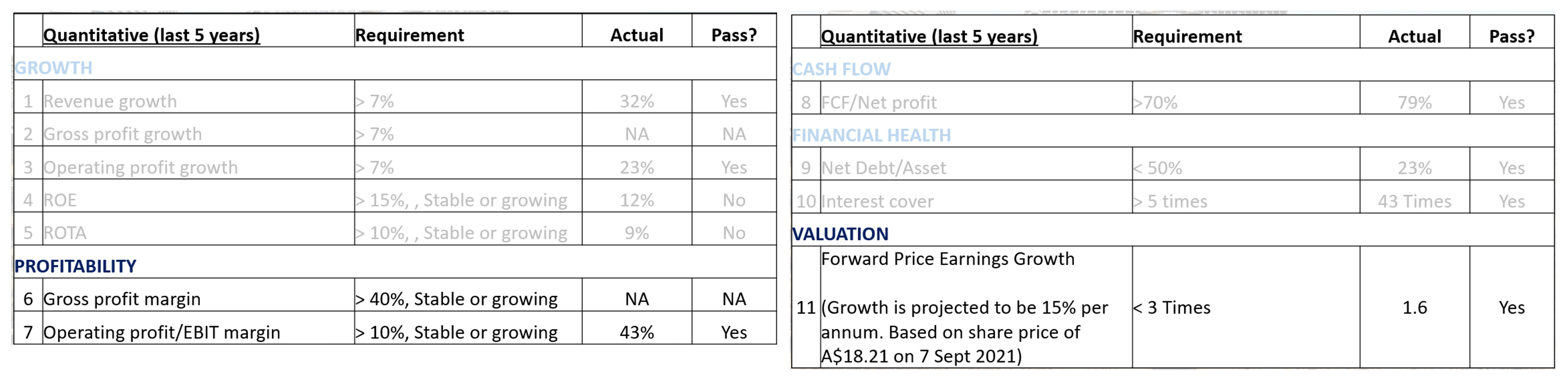

Growth of Charter Hall Group

Most of them meet our expectations, except for the ROE (Return On Equity) and Return on Tangible Assets. This is due to their fund management segment currently taking up a smaller proportion. But as it grows over time, we believe that the ROE and Return on Tangible Assets will improve as it is a very low capital-intensive business.

Profitability of Charter Hall Group

Their profitability exceeds our expectations.

Cashflow of Charter Hall Group

Their cash flow meets our requirement.

Financial Health and Valuation of Charter Hall Group

Both their Financial Health and Valuation meet our requirement. Under Valuation, we should only invest in it when it is less than 3 times the Price-to-Earnings Ratio (P/E). Based on the forward earnings of Charter Hall Group, the PEG ratio is currently at 1.6, which also meets our requirement.

Yes, No, Yetto

Yes means that the Charter Hall Group will be included in our portfolio. No means that it’s out of our portfolio. Yetto means it will be in our waiting list.

But before that, this sharing is made possible by a well-trained team of people who are willing to put in some work for the research. However, you might want to learn this knowledge to invest well on your own. If you want to learn a very fundamental value investing approach for this era of disruption, click HERE to find out more and to sign up.

To continue, it is a YES for Charter Hall Group. We like the company and the risks are well mitigated. As we shared previously, REITs could be a good investment during times of inflation which might be what is ahead. And investing in REITs managers will allow you to enjoy REITs with the additional benefits like faster growth.

Important notice

The information and opinions available in this presentation has been obtained from sources believed to be reliable and is for educational purposes only. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. The presenter accepts no liability whatsoever for any direct/indirect or consequential losses or damages arising from or in any connection with the use or reliance of this presentation or its contents. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary.

Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving or investing money nor is there any guarantee that you may experience any lost when investing. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Presenter does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission.

If you have any questions about your personal investment portfolio or want to learn how to better reap the opportunity you are now having, feel free to reach me via heb@thegreyrhino.sg or 8221 1200.

Remember to leave comments and share this site with your friends. Do subscribe to my newsletter for updates and share this site with your friends too. I would love to connect with you.

Singapore’s version is Capitaland. Running to the moon since listing.

Capitaland has taken a lesson from all these REIMs.

Interesting article as I don’t have any expertise in Oz market even though it has a reputation for being yield-focused.

My go to REIMs for the past 10+ years have been Blackstone (ok they are more of alternative investment manager, but with emphasis on real estate) and CBRE.