I previously explained that I would invest in Disney but what about its competitor, Netflix?

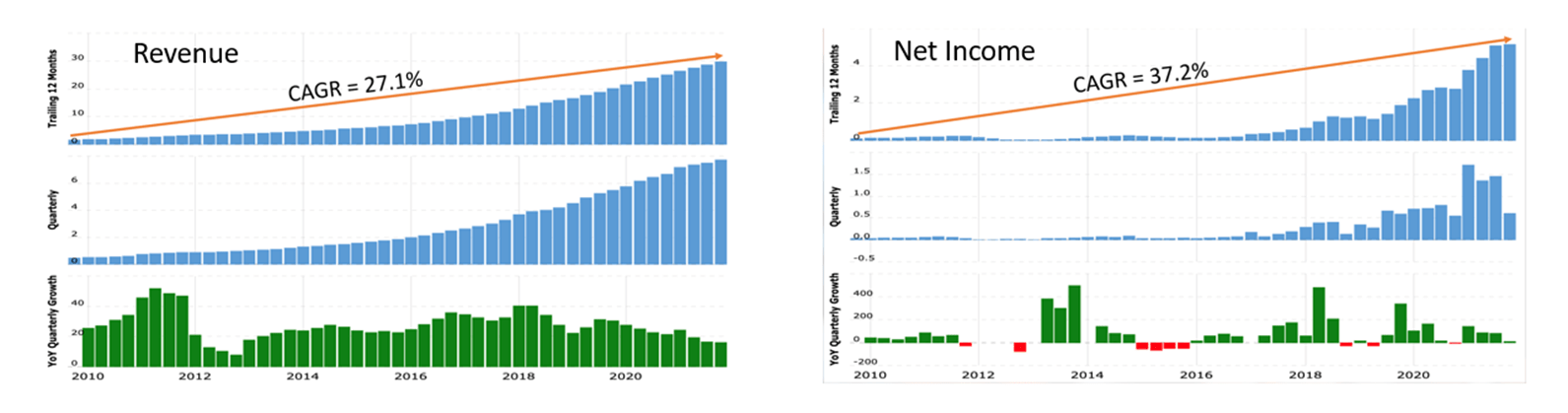

Netflix’s revenue has been growing from 2009 to 2021 at 27% per year. Its net income, on the other hand, has been growing even faster at 37% per year. These are fantastic numbers that reflect the fast rate of growth for Netflix.

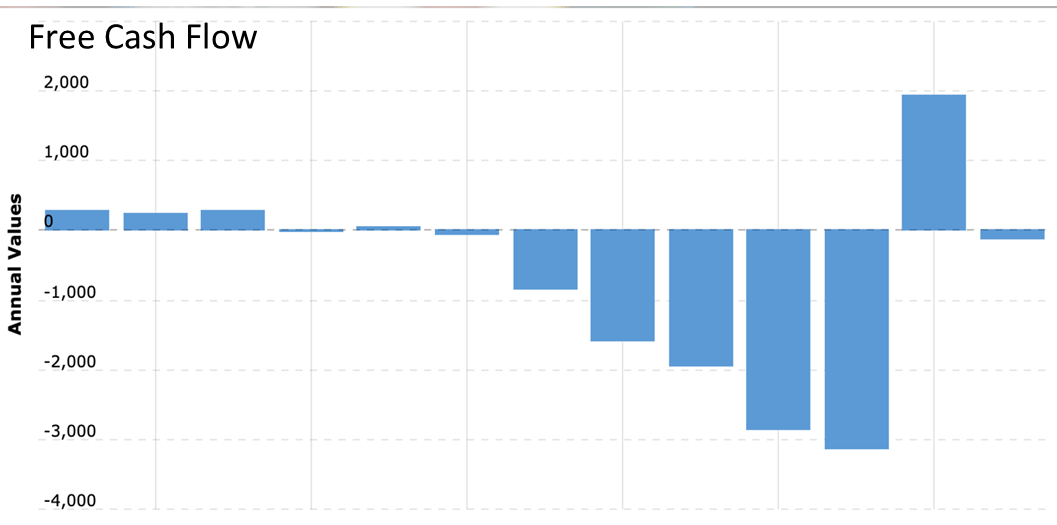

However, we must also look at Netflix’s Free Cashflow.

Netflix’s Free Cashflow

Free Cashflow is the amount of disposable cash a business has. Calculated by taking expenditure away from revenue, this disposable cash can then be used to benefit the business and shareholders. Free Cashflow can be used to pay off debts, expand operations, invest in additional assets, acquire other companies, or can be paid out as dividends. Companies need to have good and positive Free Cashflow.

As for Netflix, it has had an increasingly negative Free Cashflow for the past several years. 2020 was the only year that it did not see negative Free Cashflow as it cut back on content spending due to Covid-19.

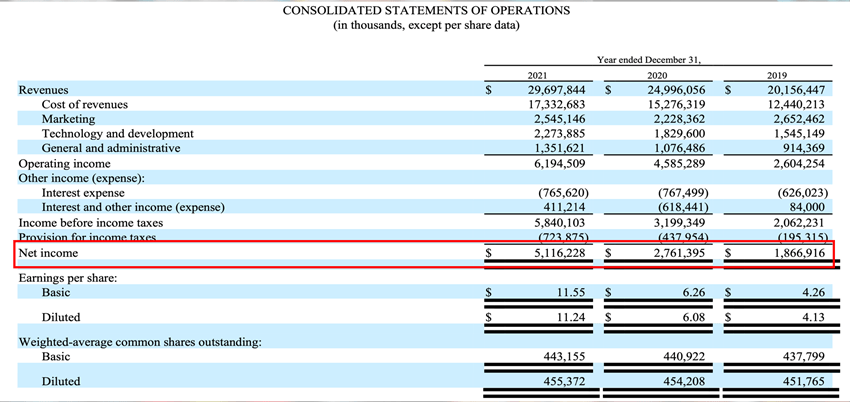

Netflix’s Net Profit

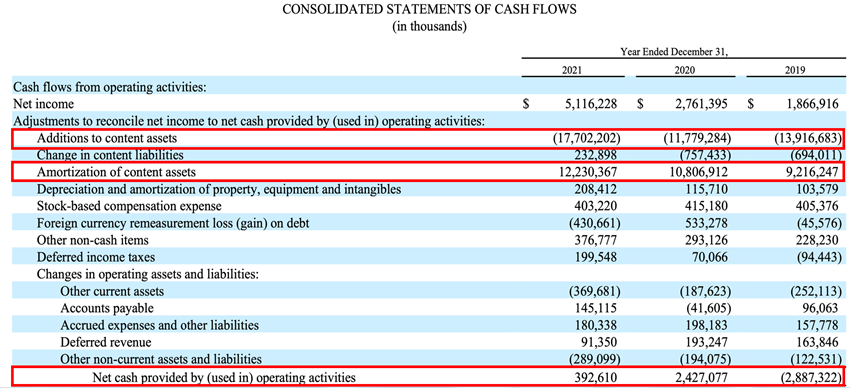

Netflix’s Net Profit from 2019 is USD$1.9 billion. It rose rapidly to USD$5.1 billion in 2021. However, its operating Cashflow in 2019 is negative USD$2.9 billion and rose to a mere USD$400 million in 2021.

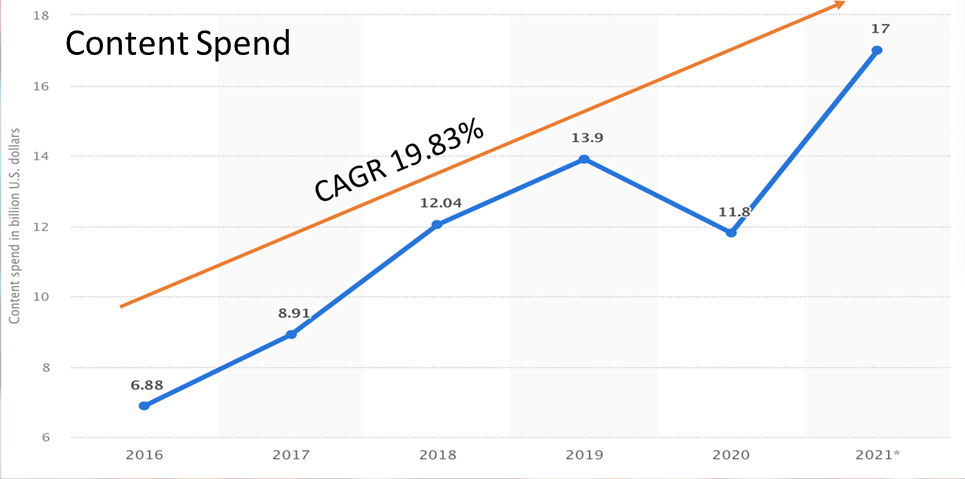

This is due to a large expenditure on additions to content assets and which is more than the amortisation of content assets. The trend generally shows that Netflix must spend more and more money on its content to retain and attract its subscribers. This is evidenced again by Netflix’s expenditure on content assets increasing by about 20% per year, from 2016 to 2021.

Netflix’s Funding of Negative Free Cashflow

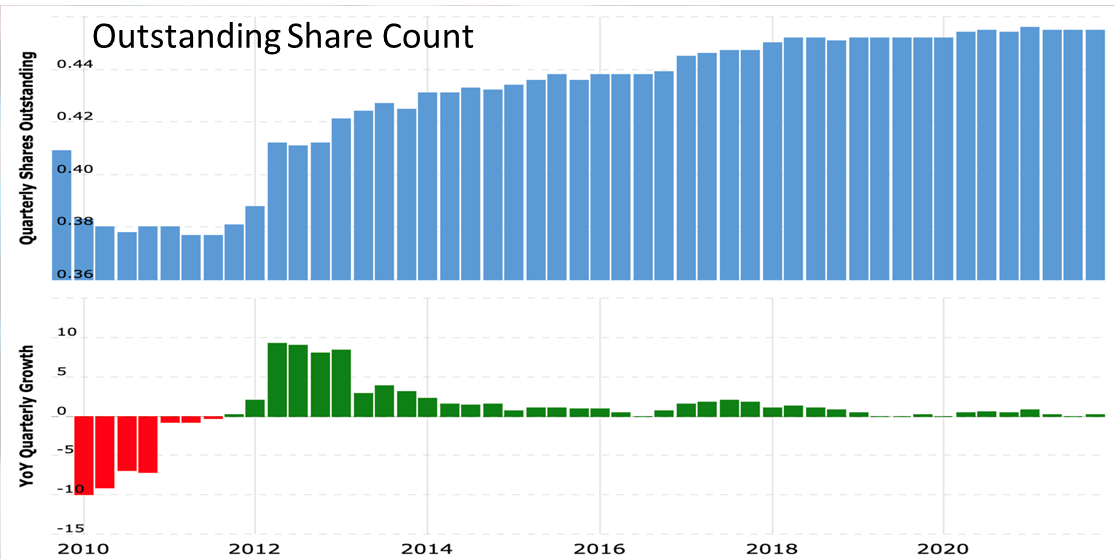

Netflix’s share count has remained stable over the years. This means that it is not issuing more shares which would dilute the existing shareholders’ share of profits.

On the other hand, its long-term debts has been increasing over the past few years. This means it has been funding its negative Free Cashflow through debt. Rising interest rates could mean that it would need to borrow more to finance its interest. This could be a headwind for Netflix.

Netflix’s subscription price

Its subscription price has been increasing over the years from USD$8 per plan to USD$9 for its basic plan. Its standard and premium plans have also risen considerably over the years. Other subscription businesses also do the same. However, if we look at a competitor like Disney, its Disney+ package is around USD$8 per month. Looking at Netflix’s trajectory we can assume that other streaming companies will continue raising prices, posing a serious competition. As such, Netflix cannot increase its price, or it might need to spend a lot more on content to retain and attract news subscribers.

Disney vs Netflix:

Disney vs Netflix: subscription price in developing countries

Netflix is successful in developed countries like US. However, it is not seeing the same success in developing countries where consumers cannot spend as much on streaming. For example, Netflix India had to reduce its price to be deemed affordable. Disney, on the other hand, chose to launch at a low price but complement it with advertising revenue.

Netflix’s subscription packages range from 149 Rupees to 649 Rupees whereas Disney’s only ranges from 33 Rupees to 125 Rupees. Disney’s is much cheaper than Netflix’s, and with the complementary advertising revenue, it is a much more sustainable model for developing countries.

Disney vs Netflix: per dollar of content spending

Netflix earned $1.19 per dollar of spending on content in 2017. It had over 100 million subscribers, the same number of subscribers as Disney now. However, Disney earns much more than Netflix, bringing in $2 for every dollar spent on content.

Disney earns much more as it has other channels like movies and television to distribute its content. Netflix, on the other hand, only has streaming. Hence, with Disney is more profitable with multiple revenue sources for the same content. Even today, where Netflix has increased prices and expanded its subscription base, wherein it can amortise the same cost over a larger base, it can only generate $1.68 per dollar of spending on content. Overall, Disney is at a more favourable and profitable position.

Disney vs Netflix: strategy

Netflix must develop a lot of new content as it does not have a library of intellectual property like Disney. Some of this new content, like Squid Game, could be very successful. On the flip side, each unsuccessful piece of content is a wasted dollar spent on content.

Disney has a lot of intellectual property like Marvel, X-Man, Star Wars, and more. It then builds a series around its successful content wherein the new series would likely attract the same fan base. This lowers the risk of putting out unsuccessful new content. Disney is also the more favourable company to choose here.

Netflix: Yes, No, or Yetto?

I will pass on Netflix. It has a negative Free Cashflow which I fear it would not be able to turn around even more so as it faces increasing competition. Disney is also much more profitable per dollar spend on additional content assets. Hence, Disney is in a much better position, and I would prefer to invest in Disney instead.

Important notice

If you would like to seek advice on your personal investment portfolio, get in touch with me at heb@thegreyrhino.sg or 8221 1200, I would love to connect with you.

Stay updated with the latest news and insights, subscribe to my newsletter, and spread the word.